S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Apr, 2023

By Allison Good

"It's hard to actually put a deal together when you don't really understand how and when those transfers occur and what is cash when it says it needs to be transferred for cash," Baker Botts LLP project finance attorney Ellen Friedman said in an interview. A big issue for some of Friedman's clients is whether an entity that receives carbon capture credits can subsequently sell them for cash, the attorney said.

For KPMG principal Hannah Hawkins, "almost anyone I talk to who is doing an activity that may be eligible for one of these credits has some interest at least preliminarily in transferability," Hawkins said in an interview.

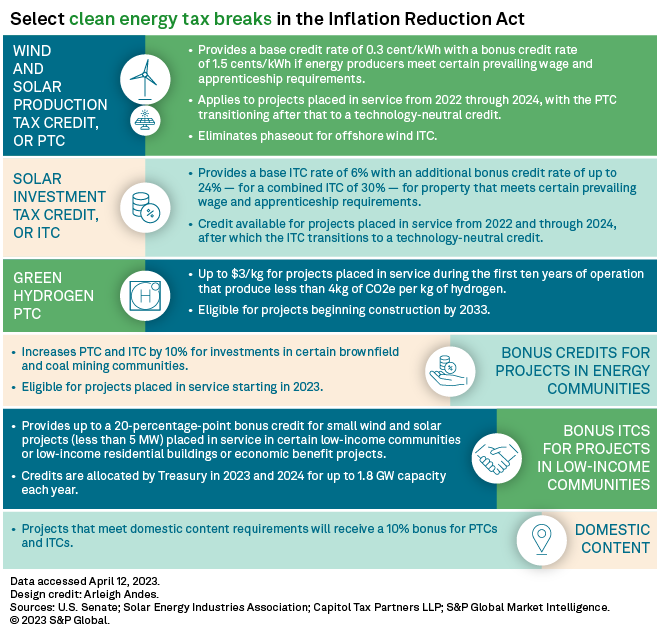

In addition to better guidance on the transferability option for monetizing tax credits, developers want more granular details about the practical applications of green hydrogen credits and how solar projects will meet domestic content bonus requirements, industry experts said. Until the IRS clarifies certain provisions, widespread adoption of the package of federal renewable energy tax credits in the Inflation Reduction Act (IRA) is not feasible for many.

So far the IRS has issued guidance on the 10% energy communities adder, prevailing wage and apprenticeship requirements tied to many of the technology credits, and eligibility for the electric vehicle tax credit. More guidance is expected before the end of the second quarter.

While the US Treasury Department must provide guidance for the green hydrogen tax credit by Aug. 16, there is no deadline for transferability or domestic content, Baker Botts LLP energy tax attorney Barbara de Marigny said in an email.

Transferability

Until recently, developers of large-scale wind and solar installations could often only monetize tax credits received from the US government by selling them to large financial firms and other companies with significant tax liabilities by creating partnerships that owned projects.

The IRA allows developers to convert tax credits into cash payments themselves by selling the credits to unaffiliated corporate entities, opening the door for direct ownership and potentially creating extra income from unused credits should transfer markets materialize.

Many developers, however, still need guidance as to whether risk allocation will be addressed by IRS rules or relegated to individual contracts, Friedman said.

When it comes to recapturing tax credits that companies lose if they do not meet certain requirements, Treasury will likely decide the developer has to pay back the IRS for any unused credits instead of whoever they are transferred to, Norton Rose Fulbright renewable energy tax expert and co-head of projects Keith Martin emphasized in February.

In practice, Alliant Corp. utility Wisconsin Power and Light Co. has already terminated tax equity financing for 12 solar projects, opting instead to own them directly. Utility holding company DTE Energy Co. told investors in October 2022 that eliminating those partnerships enables retaining "an additional 40% of the investment for our projects."

Green hydrogen mechanics

The IRA also includes a $3/kg tax credit for hydrogen made from power sources that do not emit carbon, but many companies are concerned that restrictions meant to ensure the environmental benefits could make implementation economically infeasible.

Specifically, the IRS is weighing whether to require that the electricity used in producing the hydrogen be from new renewable energy resources, be physically deliverable to the facility, and be produced during the same hour of day that facility produces the hydrogen. Such standards would ensure that hydrogen production does not result in new emissions but could complicate the industry's growth.

There are green hydrogen developers on both sides of all three criteria as the industry waits for the IRS to issue guidance.

NextEra Energy Inc. and Plug Power Inc., for example, said in 2022 comments submitted to the IRS that hourly matching could prevent green hydrogen from successfully competing with other renewable energy sources.

"Hourly matching would require a ... project to buy time-correlated renewables during periods of under-generation, which corresponds to higher market price periods, increasing the overall cost," NextEra said. Plug Power said that such a requirement would "stifle the clean hydrogen economy."

Intersect Power LLC and Hy Stor Energy LP, on the other hand, wrote that annual matching is less effective for countering emissions, with independent power producer Intersect Power claiming hourly matching is "simple and ... easily verifiable."

Norton Rose Fulbright's Martin agreed with NextEra and Plug Power that more granular matching, deliverability and additionality "could stop the green hydrogen movement dead in its tracks before it really gets going."

Another issue requiring guidance is whether producers can transport green hydrogen as end products like methanol or ammonium that are easier to move instead of a distinctly hydrogen product.

"The industry argues that if you want a hydrogen economy in practice, you have to accommodate these other outputs," Martin said.

Still, some developers are committing to projects even before the IRS provides more clarity. Constellation Energy Corp. in February announced plans to build a $900 million production facility in the Midwest that would combine nuclear and green hydrogen tax credits.

The commercial-scale facility will use 250 MW of nuclear power to produce about 33,450 metric tons of hydrogen annually, with the option to expand to 400 MW.

Solar panel showdown

Solar developers are waiting for clarity on a 10% domestic content bonus tax credit stipulating that 100% of construction materials, including steel and iron, and 40% of the cost of manufactured products are produced in the US, with the required share rising in future years.

Qualifying for that credit depends on whether the IRS rules that certain solar power inputs, including polysilicon and wafers, are considered components rather than subcomponents, with the former creating an enormous barrier to reaching those qualifications due to a dearth of US suppliers, investor-owned utility trade group Edison Electric Institute warned in 2022.

If certain inputs are declared to be components, it could negatively impact utility-scale companies making trackers, inverters and other equipment that connects to inverters that would not qualify for the bonus credit, analysts at TD Cowen wrote April 3.

They expect the IRS will rule that "modules and cells must be domestically manufactured to achieve eligibility," while "a gradual pathway down to the water level is possible but appears less likely."

Baker Botts' Friedman anticipates a more phased implementation.

"My guess is that during early years they'll be more lenient and look only to the metal components and not necessarily ding you on the panels and … in two years' time or so you'll have to have the cells manufactured here from scratch," Friedman said.

Companies like photovoltaic panel producer SunPower Corp., microinverter manufacturer Enphase Energy Inc. and thin film solar panel producer First Solar Inc. have already committed to sourcing more output in the US but have told investors that they are hesitant to spend more on domestic supply chains until specific guidance materializes.

Array Technologies Inc. CEO Kevin Hostetler said during a fourth-quarter 2022 earnings call in March that the solar tracker manufacturer is waiting for a clarified domestic steel definition.

"One would include being able to import steel from China, for example, pour it in the US and call it domestic. The other says that the steel must be from melt to coat in the US ... and those are two radically different positions," Hostetler said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.