S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Mar, 2022

By Brian Scheid

The S&P 500's market capitalization has started to recover from a $5.275 trillion loss over the first few months of the year.

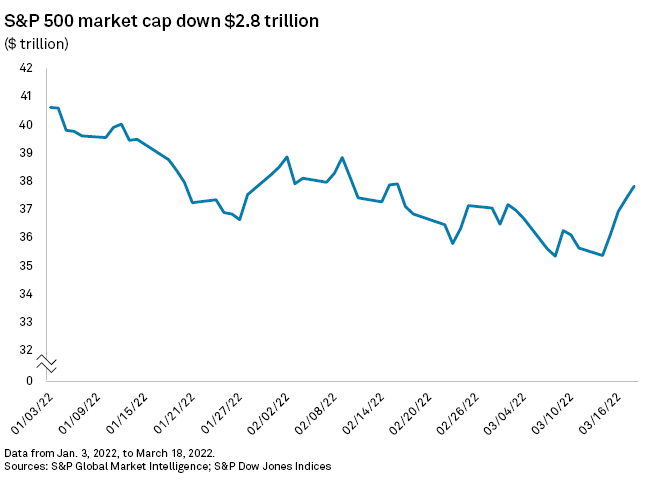

From the index's Jan. 3 peak to its March 8 low, the S&P 500's total market cap, the combined value of all shares for companies in the index, dipped from about $40.614 trillion to $35.339 trillion, according to S&P Global Market Intelligence and S&P Dow Jones Indices data. As of March 18, the total market cap of the index sat at $37.819 trillion, still less than half of the way back to its 2022 peak.

The partial recovery in market cap has come amid a rally for equities. The S&P 500 settled March 18 up 6.2% from March 11, its best week since 2020. The index on March 18 remained nearly 7% below its all-time high on Jan. 3.

Biggest stocks

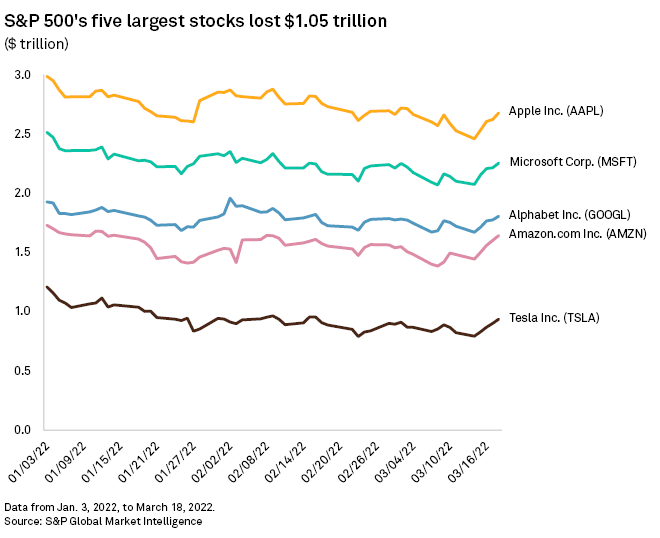

Mega-cap tech stocks, which are the index's largest players, recorded some of the biggest losses.

The five largest companies on the index — Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc. and Tesla Inc. — lost roughly a combined $1.051 trillion in market cap from the Jan. 3 peak to March 18, accounting for approximately 38% of the S&P 500's total loss over the same time. Apple and Tesla lost the most of these five companies, dropping by about $310.1 billion and $271.8 billion, respectively.

Meta drop

Meta Platforms Inc. accounted for nearly 13% of the S&P 500 market decline from Jan. 3 to March 18.

Meta's market cap fell from a peak of $1.078 trillion on Sept. 7, 2021, to a low of $508 billion on March 14. The stock's market cap rose to $589.27 billion on March 18.

Energy stock rally

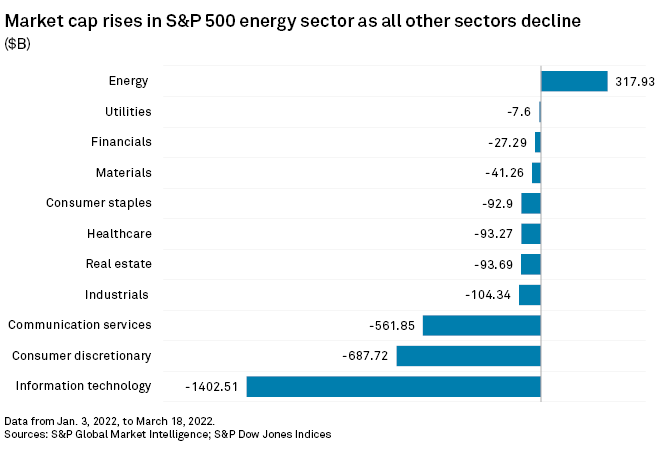

Market capitalization of the S&P 500 information technology sector tumbled by $1.403 trillion from Jan. 3 to March 18, by far the largest decline of any of the index's 11 sectors.

The only sector-level increase came in energy stocks, with the S&P 500's energy companies climbing in value by a combined nearly $318 billion over that stretch as oil prices remain elevated.