S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 May, 2021

By RJ Dumaual and Husain Rupawala

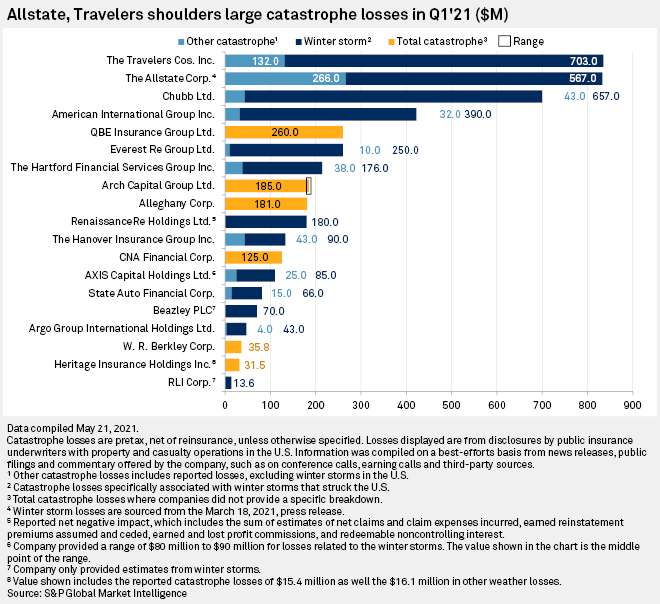

Insurers and reinsurers sustained significant insured losses in the first quarter, mainly driven by winter weather in February that paralyzed parts of the southern U.S., particularly Texas.

The unprecedented winter weather in Texas and nearby state had been expected to deal insurance and reinsurance losses of at least $18 billion by catastrophe modeling firm Karen Clark & Co., while AccuWeather Founder and CEO Joel Myers estimated total damage and economic loss of between $45 billion and $50 billion. But despite the historic nature of the event, insurance companies and industry analysts are becoming more sanguine about its impact.

Jefferies analyst Philip Kett in a research note said natural catastrophe losses from the winter storms have been repeatedly mentioned as having a material, but manageable, impact for the first quarter. Property and casualty claims frequency is high, he said, but severity trends remain more uncertain. Kett said there seems to be anecdotal evidence that severity is "relatively low," with policyholders retaining a larger proportion of claims, lessening the cost to underwriters.

Overall, The Travelers Companies Inc. recorded the largest amount of losses from the massive winter storm in the first quarter at $703 million. Chubb Ltd. followed at $657 million, according to an S&P Global Market Intelligence analysis.

The Allstate Corp. incurred insured losses from the winter weather in the southern U.S. of roughly $567 million, to go along with $266 million from other catastrophes, in the first quarter.

CFO Mario Rizzo said the company benefited "pretty significantly" from its reinsurance program. Allstate posted recoveries of about $955 million from its $5 billion current program and its aggregate cover of about $1 billion, Rizzo said during an earnings call. The CFO also said that there were more recoveries "once you start peeling back the prior year component of that reinsurance recovery," leading to a gross loss in Texas that exceeds $1.3 billion.

Lemonade Inc. had significant exposure to the Texas freeze, which drove a 50-point increase in its loss ratio. The company said it received what amounted to an "entire year's worth of claims" in the span of a few days, leading to an "extreme stress test" for operations and financials.

Nevertheless, the insurtech company still eked out a gross profit of $1.9 million for the first quarter, which JMP Securities analyst Ron Josey attributed mainly to Lemonade's reinsurance contracts. Excluding catastrophes, Lemonade's loss ratio was within 100 basis points of its year-ago level, he noted.

He also expects shortages of materials and labor, as well as COVID-19 restrictions, to amplify loss costs. RenRe logged insured losses from the Texas winter storm of $180.0 million, mostly in the property catastrophe segment.