Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Mar, 2021

By Casey Egan

Rural cable operators have never been hotter.

With the pandemic increasing demand for high-speed internet at home, analysts believe rural cable operators stand to benefit more than other broadband providers from the changing dynamics of the industry. Rural markets are traditionally less competitive; they have lower broadband penetration rates; and a higher proportion of customers in these markets are still using legacy DSL connections, making them attractive targets for cable operators.

"Rural cable is all the rage," said MoffettNathanson analyst Craig Moffett, in an email. "Competitive intensity is lower, the prospect of competing fiber overbuilds is almost zero, and penetration is generally lower as well, leaving more room for growth," he added.

Inflection point

Chris Mooney, a director at S&P Global Ratings, and S&P Global Ratings credit analyst William Savage see a similar opportunity.

"Rural cable providers stand to benefit the most, as the primary competitive advantage shifts from video scale to internet speed available," wrote Mooney in a Feb. 9 research report.

While rural providers have historically lagged in penetration rates, Mooney believes an inflection point is approaching, especially in the wake of the pandemic.

Telco offerings like legacy DSL service and fiber to the node "may no longer be sufficient for many households given the increased importance of having a fast and reliable broadband internet connection for distance learning, telemedicine, and work-from-home arrangements," Mooney wrote in his report.

DSL is delivered over older copper telephone lines, while with FTTN, data travels on fiber until it reaches a certain node in the neighborhood, then it switches to copper wires to reach the home or business. Speeds for these offerings usually cap out around 25 Mbps to 100 Mbps, which is about half the normal speed range for cable internet, according to the consumer comparison site BroadbandNow.

Mooney also wrote that as satellite TV becomes more expensive, he believes that streaming TV alternatives could push rural consumers to switch to high-speed cable to save money on TV bills.

Hanging up on DSL

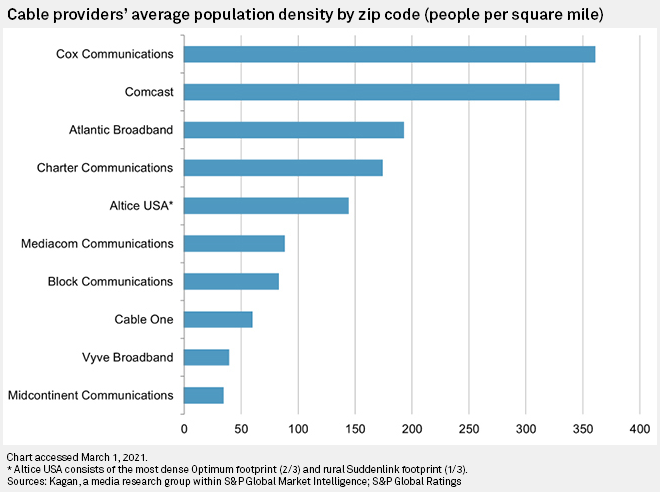

Savage noted in an interview that cable broadband providers such as Cable One Inc. or Vyve Broadband LLC, which have low penetration rates, have an opportunity, given the shifting industry dynamics.

"You kind of expect those consumers in those markets to more or less be taking DSL and not being willing to give up their phone line," Savage said.

But given the shift to increased reliance on broadband as a result of the pandemic, some consumers may shift to higher-speed broadband.

"And that's where you see these low penetrated operators — like Cable One or Vyve — where you see the potential to increase subscriber growth," he said.

Analysts also say weaker competition in these rural markets is another driving factor behind their optimism for rural operators. In his report, Mooney noted that, given the high barriers to entry, most small rated operators have no fiber-to-the-home competition in 70-80% of their footprints.

Kagan analyst Tony Lenoir expressed a similar sentiment.

"The thing about cable operators … they really operate in set geographies," he said. "So, in essence, at a local level, they are like mini monopolies. It's really … just a matter of having people take their products versus DSL," he added.

Kagan is a media research group within S&P Global Market Intelligence.

And when it comes to switching from DSL, he says the pandemic was "almost like an advertisement for cable services, because people quickly realized that a DSL connection would not cut it."

Looking past the pandemic

When asked in an interview about the runway for growth, Mooney said he expects the opportunity to persist beyond the pandemic.

"When you look at the fundamental shift in the way people are consuming data, I don't think that subsides. I think with 5G and use cases that don't even exist today and online gaming and all of the potential opportunities, we're only going to continue to see data usage increase for the foreseeable future," he said.

Looking at potential areas of subscriber growth, Mooney noted that there are still around 15 million to 20 million DSL subscribers, which leaves a good opportunity to take market share.

Analysts also believe the Federal Communications Commission's Rural Digital Opportunity Fund, which targets financial support to help deploy high-speed broadband networks in parts of rural America that do not have fixed broadband service of 25 Mbps for downloads and 3 Mbps for uploads, will help momentum for operators in rural markets, including larger operators.

An opportunity fund

Lenoir believes it equates to a government push for rural broadband providers to expand their existing footprint.

"This [RDOF] presents an opportunity for cable providers to fill in portions of markets or edge out into new adjacent markets that historically could not justify satisfactory stand-alone investment returns," wrote Mooney in his report.

Charter Communications Inc. previously announced it has secured $1.2 billion in the first phase of the RDOF auction.

The degree of participation of cable providers such as Charter is a shift from past government rural-focused subsidy programs, Mooney said in an interview. Historically, he noted a bulk of the funds have gone to telecommunications companies offering copper service.

"What you saw on RDOF was a real shift. … I think you just saw cable was a lot more active in RDOF than they had been in past auctions," he said. "I think that really represents a threat to the incumbent phone companies."

In the near term, Lenoir says the main risk he sees is the potential for market saturation.

"There's still a fairly large pool of an untapped market out there, but with the way things are going ... I can see this gap filling fairly rapidly in the next 3-4 years, max," he said. "And then you've reached saturation."