S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 May, 2023

By RJ Dumaual

Cedents in Japan and South Korea accepted big rate increases and tougher terms during the April 1 reinsurance renewal season.

Japanese agriculture insurer National Mutual Insurance Federation of Agricultural Cooperatives, also known as Zenkyoren, managed to negotiate increases of less than 20%, but most contract renewals in the Japanese market saw rate increases well in excess of that mark amid increasing natural disasters across the globe and upward inflationary pressures, a company spokesperson told S&P Global Market intelligence.

Greenlight Capital Re Ltd. seemed to benefit as it grew its Japanese catastrophe book at the April 1 renewals with rate increases of more than 20%, according to CEO Simon Burton.

"Given that we continue to see increases in reinsurance demand, as cedents attempt to reduce their own volatility, coupled with persistent supply constraints, I believe that the outlook for our underwriting model is excellent for the rest of 2023 and into 2024," Burton said during an earnings call.

Property catastrophe rates were up 15% to 25% in Japan, according to Marsh & McLennan Cos. Inc. CEO John Doyle, with the impact of rate increases on ceded premiums mitigated by higher retentions.

Insurance brokers agree that the April 1 renewals in Japan were orderly compared to the negotiations during the Jan. 1 season.

Because Japan has some of the largest buyers in the world in terms of per risk programs and because so many deals are syndicated and feature multiple reinsurers, there is less room to maneuver for cedents than in other developed markets, Brian Kirwan, global head of nonlife at financial risk management platform Vesttoo Ltd., said in an email to S&P Global Market Intelligence. Those conditions explain the more orderly approach, Kirwan said.

Long, difficult road to renewals in South Korea

Negotiations in South Korea appeared to be quite different. Global broker Aon PLC said April renewals were "slow and somewhat frustrating" for insurers in the country, as the challenging market conditions of Jan. 1 continued at April 1, despite several reinsurers entering the market. Reinsurers sought to restore "price adequacy" following a series of large risk losses coupled with natural catastrophe losses in 2022, Aon added.

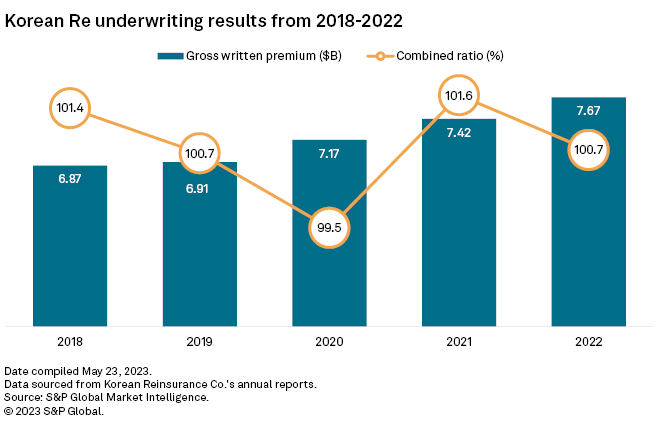

Korean Reinsurance Co. in its annual report said it "strictly maintained" underwriting discipline for treaty renewals in domestic property in 2023 by restricting reinsurance terms and conditions, reducing cession ranges and commission rates while also minimizing exposure to risks sensitive to economic downturns, including warehouse and factory fire policies.

"As we focus on building a profit-oriented portfolio, we will continue to take a highly disciplined approach to underwriting and remain selective about risk acceptance and pricing," the reinsurer added.

Vesttoo's Kirwan said April 1 renewals were "anything but orderly" for South Korea. Due to the adverse results suffered by most property treaties over recent years, proportional treaties were put under "tremendous pressure" with negotiations continuing well into the middle of March.

"All cedents were prepared for tough negotiations and tightening conditions, but many were shocked at the final terms they had to accept," Kirwan said. "The lack of competing quotes on XOL (excess of loss) treaties was another source of frustration for many cedents and reduced their room to negotiate."

Insurance-linked securities interest diverges

There were also very different levels of interest in insurance-linked securities (ILS) between Japanese and South Korean primary insurers.

There is a "definite upswing" of interest in ILS from Japanese cedents who have sometimes found specific lines harder to secure reinsurance coverage, Kirwan said. The Japan-specific personal accident line, and the heightened losses there due to COVID-19, was one of the few big challenges of the April 1 renewals.

On the other hand, South Korean insurers are "deeply conservative and reluctant to adopt innovative structures," Kirwan said. But the hardening market will force some cedents to consider alternative forms of reinsurance, he added.