Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Mar, 2022

By Cathal McElroy and Marissa Ramos

| Santander's sizeable retail deposit base has helped fund its profitable auto-lending operations. Source: VIEW press/Corbis News via Corbis News |

Banco Santander SA is bucking a European exodus from the U.S. retail market, likely because the lender's barely profitable branch network is a key funding source for lucrative auto loans.

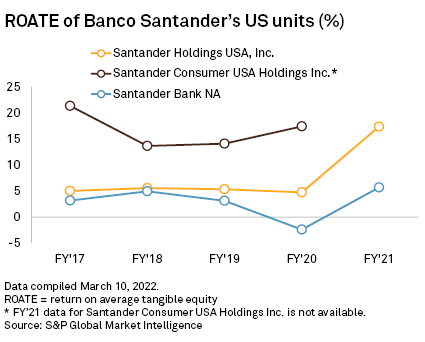

The Spanish banking giant will outline moves to simplify the U.S. retail unit next quarter, suggesting no immediate plans to join Banco Bilbao Vizcaya Argentaria SA, HSBC Holdings PLC and BNP Paribas SA in completely abandoning the low-margin market. Santander's U.S. retail bank has failed to post a return on average equity above 5% for more than a decade, according to S&P Global Market Intelligence data.

What Santander Bank NA does boast is $80 billon-plus of deposits, which have helped to turn the U.S. into Santander's largest source of profits by providing low-cost financing for auto-lending. The retail arm, which operates 483 branches around New York, Boston and Philadelphia, has about $11 billion of auto loans among its $100 billion-plus of assets, and it originated $8.4 billion of sister unit Santander Consumer USA Holdings Inc.'s auto loans last year.

"They are willing to hang onto a mediocre retail franchise because it offers cheap funding," said Christopher Whalen, a banking analyst and chairman of New York-based Whalen Global Advisers. "You don't just get rid of $80 billion in core deposits — it's a valuable asset."

The U.S. auto-lending business generated around a quarter of total group profit in 2021, according to company filings. The unit made a profit of $2.61 billion from $7.55 billion of revenue in 2021. Santander did not disclose the business's return on tangible equity for last year, but it recorded a return on average equity of 16%, based on the average between 2016 and 2020, Market Intelligence data shows.

Santander has already boosted its exposure to the unit by agreeing to buy out minority shareholders for $2.5 billion in August 2021. The deal, which valued the business at $12.7 billion, will add 3% to the group's earnings per share in 2022, Santander said at the time.

The lender will lay out plans for growing the auto business as part of its U.S. strategy update next quarter. It will also talk about how it intends to "streamline" retail operations rather than acting as a "full-service bank," Chairman Ana Botín said on a February call. The bank has already decided to end mortgage and home-equity loans in the U.S., and it may also pare commercial and industrial lending, Botín said.

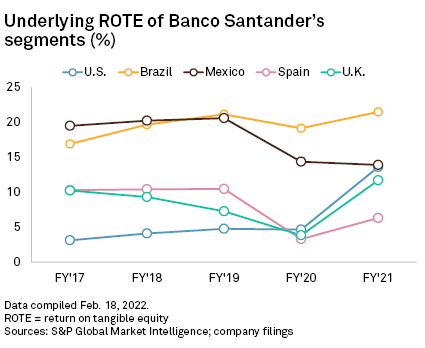

Santander's long-term goal in the U.S. is to achieve a return on tangible equity of more than 15% through the business cycle, it said in an emailed reply to Market Intelligence's questions.

The U.S. "is a hugely attractive market and the bank's focus now is on integrating our retail banking business and consumer lending to improve profitability further," the bank said, noting that returns last year were well above the cost of capital.

Staying in U.S. retail is a marked contrast to other European lenders. Late last year, BNP Paribas agreed the $16.3 billion sale of Calif.-based Bank of the West, which has 104 branches and almost $50 billion in assets. That came a few months after HSBC's sale of its retail operation to Citizens Financial Group Inc. and Cathay Bank. BBVA sold a 639-branch business with almost $115 billion in total assets for $11.6 billion in November 2020. BNP, HSBC and BBVA all retain non-retail operations in the U.S.

"European banks have discovered that banking normal run-of-the-mill Americans is not that easy," Whalen said. "If you don't have cheap funding costs and you're out there competing with community banks for that business, you're going to get killed."

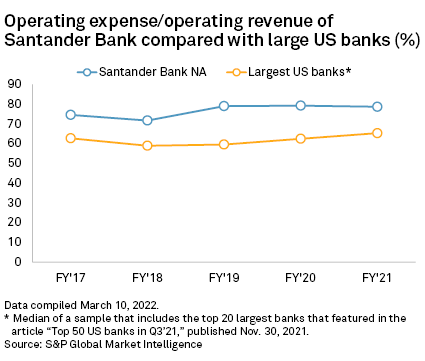

The European exodus has heightened focus on Santander's U.S. retail business, given a struggle to trim costs and improve earnings. The unit had a cost-to-income ratio of 78.66% in 2021 compared to 65.31% for the top 20 largest U.S. banks by total assets, Market Intelligence data shows.

Shares in BBVA, Santander's Spanish rival and most directly comparable peer, have surged around 45% since it announced its exit from the U.S. retail market. That is more than double the almost 20% gain for Santander during the same period.

The lagging share move has "raised fresh questions about what Santander is doing in the U.S.," said Benjie Creelan-Sandford, bank equity analyst at Jefferies.

Future sale

Such forces mean that Santander could still end up selling the U.S. retail business in the long term, said Johann Scholtz, bank equity analyst at financial research provider Morningstar.

The bank could also eventually sell off the U.S. retail business, with an enlarged operation in Mexico, said Whalen. Santander has said that it is interested in buying Citigroup Inc.'s Mexican unit, which is up for sale. Acquiring Grupo Financiero Citibanamex SA de CV would make Santander the third-largest lender in Mexico, according to Market Intelligence data.

Santander has already boosted cooperation between its U.S. and Mexican business, and it plans to make further savings of around $50 million in 2022 across its North America region, Botín said in February. Previous steps have included the introduction of a U.S.-Mexican business corridor and sharing of technology, Botín said.

Still, whatever happens in Mexico, it is likely that the U.S. retail business will take on a new and probably smaller size even as the auto-lending arm continues to grow, said Pablo Manzano, vice president, financial institutions, at credit rating agency DBRS Morningstar.

"They are going to stay in U.S. retail banking, but maybe in a different form," Manzano said. "They have realized they can't compete on the same level with the larger banks."