Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Dec, 2021

By Zoe Sagalow

|

|

The U.S. Securities and Exchange Commission is more likely to revisit best execution issues in 2022 than to ban payment for order flow, analysts predict.

Payment for order flow is a system by which wholesale trading giants pay retail brokerages to execute their clients' stock and options orders at the public market's best current price or often at even better prices. The practice has been a subject of debate in Washington before. To critics, it is a model riddled with conflicts of interest that raise questions over how retail investors' trades are handled. But proponents say it has helped enable retail trading in which investors can buy and sell securities for free, by helping replace lost revenue at brokerages moving to zero commissions.

Changing best execution rules is more likely than a ban of payment for order flow, according to Tyler Gellasch, executive director of Healthy Markets Association, an institutional investor trade group. Gellasch is a former Senate aide who was involved in drafting the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in 2010.

"The SEC could go so far as to ban payment for order flow, but they could also effectively end the practice by just enforcing existing best execution rules more aggressively," Gellasch said in an interview. "I expect the SEC will focus on how trades are reported and how best execution is measured."

Brokers are required by law to pursue the "best execution" for customers, which considers price, speed and likelihood a transaction will be executed, according to the SEC. Stricter enforcement means bringing cases against brokers that prioritize their own interests instead of their customers' interests, Gellasch said.

Disclosure requirements

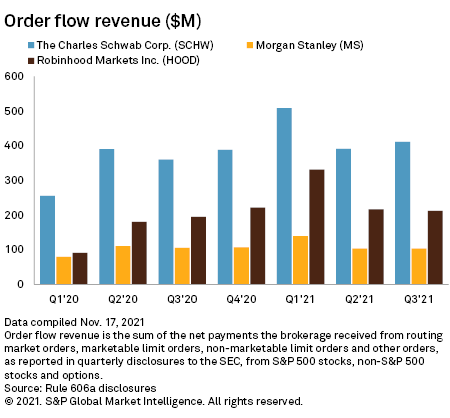

Many broker-dealers gather a chunk of their revenue from payment for order flow, in which they are paid to route market orders, marketable limit orders, nonmarketable limit orders and other orders. In the third quarter, order flow revenue was up year over year at top brokers The Charles Schwab Corp. and Robinhood Markets Inc., whereas Morgan Stanley saw a slight decline year over year.

Improved disclosure regarding execution quality for transactions is more likely and would be preferable to a ban on payment for order flow, said Jennifer Schulp, director of financial regulation studies at the Cato Institute's Center for Monetary and Financial Alternatives.

"The way that disclosure works now is not as informative or as accessible to the retail investor as it could be, and it can prevent retail investors from being able to make informed decisions about their choice of broker," Schulp said in an interview.

Market centers are required to disclose information online according to SEC Rule 605 and Rule 606. They must make detailed information about order execution available monthly and about order routing quarterly. These standardized reports must remain accessible for three years after they are posted.

The SEC might issue a new proposed rule or request for comment next year related to these issues, Schulp expects.

There are other ways to improve oversight of retail brokers and best execution aside from a ban, said Andrew Vollmer, a senior affiliated scholar at George Mason University's Mercatus Center. The SEC may not get to the issue this year because Chair Gary Gensler is "far too ambitious in the scope of his regulatory aims."

The SEC's regulatory agenda published in fall 2021 indicated that it might address these topics. It included a proposed rule on equity market structure modernization — including order routing and best execution. When asked what the SEC's plans are concerning payment for order flow and potential rule changes, a spokesperson pointed to the agenda that had been released but did not have updates on the timing of when the topic may be looked at by the regulator.

Other proposals

Other significant issues coming up for the SEC include stablecoins, other cryptocurrencies and money market mutual funds, according to Gellasch.

In a meeting Dec. 15, the agency issued a set of proposals, including ones related to money-market funds, executives' trading of their companies' stocks and increasing detail in stock buyback disclosures. The agency is seeking public comments on all the proposals.