Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Dec, 2022

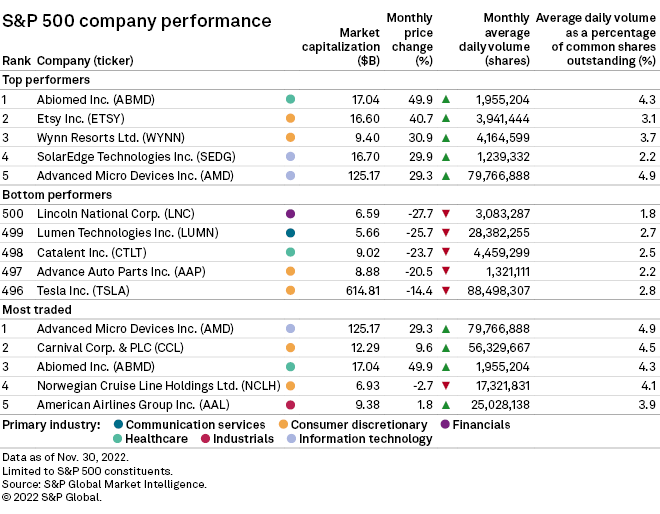

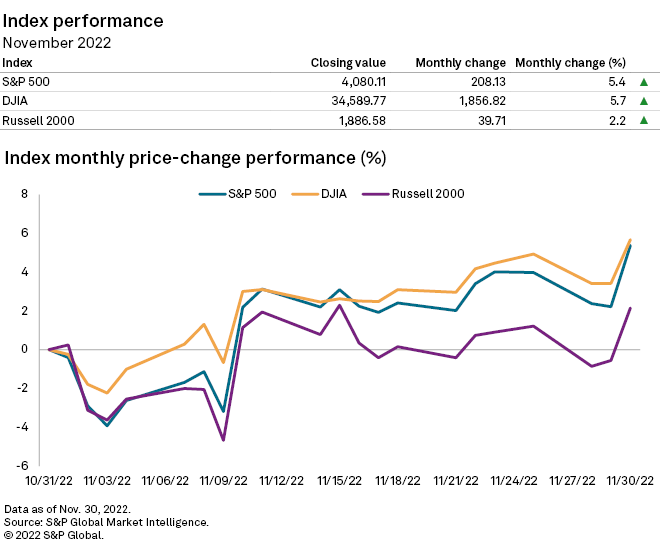

The broad U.S. stock market continued to climb in November.

The S&P 500 closed the month up 5.4%, while the Dow Jones Industrial Average increased 5.7%. Meanwhile, the smaller-cap-focused Russell 2000 ended the month up 2.2%.

Reversing a downturn that began the month, markets picked up on signs that inflation has cooled from its record highs and that the Federal Reserve may soon slow its aggressive pace of interest rate hikes.

Sector performance

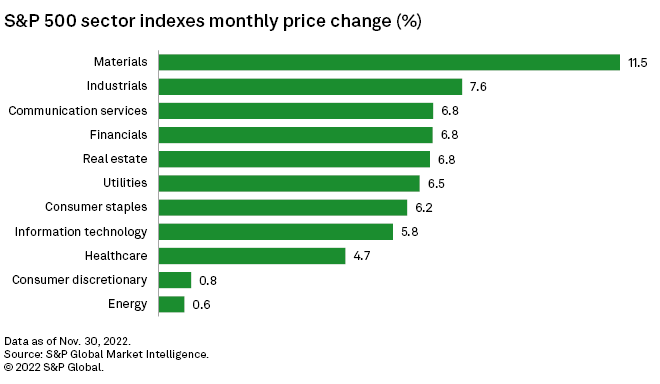

All S&P 500 sector indexes recorded monthly increases in November.

The materials sector led the way, up 11.5%, while the industrials sector placed second at 7.6%.

The communication services, financials and real estate sectors followed next, all up 6.8% for the month.

On the other end, the energy and consumer discretionary sectors logged the smallest gains during November, up a slight 0.6% and 0.8%, respectively.

Largest gains, drops

Among S&P 500 constituents, Abiomed Inc., which engages in the research, development and sale of medical devices to assist or replace the pumping function of failing hearts, logged the largest share-price increase in November, up 49.9% after agreeing to be acquired by Johnson & Johnson.

Online marketplace Etsy Inc. and casino and gaming company Wynn Resorts Ltd. placed second and third, with share-price increases of 40.7% and 30.9%, respectively.

* Click here to set email alerts for future Data Dispatch articles.

* For further global market analysis, try the Market View Excel template.

Alternatively, life insurance company Lincoln National Corp. saw the largest share-price decline in November, down 27.7% after reporting an unexpected $2.6 billion net loss for the third quarter.

Communication company Lumen Technologies Inc. and pharmaceuticals-oriented Catalent Inc. saw the next-largest share-price drops, at 25.7% and 23.7%, respectively.

Semiconductor company Advanced Micro Devices Inc. was the most-traded stock within the S&P 500 for the month with an average daily volume equal to roughly 4.9% of its shares outstanding.