Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2022

By Nick Albicocco and Robert Clark

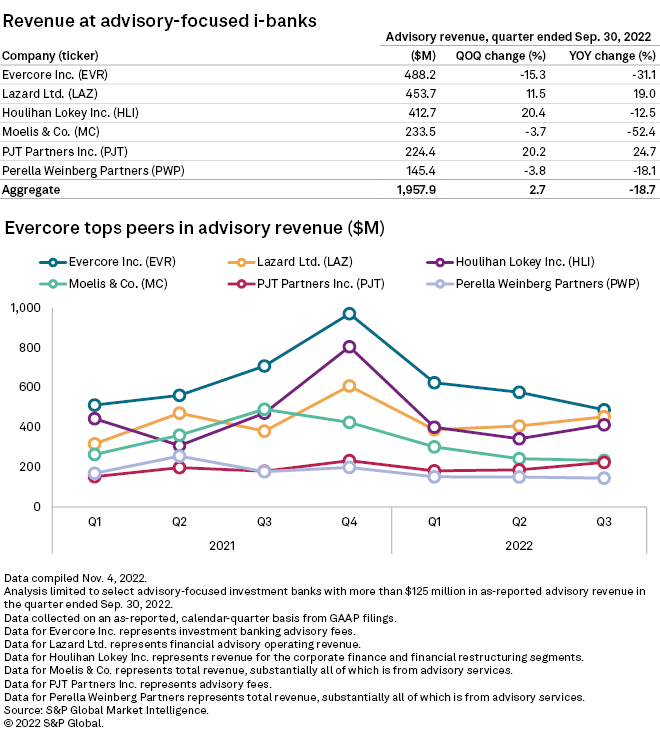

Quarterly increases in advisory revenue for Houlihan Lokey Inc., PJT Partners Inc. and Lazard Ltd. powered an aggregate gain in the metric among advisory-focused investment banks in the third quarter.

The three investment banks, along with Evercore Inc., Moelis & Co. and Perella Weinberg Partners, had their combined third-quarter advisory revenue rise 2.7% quarter over quarter to nearly $1.96 billion. The increase came on the heels of two difficult quarters. Aggregate advisory revenue plummeted 36.8% sequentially in the first quarter and declined 7.0% sequentially in the second quarter.

Executives at several firms in the group said rising levels of restructuring opportunities are helping drive new business.

"Restructures are up significantly," Moelis founder, Chairman and CEO Kenneth Moelis said on a Nov. 2 earnings call. Mandates are up roughly 20% to 25% sequentially, "and it's starting to ramp," he added.

At Houlihan Lokey, which posted a 20.4% increase in advisory revenue to $412.7 million, CEO Scott Beiser told analysts on an Oct. 27 earnings call that market conditions for financial restructuring continue to improve, with the company seeing "elevated levels" of restructuring work.

Strong performers

Houlihan Lokey's gain in advisory revenue, which consists of revenue for the corporate finance and financial restructuring business segments, was the largest in the group. In mid-November, the company bolstered its advisory capabilities when it announced its acquisition of London-based advisory firm Oakley Advisory Ltd.

PJT Partners posted a 20.2% quarterly increase to $224.4 million in advisory revenue. The company also had the largest year-over-year revenue increase in the group, at 24.7%.

"Despite the volatile operating environment, many of the leading indicators we track remain positive. Our mandate count is at near record levels as our clients remain highly engaged on matters of strategic importance," Paul Taubman, the firm's founding partner, chairman and CEO, said on an Oct. 25 earnings call.

Taubman said the company's restructuring business has become "increasingly active" with an uptick in mandates driving its third-quarter revenue increase. "The restructuring trend will continue to vector up and to the right," Taubman said.

Besides PJT Partners, Lazard was the only other investment bank among the group that posted both a quarterly and a yearly increase in advisory revenue. Lazard reported $453.7 million in advisory revenue, up 11.5% sequentially and 19.0% year over year.

Lazard set a quarterly company record for financial advisory revenue in the third quarter, "driven by record performance in Europe, despite a slowdown in M&A activity around the world," Chairman and CEO Kenneth Jacobs said on an Oct. 27 earnings call.

While restructuring activity is still relatively low for the company, CFO Mary Ann Betsch said, "our discussions with clients are increasing as a result of current market conditions and demand for liability management."

Biggest decliners

Evercore's 15.3% revenue decline, to $488.2 million, was the worst sequential dip among the six i-banks.

"The number of announced global transactions for Evercore is down only 8% versus the prior year," Chairman and CEO John Weinberg said on an Oct. 26 earnings call. "M&A activity in our U.S. business was down, though it was partially offset by our team in Europe having a very strong quarter led by the financials, utilities and industrial sectors."

Moelis & Co. reported a 3.7% sequential decrease in total revenue — substantially all of which is from advisory services — to $233.5 million. It was the fourth straight quarter in which Moelis & Co. reported a decrease in revenue from advisory services.

The third-quarter decline was "primarily attributable to lower levels of transaction completions driven by the volatile markets," CFO Joseph Simon said.

Perella Weinberg Partners reported $145.4 million in total revenue, substantially all of which is from advisory services, for a 3.8% decrease. It was the firm's third consecutive quarter of declining revenue.

Co-founder and CEO Peter Weinberg said on a Nov. 3 earnings call that the company's gross deal pipeline "can be characterized as extremely full." Nevertheless, he added, "given elevated completion risk and longer closing times, our announced backlog is experiencing a step down as key events get pushed out."