S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Feb, 2022

By Kip Keen

Russia's military operations in Ukraine are driving metal prices higher while casting uncertainty on metal markets amid worries over supply disruptions and the impact of tougher Russian sanctions and ensuing retaliation.

The price of gold, seen as a safe-haven asset by some investors, jumped in early trading Feb. 24 to near $1,980 per ounce, up from about $1,900/oz the day before, as Russian forces started their incursion into Ukraine. The price of palladium, a key Russia-produced metal, surged from under $2,500/oz on Feb. 23 to over $2,600/oz in trading early Feb. 24.

"The thing that's really risen sharply is uncertainty," CPM Group managing partner Jeffrey Christian said in an interview. "And that uncertainty is going to be here for a while."

Renewed fighting in Europe is set to hang over the metals sector until it becomes clearer how far sanctions will go, what Russia might do in retaliation to sanctions and how long the conflict will last, analysts said.

Sanctions against Russia might not directly target commodity markets, in part to avoid disruptions in global supply chains. Likewise, Russia might not want to restrict exports of key metals to preserve its own market share and profits, some analysts said.

"Even in the darkest days of the Cold War, the Soviet government would sell you any amount of palladium that you wanted," Christian said. "And the auto industry is struggling as it is, and they desperately need platinum, palladium and rhodium to make their cars."

U.S. President Joe Biden ratcheted up sanctions on Russia on Feb. 24, targeting major Russian banks, wealthy Russians with close ties to Russian President Vladimir Putin and technology imports. Biden said that over time, the sanctions would hamper the Russian economy, degrade its military and force Putin to decide whether the incursion is worth the economic cost.

"Putin is the aggressor. Putin chose this war," Biden said.

Russian fertilizer exports at risk

Gains in metal prices arrive on the back of concerns over supply disruptions but not actual interruptions, TD Securities commodity strategists said in a Feb. 24 research report. "In fact, there remains a substantial amount of uncertainty with respect to the West's willingness to sanction those critical commodity sectors that are ultimately consumed in Europe and in the [U.S.]," the analysts said.

Still, precious metals producers could face sectoral sanctions, the analysts said, a point echoed in a Feb. 23 note by J.P. Morgan analysts. The latter analysts said there is a higher chance that less "globally critical" sectors, including precious metals, are targeted than more crucial sectors, including Russia's fertilizer and platinum group metals industries.

Moscow-headquartered gold miner Nord Gold PLC declined to comment on the potential impact of the Ukraine-Russia conflict. Kinross Gold Corp., which has gold assets in Russia, could not be reached for comment, but it did issue a news release Feb. 23 confirming its gold mining operations remained unaffected by economic sanctions posed by the U.S.

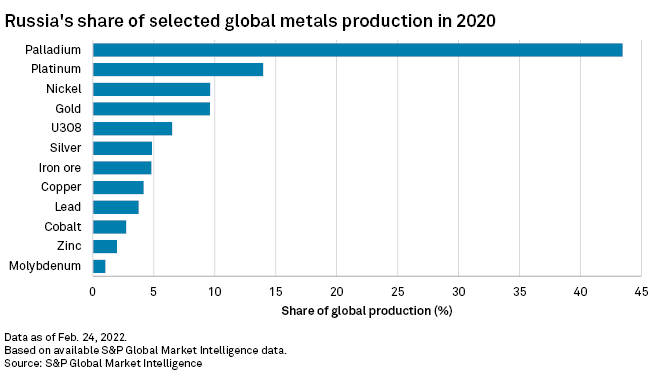

In 2020, Russia accounted for 43.4% of global production of palladium, a key metal used in catalytic converters, and for 14.0% of global platinum and 9.6% of both nickel and gold, according to S&P Global Market Intelligence data. With regard to fertilizer exports, Russia had dominant positions in several commodities in 2021, accounting for 49% of ammonium nitrate, 38% of NPK fertilizers, 30% of ammonia and 27% of potash export markets, according to Argus Media.

"There is a risk to Russian fertilizer exports, certainly, but it's very unclear at present what might happen as we await the latest sanctions from the U.S. and the EU," CRU Group fertilizer analyst Humphrey Knight said in an email.

Russia's Ukrainian incursion also complicates the picture for fertilizers, in part because earlier sanctions on Belarus, a major potash exporter, forced shipments away from Lithuania as of Feb. 1 and through Russia instead, where it remains unclear how much slack there is in port and rail capacity to handle the extra potash tonnage.

"This could make the situation more challenging for Belarusian volumes to get out of Russia, but ultimately, the main bottleneck remains available terminal capacity in the country," Knight said.

Trade embargo is 'unlikely'

As the conflict in Ukraine unfolds, the U.S. and other countries could implement further sanctions. This could include broader sectoral sanctions or measures meant to punish Putin more directly. But so far, there has been little talk, at least publicly, of heavier-hitting measures such as a full-scale trade embargo.

"A trade embargo on a jurisdiction like Russia is unlikely," said Adam Smith, a partner with Gibson Dunn & Crutcher who focuses on international trade, including sanctions. Smith was senior adviser to the director of the U.S. Treasury Department's Office of Foreign Assets Control for five years during the Obama administration.

Smith described a broader measure such as a trade embargo as challenging to implement, with ways for Russia to work around it through allies such as China.

"I do think that they will leave some quote-unquote powder dry," Smith said, referring to the potential for sanctions to ratchet up against Russia in response to the ongoing conflict.