S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jan, 2022

By Allison Good

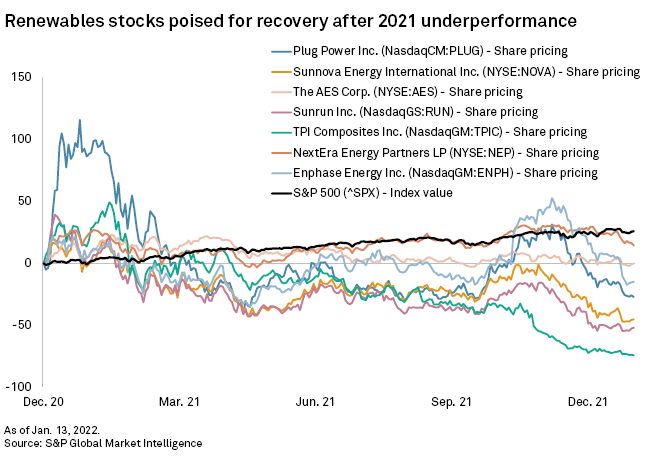

Some North American renewable energy companies could see their stock prices recover in 2022 after diving in 2021.

The iShares Global Clean Energy ETF plummeted nearly 25% in 2021 compared to the S&P 500's 27% gain, reflecting a long list of headwinds including inflation, solar panel and raw materials shortages, uncertainty surrounding tariffs and tax credits, and a California proposal to restructure the state's most important program for on-site solar at homes and businesses.

Longer term, higher commodity and freight prices could raise investment costs by $70 billion for solar between 2021 and 2026 and by $35 billion for onshore wind, which could slow the pace of project development, according to the International Energy Agency.

The stalled Build Back Better bill would infuse the clean energy industry with $325 billion in tax breaks. Some analysts expect certain energy-related provisions within the bill to attract enough bipartisan support to pass as stand-alone measures even if the broader legislative package does not. But Morgan Stanley analysts see other factors setting up the sector for higher equity valuations.

"Many clean-tech stocks are pricing in very little growth, while our confidence in many (but not all) clean-tech companies' ability to achieve strong growth and margins is actually increasing," Morgan Stanley analysts told clients in a Jan. 13 report. "We see continued strong growth for wind, solar, energy storage, fuel cells, and electrification technologies, regardless of whether draft U.S. federal legislation (Build Back Better, or BBB) passes."

Energy storage, in particular, will benefit from recent breakthroughs, with developers planning to build 9 GW of capacity in 2022.

One of the factors pushing renewables growth is deteriorating grid reliability resulting from increasingly severe weather events, creating an opening for clean technology to grab market share from utilities, according to Morgan Stanley.

"We see the potential for clean energy companies to be more disruptive than appreciated to U.S. utilities with high (and rising) customer bills, above average exposure to physical risks from climate change and challenges in ensuring adequate power supply," the analysts said.

KeyBanc Capital Markets has a "cautious to negative" outlook for North American renewables developers, but analysts wrote Jan. 12 that they do not expect major strategic changes from renewable companies if the Build Back Better bill dies and said they "view such a scenario as a lack of incremental positives rather than a negative."

The analysts cited offshore wind, onshore wind and solar growth as continuing on positive trajectories, given "aggressive" state commitments and demand from the commercial and industrial and utility industries, favoring Enphase Energy Inc., NextEra Energy Partners and Sunnova Energy International Inc. despite supply chain concerns.

For Morgan Stanley, the "strong barriers to entry" against competition for Plug Power Inc., Sunrun Inc., AES Corp. and TPI Composites Inc. generate particularly significant upside for those companies in 2022, and Bloom Energy Corp., NextEra Energy Inc. and Avangrid Inc. could benefit from green hydrogen technology advancements and cost reductions.

In October, Plug Power announced construction in New York of the U.S.' largest green hydrogen plant. That same month, NextEra, the country's largest renewables company, said it contracted to develop a 500-MW wind farm to power a new green hydrogen facility.

Morgan Stanley is also cautious when it comes to yieldcos in 2022 due to "increasing competition from many large pools of private capital to acquire operational renewable assets" at higher prices, such as heavyweights Apollo Global Management Inc. and Blackstone Inc.

Utility giants such as Duke Energy Corp. and American Electric Power Co. Inc., which have nonregulated renewables businesses, as well as companies such as Consolidated Edison Inc. that acquired such businesses from other utilities, are expected to sell those portfolios that have not integrated into their rate bases. Algonquin Power & Utilities Corp. could also unload its 44% stake in Atlantica Sustainable Infrastructure PLC formerly known as Atlantica Yield, to help finance the purchase of AEP's Kentucky utility.