S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Sep, 2021

By Charlsy Panzino and Chris Hudgins

U.S. retail sales unexpectedly rose in August from the previous month's drop, boosting economists' confidence that consumer spending will keep growing the rest of the year.

"Despite risks to the economic outlook due to the delta variant [of the coronavirus] and rising inflation, consumers seem to be on solid footing," said Lauren Henderson, economic analyst at Stifel Investment Services, in an interview.

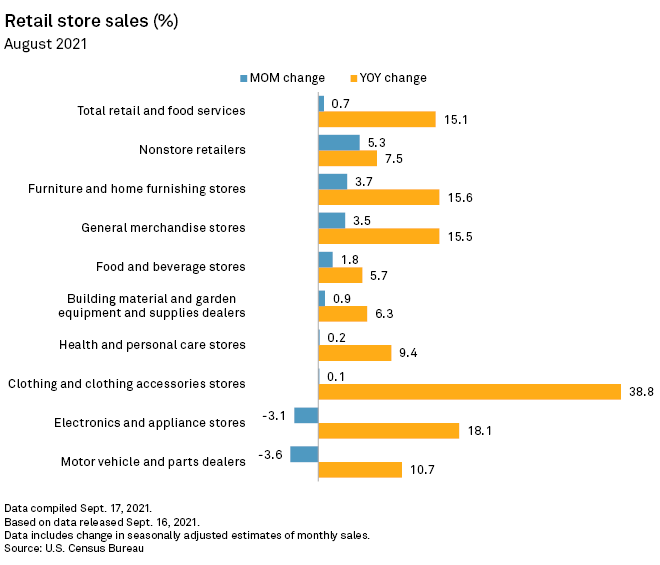

Retail and food services sales increased 0.7% month over month in August after a revised 1.8% drop in July, according to U.S. Census Bureau data released Sept. 16. August retail sales were expected to drop 0.8%, according to a consensus of economists' forecasts compiled by Econoday.

Back-to-school shopping likely contributed to the rise as students across the country returned to in-person learning, economists said. Shoppers also boosted spending online and at furniture and building equipment stores but cut back on dining out and harder-to-find goods like electronics and cars.

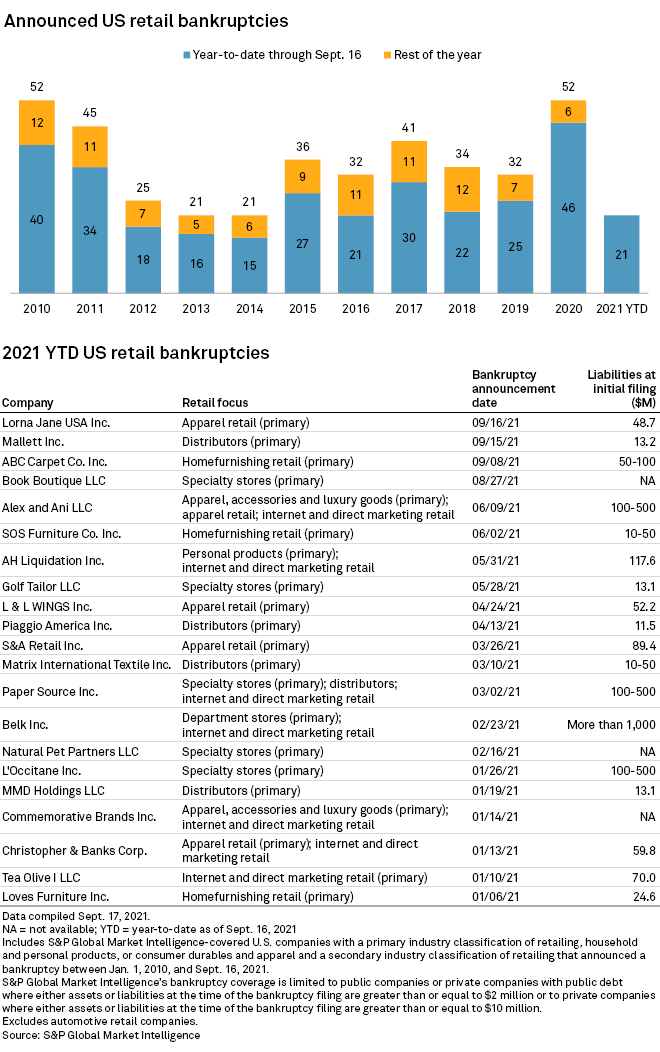

Meanwhile, four retail companies filed for bankruptcy in the month through early September, marking the first filings in the sector since early June.

Retail sales

U.S. retail and food services sales increased to $618.68 billion in August, according to advance estimates by the Census Bureau. This is up from a revised $614.31 billion in July.

Sales at electronics and appliance stores fell 3.1% month over month in August, while sales of motor vehicles and parts dealers dropped 3.6% but rose 10.7% year over year. On a year-over-year basis, retail and food services sales rose 15.1% with growth in all categories.

Sales in the retail trade, which excludes food services, rose 0.8% from July and 13.1% year over year. Clothing and clothing accessories sales were up 38.8% year over year, while gas station sales were up 35.7% year over year.

"Households are constantly readjusting their spending mix depending on the COVID situation, supply constraints and prices," said Gregory Daco, chief U.S. economist at Oxford Economics, in a Sept. 16 note.

The weak July retail sales report heightened fears of a consumer spending pullback in August, but retail sales roared back instead, according to Stephen Stanley, chief economist at Amherst Pierpont.

Even if September retail sales performance is muted by the pandemic, holiday sales and a possible end to the delta variant spike in COVID-19 cases could result in a "stellar fourth quarter," Stanley said.

Monthly volatility is expected to continue heading into the end of the year. As expanded federal unemployment benefits ended Sept. 6, job and income growth are the likely sources of support for continued spending, Stifel's Henderson said.

This will likely result "in a somewhat uneven, albeit positive, rate of consumption towards the end of the year and into next," Henderson said. "Additionally, supply-chain bottlenecks will continue to impact consumption in the near term, especially motor vehicle sales."

Bankruptcy

Four new retail bankruptcy filings from late August to mid-September marked the first filings in the sector in more than two months. New filers included women's-apparel maker Lorna Jane USA Inc. and antique dealer Mallett Inc.

There have been 21 retail filings so far in 2021, less than half the number for the same period in 2020, according to S&P Global Market Intelligence.

While fewer companies are turning to bankruptcy in 2021, consumer companies , including retailers, continue to file for court protection in higher numbers than other business sectors.

Consumer prices

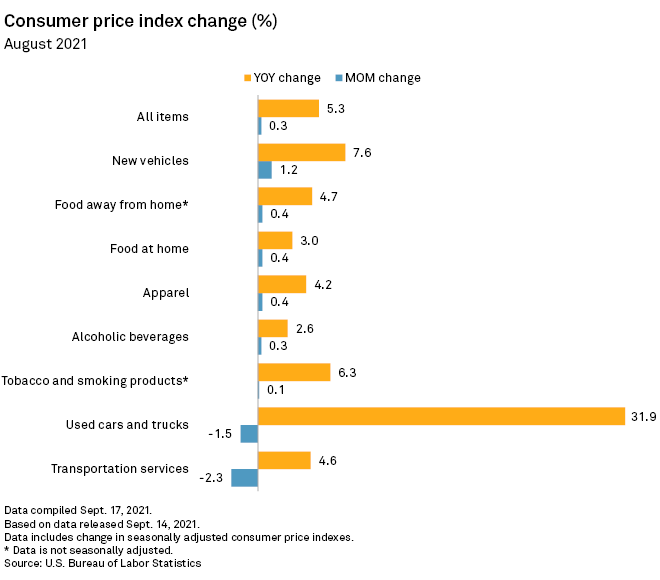

Consumer prices rose 0.3% in August compared with the previous month, according to data from the U.S. Bureau of Labor Statistics. Year over year, prices jumped 5.3% before seasonal adjustment. Prices for new vehicles rose 1.2% month over month in August and 7.6% on an annual basis.

Employment

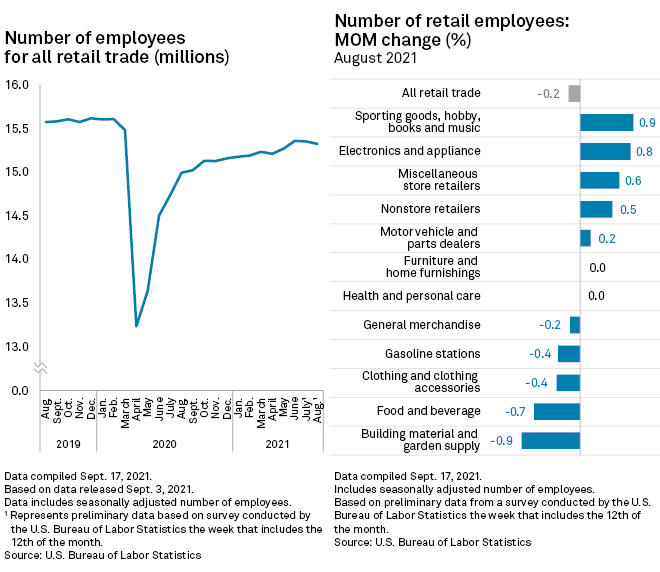

Employment in the retail sector was at 15.32 million jobs in August, down 0.2% from 15.35 million jobs in July, according to Bureau of Labor Statistics data.

Jobs at clothing stores and gas stations each dropped 0.4% in August from July. Employment at motor vehicle and parts dealers increased 0.2%, and building material and garden supply stores registered a 0.9% drop in jobs.

Vulnerability

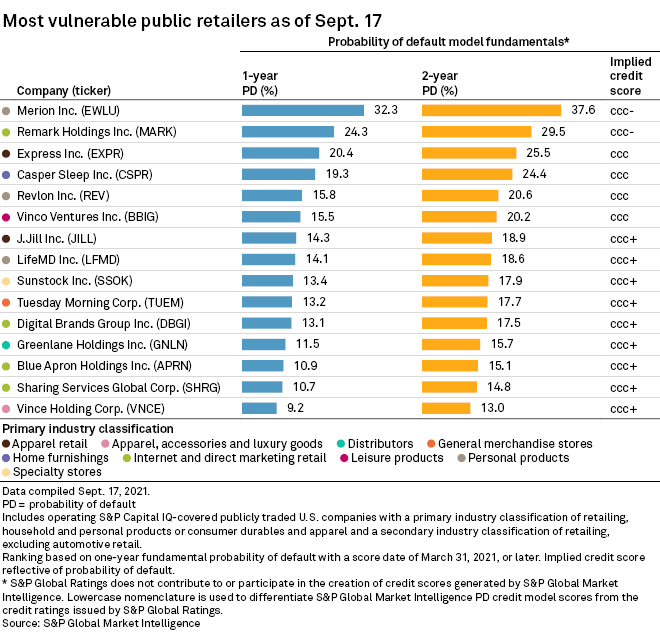

An analysis of the one-year probability of default scores identified 15 public retailers with scores ranging from 9.2% to 32.3% and corresponding implied credit scores of "ccc-" to "ccc+." A probability of default score represents the odds that a company will default on its debt in a year, based on financial reports and accounting for different macroeconomic factors.

Health supplements retailer Merion Inc. topped the list with a probability of default score of 32.3%. The company did not respond to a request for comment.