S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 May, 2021

By Sanne Wass

A recent revision to European Union rules around labeling sustainable finance products could give new impetus to the continent's market for environmentally friendly "green" covered bonds. But the market's growth will depend on further rule changes as banks face problems collecting data and locating enough green assets.

The EU's taxonomy regulation, due to come into effect in 2022, will act as a guide for investors to assess the sustainability of projects and financial products such as covered bonds. These debt securities, popular in Europe, are issued by financial institutions and backed by a pool of assets, usually residential mortgages, and differ from mortgage-backed securities in that the loans remain on the books of the issuing bank.

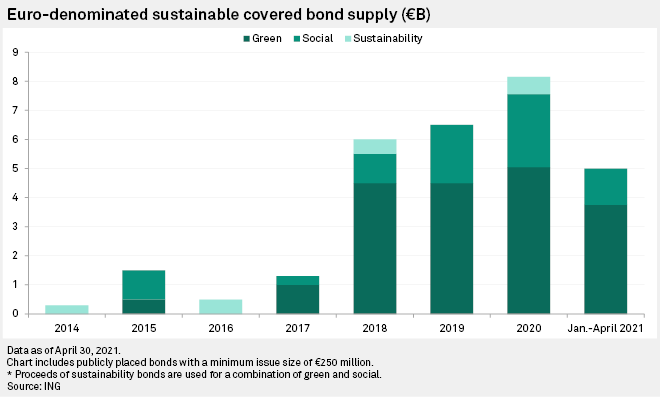

Green covered bonds are largely collateralized against green mortgages that help borrowers buy a sustainable building or renovate an existing one to make it greener, and the taxonomy's criteria for buildings will be essential in determining the scope of assets eligible for such bonds. The supply of euro-denominated green covered bonds jumped to €6 billion in 2018, from €1.3 billion the year before, and reached €8.15 billion in 2020, according to data from ING Groep NV.

Relaxed criteria

The initial draft of the taxonomy was released in November 2020 and included strict energy performance requirements for buildings backing green covered bonds. But an update of the rulebook published April 21 relaxed the criteria.

For example, buildings constructed before December 2020 will now be classified as green if they have an Energy Performance Certificate, or EPC, class "A" or are within the top 15% most energy-efficient in their country. The latter measure has been added since the draft, and represents a "key measure" that will help to "get the market going," according to Sean Kidney, CEO of the Climate Bonds Initiative, an investor-focused nonprofit organization.

Relying on a building's EPC label alone would have significantly limited the available assets for green covered bonds; in some countries it would make it close to impossible for issuers to find green building stock. It would have effectively "killed the market," said Karlo Fuchs, head of covered bonds at Scope Ratings, in an interview.

By making it easier for banks and mortgage providers that issue green covered bonds to identify assets, the EC's top 15% criteria made "an important concession" to the market, said Maureen Schuller, head of financials sector strategy at ING. Overly strict criteria would likely have prompted the development of a market for green covered bonds outside the taxonomy, she told S&P Global Market Intelligence.

Hurdles remain

The revised taxonomy provides a "foundation for growth," but the green covered bond market will still face challenges that "make it difficult to see it explode," said Casper Andersen, sector lead for covered bonds at S&P Global Ratings, in an interview.

One hurdle is the limited stock of green assets available. The mostly residential nature of covered bond collateral means that issuers have so far struggled to gather a substantial pool of eligible green assets, and that challenge will likely remain, said Andersen. While banks could take the lead in encouraging more customers to take up green mortgage loans, regulators could incentivize such behavior through, for example, tax benefits or housing development schemes, he added.

Still, it will require "quite some stamina" from issuers to identify and grow the pool of eligible green collateral, said Fuchs. Collecting the relevant data on the assets will be "a Herculean task" for issuers, particularly when it comes to old buildings, which would require the mortgage provider to reach out to borrowers to obtain information that meets the criteria.

"No normal bank really collected the data that is expected [under the taxonomy] in the normal underwriting. It was simply information that was not available," Fuchs said.

The greatest data challenge for issuers will be in meeting the taxonomy's "do no significant harm" criteria, said Kidney, speaking at a webinar April 27. No-harm rules cover water usage, waste and the land that buildings are constructed on, and also stipulate that a building cannot be labeled as green if it is dedicated to activities such as the extraction or manufacture of fossil fuels.

Regulatory intervention will be crucial in supporting the supply of data through, for example, building labeling schemes, said Kidney. "If banks are making a housing loan, there's only so much information they can collect in the limited amount of data. We can ask them to ask more questions. … But on the other side of it, we also need to ensure that municipalities, member states and other parties are making that data available."

Long-term potential

Other factors are likely to hamper the growth of the green covered bond market, at least in the short term. Banks are presently "swamped with liquidity," said Fuchs, while the current pricing advantages of green covered bonds over vanilla ones "is marginal, if any," according to ING's Schuller.

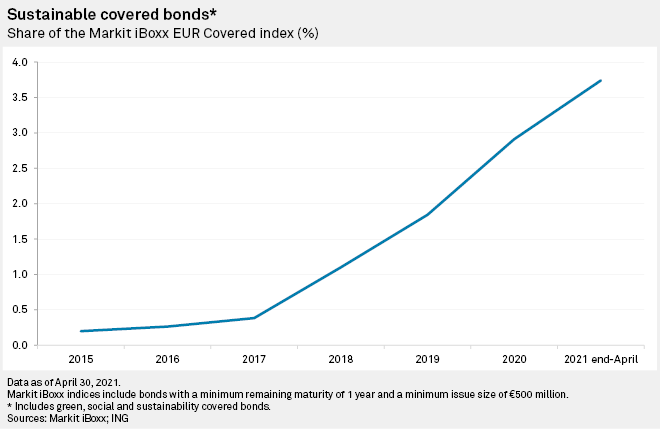

Nevertheless, the green part of the market is "still on track to grow," said Schuller. Sustainable covered bonds have grown to make up nearly 4% of the Markit iBoxx EUR Covered index, as of the end of April, up from less than 0.5% in 2017. ING estimates that euro-denominated sustainable covered bond supply will reach €10 billion in 2021, up from €8.15 billion in 2020. Issuers may not gain pricing advantages at present but see reputational benefits in green issuances, Schuller said.

Moving toward a more standardized model will likely support growth in the long term, said Andersen, making it less costly for banks to set up programs, while the "quality seal" of the EU taxonomy is likely to drive further investor demand. Also, countries outside the EU may adopt similar standards, making their markets for green covered bonds more attractive.