S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Mar, 2022

By Avery Chen

| Canadian miner Neo Performance Materials processes rare earth materials at its facility in Estonia. |

Russia's war on Ukraine could undermine efforts by the EU to bolster its rare earth mineral supply and break China's hold on the market.

Russia supplies the majority of feedstock for Europe's only commercial rare earth separation plant, Silmet in Estonia, owned by Canadian miner Neo Performance Materials Inc. At Silmet, Neo Performance processes mixed carbonates from Russia into materials for rare earth magnets, which are critical for producing batteries and other clean energy technology. To achieve the EU's climate neutrality goal by 2050, the bloc will need at least 37,500 tonnes of rare earth magnets in 2030, more than double 2019 demand and far more than current investments will yield, according to the European Raw Materials Alliance, or ERMA, which was established by the European Commission.

The war has not interfered with the flow of raw materials to Silmet, but analysts worry the conflict or future sanctions on commodities will disrupt supply from Russia. Europe would then struggle to implement policies to reduce its dependence on China, which supplies the bloc with 98% of its rare earth magnets, according to ERMA.

"It could be a step backward," said David Merriman, research director of rare earth elements at consultancy Wood Mackenzie.

Risk of Russian sanctions

Russian supplier OJSC Solikamsk Magnesium Works has not been subject to sanctions, Neo Performance CEO Constantine Karayannopoulos said during a March 10 analyst call. Solikamsk has been a supplier to Silmet for over 30 years, representing about 70% of the plant's rare earth feed material, Karayannopoulos said.

A risk for the facility — and for Europe's goal of easing its dependence on China — is the chance of global governments imposing sanctions directly on Russian rare earths.

"Today, Silmet is dependent on Russian-originated feedstocks, and so the company may have problems related to the sanctions," said Jack Lifton, editor-in-chief and co-publisher of InvestorIntel Corp., which provides public market coverage.

If Silmet loses access to Russian feedstock, "European suppliers will likely turn to China, as it is the main supplier of materials to the global market," Merriman said.

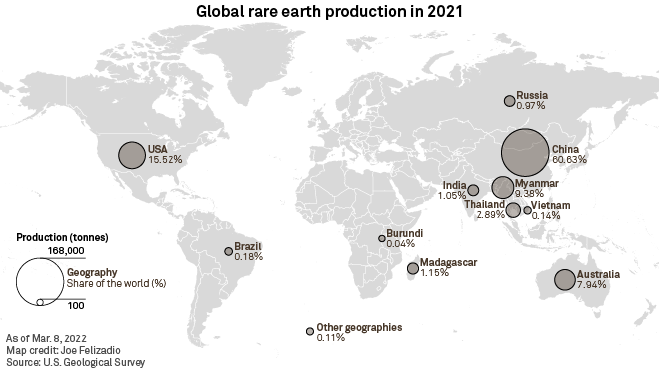

China accounted for 60% of global rare earth minerals output in 2021, according to the United States Geological Survey, and the country produced 85% of global refined rare earth products in 2020, according to Wood Mackenzie. The global green push is expected to boost China's rare earth output, exports and prices in 2022.

Supply from Australia's Lynas Rare Earths Ltd., the world's biggest rare earths producer outside of China, is largely mopped up by Japan, and there are few other alternatives to Chinese refined products in other markets, Merriman said.

Striving for independent supply

In a bid to move away from its dependence on China, the EU proposed a plan in September 2021 to invest €1.7 billion in 14 projects on the continent, from mining to magnet making and recycling, including Silmet in Estonia. Combined, the projects aim to increase annual magnet production from 500 tonnes to 7,000 tonnes by 2030, which would meet 20% of the EU's rare earths magnet demand.

Under the proposal, the European Commission should launch a "bridge fund" in the fourth quarter, providing €150 million to €200 million per year to finance rare earth projects, ERMA said. EU members are considering offering tax breaks to rare earth magnet manufacturers to compete with Chinese players, as Chinese magnets are 20% to 30% cheaper than magnets made in Europe, according to the alliance.

More than 90% of rare earth magnets, which are used for a variety of applications including renewable energy, robotics, electric vehicles and aerospace and defense, are produced in China, according to ERMA.

"This high production concentration in combination with rising global political tensions and a growing Chinese domestic market demand — particularly driven by a growth in electric mobility — results in a high supply risk for these materials from a European perspective," the alliance said in its September 2021 report.

The EU could only supply 2.8% of the magnets it required in in 2019, according to the alliance. Against this backdrop, Neo Performance, which mainly sources its feedstock from Russia, is an important supplier of rare earth products, Wood Mackenzie's Merriman said.

Neo Performance announced a partnership with Colorado-based Energy Fuels Inc. in March 2021 to build a United States-to-Europe rare earth supply chain. However, only 30% of Silmet's rare earth feedstock comes from Energy Fuels, and it will take some time to secure additional supply of monazite, a phosphate mineral that contains rare earth elements.

"Energy Fuels is accelerating its campaign ... and we have had many discussions about moving future campaigns forward and expanding them accordingly. So we don't have a set target," Karayannopoulos said.

'Russia will remain dependent on China'

Russia would like to bite off a larger chunk of the global rare earths market, but it has struggled to make the most of its reserves, and financial sanctions imposed in response to the country's war against Ukraine have only magnified its problems.

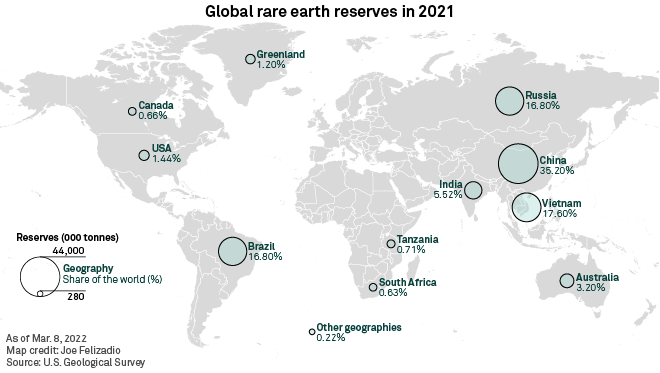

Russia hosted 21 million tonnes of reserves of rare earth minerals as of January, according to the United States Geological Survey, or USGS. The Russian deposits under consideration are in Siberia, where climate and logistical issues can present hurdles to capitalization, Lifton said. Russia is home to 16.8% of global rare earth reserves, but it contributed less than 1% of global production in 2021, USGS data showed.

Companies in Russia have successfully developed rare earth production capacity, but those companies have largely suspended operations due to lower prices between 2015 and 2021, Merriman said. Rare earth companies have been lacking strong support from state governments, similar to Chinese peers in past decades, Merriman added.

Russia planned to spend $1.5 billion on rare earth minerals as of August 2020, with an aim to become the second-largest global producer after China by 2030, Reuters reported, citing Alexei Besprozvannykh, Russia's deputy industry and trade minister.

The war in Ukraine might complicate matters. "Significant weakening of the ruble and difficulties in accessing finance in Russia have the potential to delay or increase costs at rare earth projects under development, which a sustained conflict in Ukraine would likely precipitate," Merriman said.

Although Russia is looking at rare earth projects, many of them are at the early stages of development and are still several years away from proposed commissioning.

"Russia will remain dependent on China for downstream rare earth products, and development of projects means Russian rare earth mine production is unlikely to be bolstered in the short term," Merriman said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.