S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Jan, 2022

By Christie Moffat, Chris Hudgins, and Ronamil Portes

The U.S. REIT sector will continue to benefit from improving economic conditions in 2022, building on the recovery and growth of the past 12 months, industry experts say.

The vaccine rollout, low interest rates and improving market confidence are among the factors to have supported that recovery.

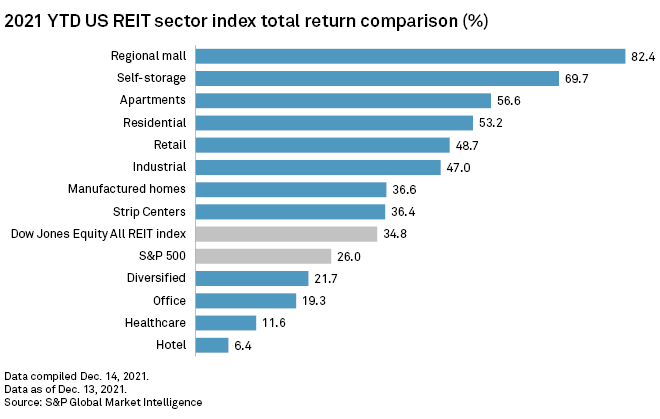

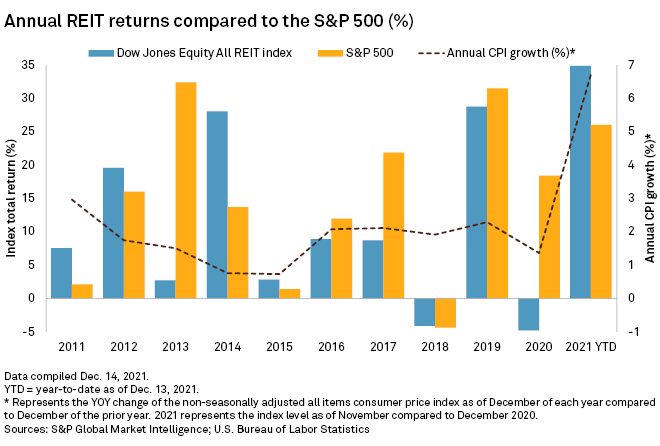

Generally, REITs outperformed the stock market in 2021. As of Dec. 13, the Dow Jones Equity All REIT Index showed total annual growth of 34.8%, while the S&P 500 showed growth of 26%.

Property types that did particularly well in 2021 included retail, self-storage, multifamily and industrial.

Gains are expected to improve in 2022, though inflation will remain a key issue for REITs to watch in 2022, according to SMBC Nikko Securities America Inc. Research Division analyst Richard Anderson.

He said that while current inflation levels are unsustainable, he doesn’t think that they will return to pre-pandemic levels and that the industry is starting to question the notion that the inflationary environment is only transitory.

Real estate has historically performed well during inflationary periods, reflecting its ability to pass on the majority of rising costs. But COVID-19 created unusual economic conditions, and inflation is on track to outperform REIT dividend growth in 2021.

"Inflation is very much top of mind in investors, whether you're a REIT investor, or just a generalist. But the broader idea is REITs are supposed to be inflation hedges, and now we'll perhaps get a chance to see if the proof is in the pudding," Anderson said.

Jeung Hyun, a portfolio manager at Adelante Capital Management LLC, said that property types that can raise rents quickly are more likely to attract the interest of investors in 2022. Examples include multifamily, hotels and self-storage.

"I think in general, if there is an inflationary outlook, and I'm not even sure if there is, then portfolio managers in general will try to kind of gravitate toward the type of property types that you can reset rents quickly," Hyun said.

Both Anderson and Hyun noted that REITs will be closely watching to see whether the U.S. Federal Reserve will raise interest rates in 2022. Interests have been low for several years, making it cheaper to borrow funds, and a rate increase could potentially have a negative impact on some firms.

The other major issue to watch in 2022 is the status of the pandemic itself, Hyun said. The emergence of new variants has forced many companies to delay the return to the office multiple times, and it remains unclear as to when the pandemic will become endemic.

Hyun said that while people in the U.S. are learning to live with COVID-19, the wildcard for REITs is how different municipalities deal with it in the future. If restrictions are reintroduced in response to new disease developments, it could create ongoing headwinds for landlords.

"[REITs] don't necessarily want to make all their decisions based on a world which is pre-dominated by thoughts about COVID. But they can't ignore it either," Hyun said.