S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Nov, 2021

By Annie Sabater and Dylan Thomas

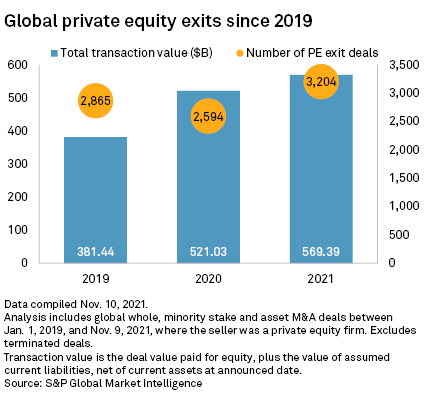

Global private equity exit activity has already exceeded last year's totals in both value and volume and could be on track for a record year, according to S&P Global Market Intelligence data.

In the year to Nov. 9, private equity firms exited 3,204 investments for a total deal value of $569.4 billion, already ahead of full year 2020, which recorded 2,594 exits worth an estimated $521 billion.

The industry's record year for exits was 2015, when the total value globally reached about $700 billion, according to Market Intelligence data.

U.S.-based portfolio companies accounted for $371.2 billion or about 65% of the global exit value through Nov. 9.

"We've been extremely busy, really all year," said Brian Richards, a Chicago-based partner in the private equity and M&A practices of law firm Paul Hastings.

Six of the 10 largest private equity exits of the year so far have involved companies in the healthcare industry, Market Intelligence data shows. But Richards said exit activity hasn't been dominated by one sector.

"Generally speaking, this has been an across the board, somewhat sector agnostic bull market for companies."

Exit drivers

In the U.S., private equity divestitures have been driven in part by the stock market, which has been reaching and surpassing all-time highs and creating conditions for attractive IPO exits. The S&P 500, Dow Jones Industrial Average and Nasdaq all set new records this month, with the S&P 500 ending eight consecutive trading days at an all-time high for the first time since 1997.

Economic tailwinds are also contributing, Richards said. Strong corporate profits are boosting the valuations of private equity portfolio companies, making it look like a good time to exit. Buyers are also taking advantage of low interest rates, using the cheap debt to pay more for acquisitions and driving pricing and multiples higher. The looming threat of tax hikes is another reason; even if plans to raise taxes significantly on capital gains and carried interest are now in doubt, "the market was betting that would happen," Richards said.

Pete Witte, global private equity lead analyst for EY Knowledge, added that a key factor has been special purpose acquisition companies, which have roughly $180 billion in capital ready to deploy.

"A lot of that is going to flow to private equity-backed assets. We saw that in the first half of the year, where about 20% of the exits, or so, went to SPACs," Witte said.

The biggest exit this year to Sept. 30 was the sale of PPD Inc., a Wilmington, N.C.-based contract research organization serving the healthcare industry. Thermo Fisher Scientific Inc. agreed in April to acquire the company from Hellman & Friedman LLC and The Carlyle Group Inc. in a transaction valued at $20.9 billion, including a $17.4 billion purchase price and the assumption of about $3.5 billion in debt.

That deal was surpassed Nov. 8 when TPG Global LLC announced an agreement to exit California-based McAfee Corp. An investor group acquired the computer security software company for $14 billion, but the total value of the deal came to nearly $22.7 billion including debt and liabilities.

While Richards predicted it would take an economic shock to end the record run of exits, he suggested the fading threat of tax rate increases could take some of the pressure off deal-makers to act quickly. "If the Republicans get some piece of Congress, then the tax risk will abate entirely," he said.

Witte, from EY, forecast "continued strong activity" for private equity exits heading into 2022. "We're seeing a lot of interest from trade buyers, and certainly secondaries. SPACs are another dynamic in the market that just wasn't there a year ago at this time," Witte said.