S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jul, 2021

By Karin Rives

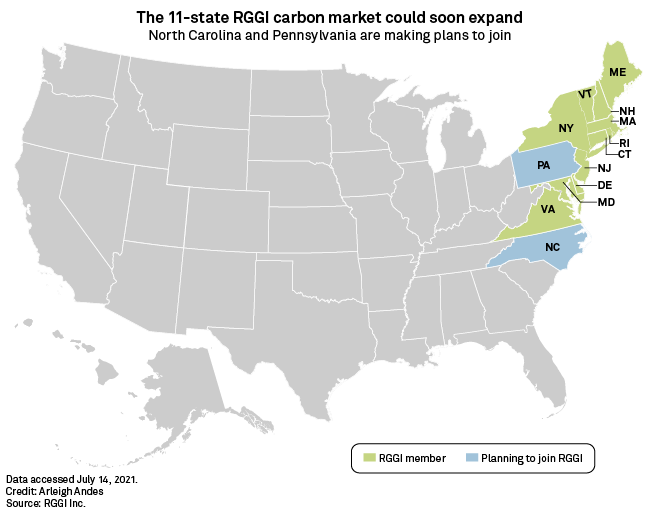

On the same day that North Carolina regulators advanced a proposal to include the first Southern state in the Regional Greenhouse Gas Initiative, a similar and highly contentious plan in Pennsylvania cleared a critical threshold.

The Pennsylvania Environmental Quality Board voted 15-4 in favor of advancing Democratic Gov. Tom Wolf's signature climate initiative on June 13, despite fervent efforts by Republican legislators to keep their state out of the expanding cap-and-trade market.

One of the most outspoken opponents of the measure, Republican state Rep. Daryl Metcalfe, who represents a coal-heavy district in western Pennsylvania, vowed July 14 to continue the battle against "the governor’s unconstitutional and unlawful carbon-tax imposing RGGI scheme."

Whether Wolf's plan will survive now depends on whether Metcalfe and other state lawmakers can override the governor's veto of any final legislative bids they introduce in the coming weeks to try to halt the process. They will need two-thirds majorities in both chambers of the Republican-controlled legislature to override a veto, something they have thus far been unable to achieve.

The state's energy players are split on the issue, with nuclear-heavy Exelon Corp. seeing a bright future for its emissions-free fleet, and oil and gas drillers arguing against RGGI.

"Joining RGGI provides Pennsylvania with a proven, efficient tool to begin addressing climate change and supporting the preservation and deployment of clean sources of electricity, including nuclear," Exelon wrote in its comment on the proposed RGGI rulemaking earlier this year. "It is a prudent insurance policy to help maintain our existing clean electricity resources and encourage continued expansion of emission-free electricity."

Pennsylvania was the fourth-largest emitter of energy-related carbon pollution among U.S. states after California, Texas and Florida in 2018, according to the most recent data from the U.S. Energy Information Administration. It is also the second-largest producer of natural gas and the third-largest coal producer, agency data shows.

The state's entry into RGGI in 2022 would thus significantly expand the carbon market's footprint and economic impact.

Since 2009, RGGI's quarterly allowance auctions have raised $4.1 billion as emissions in participating states dropped by more than 40%. States have invested $2.8 billion of those proceeds in energy efficiency and clean energy programs. Wolf's administration has estimated that Pennsylvania would raise $300 million from such auctions during the first year and grow the gross state product by nearly $2 billion by 2030.

A trust for energy communities would receive nearly 38% of the state's auction money to help pay for worker retraining and to support school districts that are losing critical tax revenue as coal mines and plants shut down.