Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Jan, 2023

By Chris Hudgins and Umer Khan

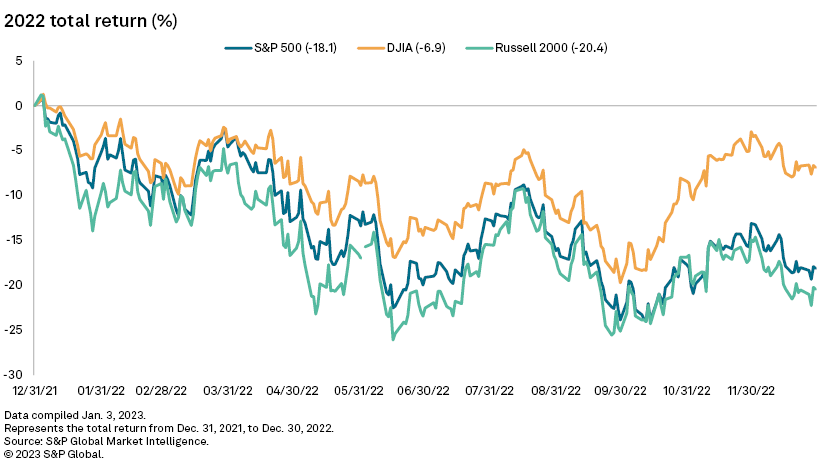

The S&P 500 closed 2022 with a total return of negative 18.1%, its worst annual return since the Great Recession.

While the Dow Jones Industrial Average performed stronger than the S&P 500 in 2022, it also closed the year in the red with a return of negative 6.9%. Meanwhile, the smaller-cap-focused Russell 2000 finished the year with a total return of negative 20.4%.

2022 proved challenging for many U.S. companies as inflation soared, peaking at 9.1% year over year in June, and the Federal Reserve rapidly increased interest rates in an effort to combat high prices.

Sector performance

Despite the S&P 500 logging one of its worst years in recent history, the energy sector performed well in 2022.

The S&P 500 Energy index generated a return of 65.7% during the year, the highest of any sector by a significant margin.

The S&P 500 Utilities index was the only other sector to close 2022 with a positive return at 1.6%.

* Click here to set email alerts for future Data Dispatch articles.

* For further global market analysis, try the Market View Excel template.

On the other end of the spectrum, the S&P 500 Communication Services index logged the worst return in 2022 of the group, at negative 39.9%. The S&P 500 Consumer Discretionary index followed closely behind with a return of negative 37.0%.

Largest gains, drops in 2022

Energy-focused companies were the top-performing S&P 500 constituents in 2022. Occidental Petroleum Corp. generated the highest return for 2022 at 119.1%.

Constellation Energy Corp. and Hess Corp. followed with returns of 107.1% and 94.1%, respectively.

On the other end, Generac Holdings Inc., a company that produces power generation equipment, was the worst-performing S&P 500 constituent in 2022 with a return of negative 71.4%. Dating-service-oriented Match Group Inc. and Align Technology Inc., which sells Invisalign clear aligners and iTero intraoral scanners, followed with returns of negative 68.6% and negative 67.9%, respectively.

Semiconductor company Advanced Micro Devices Inc. was the most-traded S&P 500 stock in 2022 with an average daily volume of over 91 million shares, or roughly 5.7% of its common shares outstanding. Other highly traded stocks included airline companies American Airlines Group Inc. and United Airlines Holdings Inc., as well as cruise-oriented Norwegian Cruise Line Holdings Ltd. and Carnival Corp. & PLC.

December performance

In just December, the top performers largely stemmed from the healthcare sector, with Universal Health Services Inc. logging the highest return for the month at 7.7%. Organon & Co. and Align Technology Inc. placed second and third with returns of 7.3% and 7.2%, respectively.

Electric car manufacturer Tesla Inc. saw the largest drop in December, with a return of negative 36.7%. Cruise-line company Norwegian Cruise Line Holdings Ltd. and electric power-oriented NRG Energy Inc. followed with returns of negative 25.5% and negative 25.0%, respectively.