Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Nov, 2021

By Christie Moffat and Chris Hudgins

Self-storage has been among the highest-performing asset types during the COVID-19 pandemic. But after more than a year of robust leasing and rental rate growth, occupancy has reached a point where there is not much space to improve, according to Steve Sakwa, head of real estate research at Evercore ISI.

As a result, Sakwa expects self-storage occupancy to fall in 2022, leaving rent growth as the main driver for the sector.

"At some point, your portfolio just becomes completely fully leased, and all you can really do is push rent," Sakwa said.

Investors have found unusually high returns in self-storage since the beginning of 2021. The Dow Jones U.S. Real Estate Self Storage index indicated that as of Nov. 22, self-storage REITs showed year-to-date returns of 59.1%, a significantly stronger performance than indexes for other asset types. The index includes CubeSmart, Extra Space Storage Inc., Global Self Storage, Iron Mountain Inc., Life Storage Inc., National Storage Affiliates Trust and Public Storage.

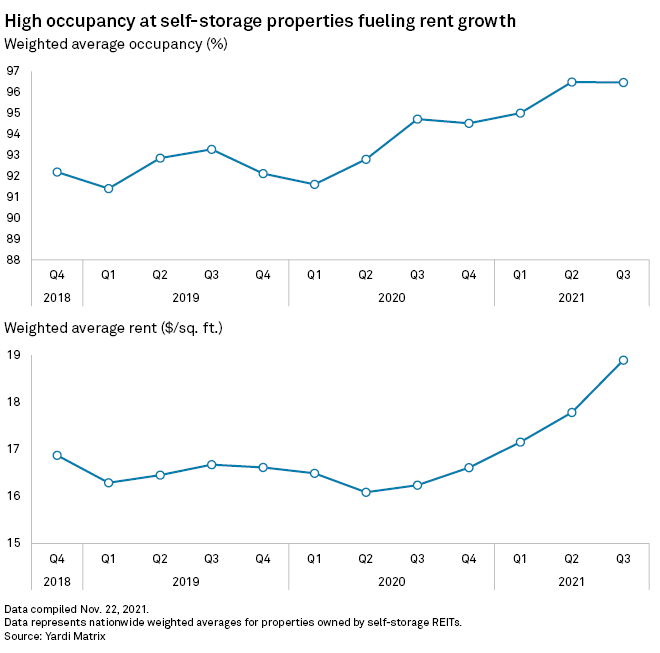

National self-storage occupancy averaged 91.5% in the first quarter of 2020, and as of the third quarter of 2021, was averaging 96.5%, according to a Yardi Matrix analysis of quarterly data reported by major U.S. self-storage REITs.

As the pandemic stretched on, storage facilities filled up as people moved to remote work and were forced to convert space in their homes into offices, while businesses reconfigured or pared down spaces for social distancing.

Notably, self-storage REITs reported significantly lower expenses in the third quarter, partly due to greatly reduced marketing costs. Sakwa said it was a good indication of how the high occupancy levels have diminished the need to advertise space.

Many large employers have indicated further delays in returning to the office or a permanent shift to hybrid work, which could support strong demand in the long term. But Sakwa believes that occupancy levels are now so high that there is only one direction for them to go.

"We assume some of this is sticky," Sakwa said. "But we don't assume 100% of the occupancy gains since COVID are sticky, so we assume they give some of that back."

Soaring occupancy levels have complimented rising rental rates. Monthly street rates for climate-controlled, 10 feet by 10 feet self-storage units averaged $128 in October, up 10% from a year ago, according to Yardi Matrix's November 2021 National Self Storage Report.

However, street rate growth is beginning to decelerate. Yardi Matrix found that rate growth in October fell from cycle-high peaks recorded in the summer, and the firm also expects above-average gains to slowly shrink back closer to the long-term average in the coming months.

"We have good growth, but we do assume that things decelerate [in 2022]. And again, part of it is the companies did phenomenally well in 2021 and were probably bigger beneficiaries from COVID than we had anticipated at the start of the year," Sakwa said.