S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jul, 2021

By Cathal McElroy and Marissa Ramos

|

Pedro Castillo, a left-wing school teacher and trade union leader, looks set to assume power in Peru, and several more elections are upcoming in Latin America. |

The shifting political winds in Latin America will be monitored closely by Spain's Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA, which have come to rely on the region to offset weak profitability in their European businesses.

Peru has yet to declare a victor from its June 6 presidential election, but with attempts by right-wing candidate Keiko Fujimori to challenge the legality of left-wing outsider Pedro Castillo's narrow victory losing momentum, it appears to be a matter of time before the school teacher and union leader takes office.

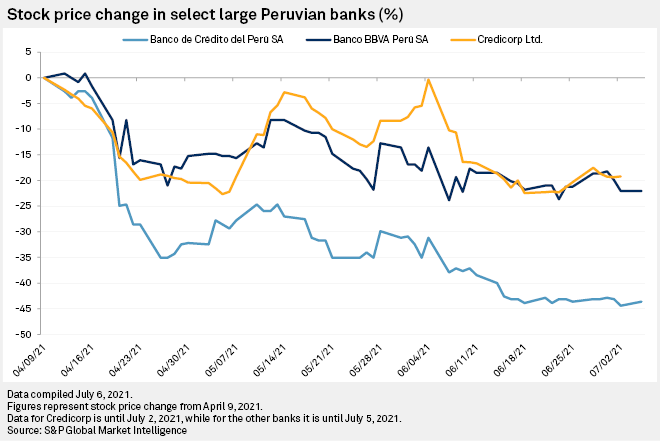

Investors in Peru's largest banks have reacted negatively to Castillo's ascent to power. Shares in Banco de Crédito del Perú SA, Banco BBVA Perú SA and Credicorp Ltd. fell by an average of 26.97% between April 11, when Castillo topped the polls in the first round of the election, and July 5. Since that surprise victory, Castillo's radical left-wing rhetoric has softened, which has given some reassurance to investors and capital markets, said Eileen Gavin, principal analyst for global markets and Americas at strategic consulting firm Verisk Maplecroft.

Castillo's rise from rural obscurity to the top of Peruvian politics is the latest twist in an increasingly volatile political climate in Latin America. With presidential elections set for Chile in November, and Brazil and Colombia in 2022, and left-wing candidates topping the polls in each country, further change is expected.

Poll tax

As the largest and fourth-largest Latin American economies respectively, Brazil and Colombia are key markets for Spain's two biggest banks. Brazil was Santander's biggest profit center in 2020, making up 30% of the group's underlying attributable profit, up from 21% in 2016. Colombia is BBVA's biggest South American market by number of branches and accounted for 5.35% of net attributable profit in 2020.

Of the two left-wing favorites in Brazil and Colombia, former Bogotá Mayor Gustavo Petro in the latter is likely to be "a little more radical," said Gavin. "He would try to promote more lending to vulnerable sectors, to women, to SMEs, micro lending," Gavin said. "There might be some impositions and regulations around that, and banks don't tend to like that, but they might have to be nudged a bit in that direction."

The frontrunner in Brazil, former President Luiz Inácio Lula da Silva, "is more about income equality as opposed to imposing some kind of dogmatic left-wing structure," Gavin added.

Santander's presence in Latin America as a percentage of total assets has remained broadly stable in recent years, standing at 21.12% in 2020, compared to 23.95% in 2016. But the region has become more significant to the Madrid-based lender as a source of underlying attributable profit during that time, rising to 53% in 2020 from 40% in 2016.

Latin America was even more important to BBVA in 2020, representing 55.9% of profit for the year, although this has fallen from 64.3% in 2016. BBVA sold its Paraguay unit in 2019, but its recent exit of the U.S. retail market has increased the relative value of Latin America to the bank. The region accounted for 22.5% of BBVA's total assets in 2020, prior to the sale of its U.S. retail business, slightly down from 23.39% in 2016.

Asked during BBVA's first-quarter earnings call about how upcoming elections in Mexico and Peru might impact the bank's business in those markets, CEO Onur Genç said he was confident of continued success whatever the results. "Independent of what happens, we are a very sizable long-term investor in those respective countries, and we will do well," said Genç. "We are not expecting any major deviation from our path."

Similarly, Santander CEO Jose Antonio Alvarez said during his bank's first-quarter earnings call that Latin American markets still presented its best growth opportunities. "We are in geographies [with] plenty of growth in front of us; this is [from] geographies in Latin America," said Alvarez. "We are growing nicely, even in the middle of the pandemic."

Still, concerns about potential shifts in the regulatory landscape are more prevalent in the Latin American banking sector than in other regions, according to the latest annual global bank risk management survey by EY and the Institute of International Finance, published in June. "Implementation of regulatory rules/expectations" was cited as a risk priority over the next 12 months by 44% of Latin American banking chief risk officers surveyed, compared to 22% in Europe and a global average of 31%.

While BBVA and Santander are sure to keep a close eye on political developments in key Latin American markets in the coming months, the exact impact of changes in government can be hard to gauge even if candidates' policy agendas are clear, said Sanghani.

Mexico, which accounted for 11% and 44.6% of 2020 profit for Santander and BBVA, respectively, voted left-wing populist Andrés Manuel López Obrador into power in 2018. López Obrador's election prompted fears that his policies would harm the economy, but the worst of those have not materialized, Sanghani said.

"The fiscal situation certainly looks more favorable in Mexico than other places like Colombia or Brazil, where they had supposedly more market-friendly leaders in power," said Sanghani. "There's a bit more nuance to [Latin America's political landscape]. I don't think it's necessarily right to paint the region with the same brush."