Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2024

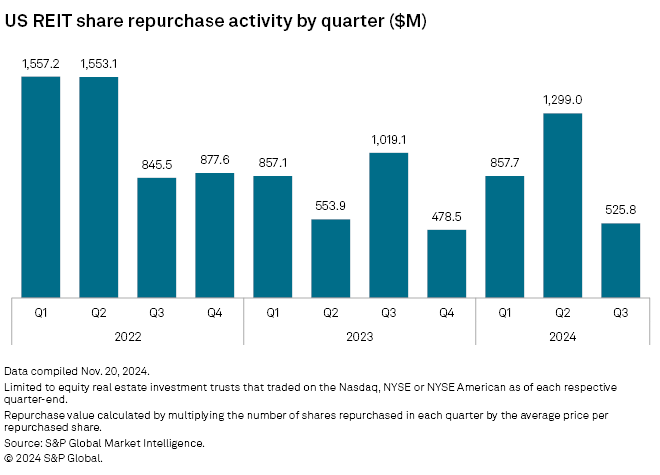

Share repurchase activity by US equity real estate investment trusts fell sharply in the third quarter of 2024, according to an analysis by S&P Global Market Intelligence.

The US REIT sector repurchased $525.8 million worth of common stock during the recent quarter, a 59.5% drop from the quarter prior and down 48.4% year over year.

The analysis included equity REITs that traded on the Nasdaq, NYSE or NYSE American as of each respective quarter-end.

Largest common stock repurchases

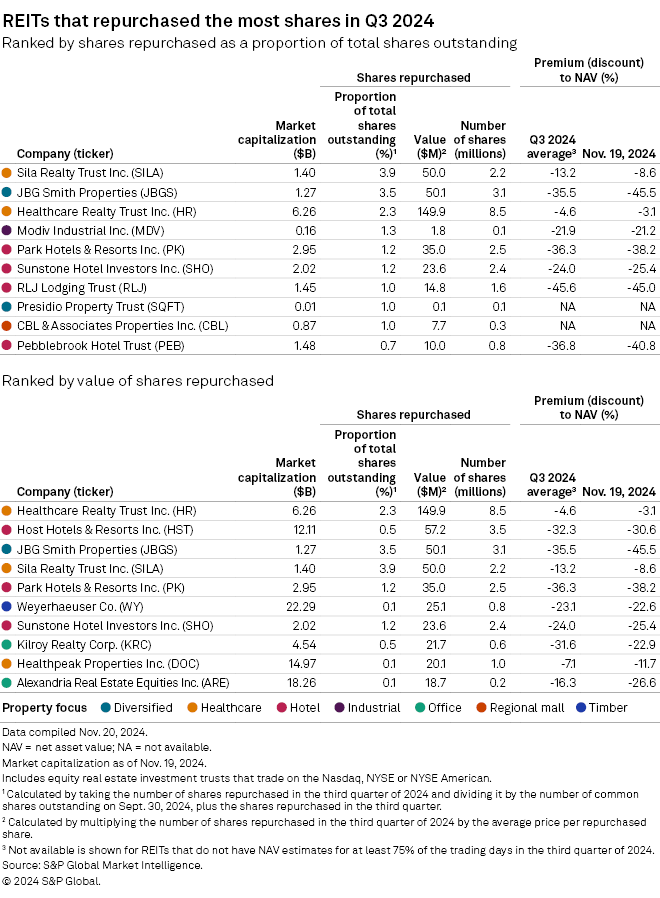

Sila Realty Trust Inc. repurchased the largest proportion of its common stock during the third quarter. The healthcare REIT bought back more than 2.2 million common shares for approximately $50 million. The repurchased common stock represented about 3.9% of the REIT's total common shares outstanding.

JBG Smith Properties also continued to repurchase shares in the recent quarter. The Washington, DC-focused REIT repurchased nearly 3.1 million common shares for approximately $50.1 million, or about 3.5% of its total common shares outstanding.

Healthcare REIT Healthcare Realty Trust Inc. repurchased $149.9 million worth of common stock during the quarter, the most of any equity REIT. The 8.5 million shares repurchased by Healthcare Realty represented approximately 2.3% of its total shares outstanding.

Hotel REIT Host Hotels & Resorts Inc. also repurchased $57.2 million worth of common stock.

– Set email alerts for future Data Dispatch articles.

– Read other Data Dispatch articles by S&P Global Market Intelligence.

– Explore more real estate coverage.

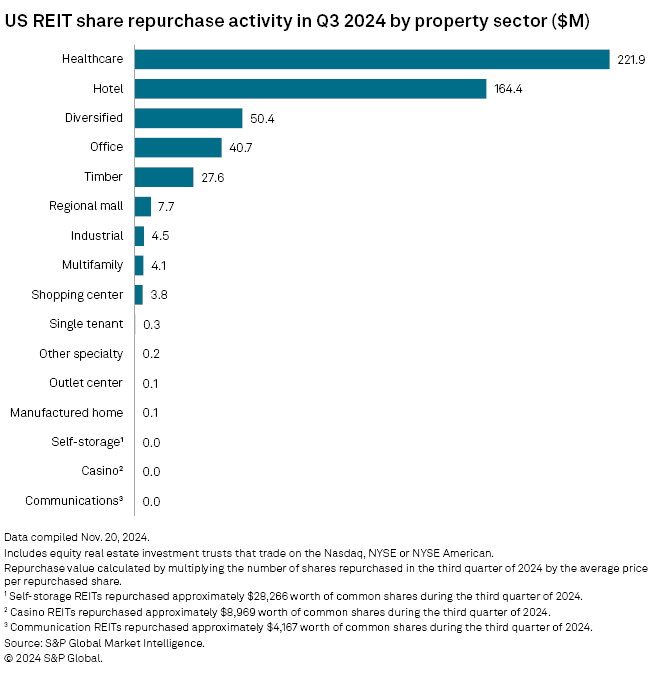

By property sector, healthcare REITs repurchased the most common stock during the third quarter, at $221.9 million in the aggregate.

The hotel sector followed next, with $164.4 million worth of common stock repurchased.

New share repurchase plans

Two REITs announced new share repurchase programs during the third quarter.

Healthpeak Properties Inc.'s board approved the healthcare REIT's new share repurchase plan July 24, allowing it to buy back up to $500 million worth of common stock through July 2026. As of Sept. 30, no shares have been repurchased under its new share repurchase program.

On July 31, Regency Centers Corp.'s board authorized the shopping center REIT's new common stock buyback program under which the company may repurchase up to $250 million worth of its common shares. At quarter-end, the full $250 million remained available under the program.