Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Aug, 2022

By Hailey Ross

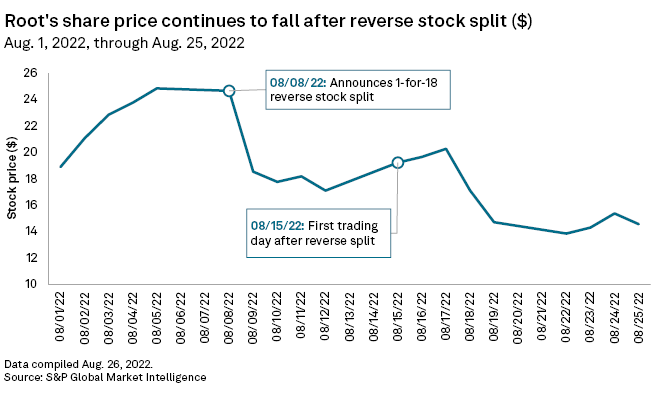

Root Inc. underwent a reverse stock split that took effect Aug. 15, but the move has seemingly done little to quell the company's steady share price decline.

The insurtech went public in late 2020 with its shares trading at $27 apiece. But Root's stock closed at just 95 cents at the end of the day on Aug. 12, the final trading session before the 1-for-18 reverse stock split went into effect.

The whole thesis behind a reverse stock split is to get the stock price up enough that it "becomes attractive again" for institutional investors, Kaenan Hertz, managing partner with Insurtech Advisors, said in an interview. But that is not holding true for Root right now, he said.

Although the stock price climbed in the first three trading days following the reverse split, it has since lost ground and closed at $13.37 on Aug. 26.

Several other insurance technology companies, including Hippo Holdings Inc. and GoHealth Inc., have also announced that their shares may undergo reverse stock splits.

Hippo plans to hold a special meeting Aug. 31 to discuss a reverse stock split that would be in the range of 1-for-20 to 1-for-30. GoHealth has not revealed many specifics around its intent to complete a similar move. SelectQuote Inc. is also on Hertz's radar as an insurtech that may eventually undergo a reverse stock split, though it has yet to announce any such plans.

Hertz believes the reverse stock splits from these insurtechs are "unlikely to solve the downward pressure" on their prices until institutional investors are willing to buy those stocks in a significant way.

The lock-up period, the time during which certain stockholders agree to waive their right to sell their shares of a public company, is going to end for some of these insurtechs in the near future, Hertz also noted. When that happens, there will be potential for a "flood of shares" which could again push down the stock prices unless there are investors willing to buy up that capacity.

Hippo's stock rose 12.70% for the week ending Aug. 26. GoHealth shares finished down 6.69%, while SelectQuote's share price ticked up 2.26%.

Orderly runoff

United Insurance Holdings Corp.'s stock skyrocketed after it announced that personal lines subsidiary United Property & Casualty Insurance Co. filed plans of withdrawal in Florida, Louisiana and Texas related to the non-renewing personal lines policies in these states. Louisiana has already granted regulatory approval for the move, but decisions are still pending in Florida and Texas. The company also expects to file a plan of withdrawal in New York.

"These plans would effectively place United P&C into an orderly run-off so long as United P&C remains in compliance with the rules and regulations of each state," United Insurance said in a press release.

Demotech also notified United P&C of its intent to withdraw the company's financial stability rating.

United Insurance Holdings ended the week as one of the biggest winners across all insurance sectors, with its stock price jumping 17.65%.

Another Florida-based insurer, Heritage Insurance Holdings Inc., also saw its shares gain ground, rising 5.56%.

In contrast to its peers operating in the Sunshine State, FedNat Holding Co. landed a spot among the biggest losers of the week with its stock declining 10.95%.

Equities crumbled in the final session of the week ending Aug. 26 leading to a full-week loss for the S&P 500 of 4.04%, finishing at 4,057.66. The S&P 500 U.S. Insurance index dropped 3.47% to 554.09.