S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jul, 2023

US equity real estate investment trust stocks underperformed the broader stock market in the second quarter of 2023.

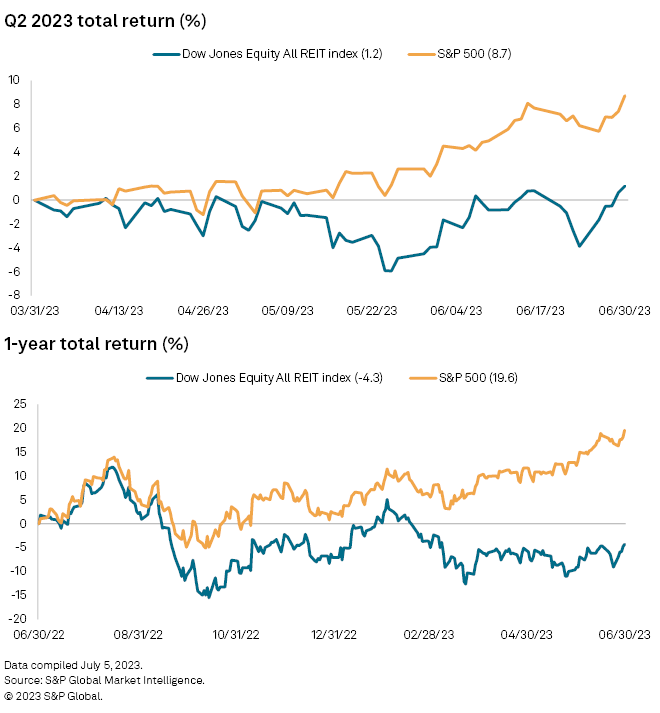

The Dow Jones Equity All REIT index finished the recent quarter with a 1.2% total return, compared to the S&P 500's strong 8.7% return for the quarter.

On a one-year basis, the Dow Jones Equity All REIT index logged a return of negative 4.3%, while the S&P 500 closed in the black with a 19.6% total return over the same time period.

Sector returns

The apartment and healthcare sectors were the best-performing property sectors in the second quarter. The Dow Jones US Real Estate Apartments index generated an 8.9% return for the quarter, while the healthcare-focused index reported a 7.7% return over the same time period.

– For further analysis, try the Worldwide Real Estate Total Return Analysis Excel template.

– Set email alerts for future Data Dispatch articles.

Independence Realty Trust Inc. was the best-performing apartment-focused REIT during the quarter with a return of 14.7%. Centerspace and AvalonBay Communities Inc. placed next with returns of 13.7% and 13.6%, respectively.

The Dow Jones US Real Estate Diversified was the worst-performing real estate sector index during the quarter, with a return of negative 3.7%. The manufactured home and self-storage indexes followed next at negative 3.5% and negative 1.8%, respectively.

Top-performing REITs

Healthcare-focused Diversified Healthcare Trust was the top-performing REIT stock above $200 million market capitalization for the second-consecutive quarter. After a strong fourth-quarter earnings release led to a large spike in share price the quarter prior, Diversified Healthcare Trust's share price spiked again in early June.

Diversified Healthcare Trust announced its merger with Office Properties Income Trust early in the quarter on April 11, but the REIT's share price climbed significantly in early June, shortly after its monthly update on its senior housing portfolio and around the same time investment management firm Flat Footed LLC ramped up its stake in the REIT in opposition of the pending merger. While Diversified Healthcare's board unanimously recommended that its shareholders vote in favor of the merger, Flat Footed owns approximately 9.8% of the outstanding common shares of the healthcare REIT and intends to vote against the merger at the REIT's upcoming special meeting of shareholders scheduled for Aug. 9, 2023.

Communications REIT Uniti Group Inc. placed second for the quarter with a 34.5% return, while New York office-focused SL Green Realty Corp. rounded out the top three at 32.0%. SL Green's jump in share price came at the end of the quarter after its sale of a 49.9% interest in 245 Park Ave. helped spark optimism about valuations for the Manhattan, NY, office market.

Bottom-performing REITs

Two office REITs, Office Properties Income Trust and Hudson Pacific Properties Inc. were the two bottom-performing REIT stocks during the quarter with returns of negative 35.1% and negative 34.9%, respectively.

Ground-lease-oriented Safehold Inc. placed third from bottom with a return of negative 18.6% for the quarter.