Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Feb, 2021

By Declan Harty

Wall Street is facing renewed skepticism from Washington, D.C., in the wake of the GameStop Corp. saga over the practice of payment for order flow, which has become a key revenue source for some retail brokerages.

Lawmakers and regulators have recently begun pressing for details about the intricate and controversial structure of payment for order flow, or PFOF, in which wholesale trading giants such as Citadel Securities, Virtu Financial Inc. and Two Sigma Securities LLC pay retail brokerages including Robinhood Markets Inc., Charles Schwab Corp. and E*TRADE Financial LLC to execute their clients' stock and options orders at the public market's best current price, or often at even better prices.

Caroline Crenshaw, one of the U.S. Securities and Exchange Commission's Democratic commissioners, told S&P Global Market Intelligence in a recent interview that the regulator should take a close look at payment for order flow as part of a broader review to ensure that brokers are meeting their best-execution obligations. And on Capitol Hill, Sen. Elizabeth Warren, D-Mass., recently called for Menlo Park, Calif.-based Robinhood to issue a "clear accounting" of its relationships with large financial institutions like Citadel Securities in a letter to CEO Vlad Tenev.

"One of the things that seems fairly clear is that payment for order flow played a major role in all of this. A lot of the other issues we talk about are issues because of payment for order flow," said Barbara Roper, director of investor protection at the Consumer Federation of America, in an interview. "When investors can trade for free, including in stocks and options, there's no friction that prevents this type of frenzied trading. Would these events have unfolded the same way if they had to pay $5? Payment for order flow creates incentives for brokers who rely on it for zero commissions."

|

Payment for order flow has been a subject of debate in Washington before. To critics, it is a model riddled with conflicts of interest that raise questions over how retail investors' trades are handled. But proponents say it has helped enable a new era of retail trading where investors can buy and sell securities for free by helping replace lost revenue at brokerages moving to zero commissions.

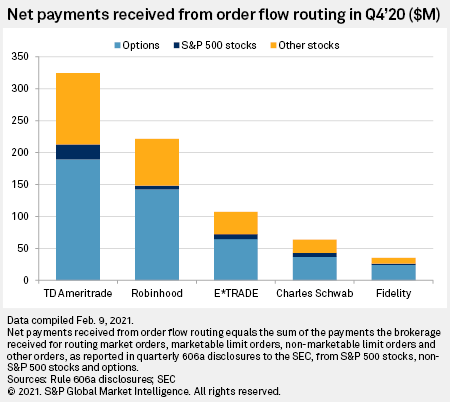

In the fourth quarter of 2020 alone, for instance, Robinhood, Schwab, E*TRADE, TD Ameritrade Holding Corp. and Fidelity Investments netted more than $750 million from payment for order flow, according to an S&P Global Market Intelligence analysis of quarterly filings. Not every retail brokerage accepts payment for order flow, though. Fidelity does not for any of the equity orders it sends to wholesalers. And one brokerage, New York-based Public Holdings Inc., said it is stopping the practice after the GameStop episode to "remove this conflict of interest" from its business model. Public will instead allow its customers to tip the company an amount they choose, according to a Feb. 1 blog post on its website.

For Virtu CEO Doug Cifu, who runs one of the biggest trading companies on Wall Street, the dialogue around payment for order flow is the result of misconceptions about the practice. Wholesalers like Virtu that handle retail brokerages' orders collect part of the small spread on each of the buy and sell trades they execute throughout the day. In the cases where brokerages charge for flow, an equal rate is set for the wholesalers who then compete with one another for more orders based on their execution quality.

Whether or not the brokerage accepts payment for order flow, proponents say the retail investor usually gets a price that is better than the displayed national best bid or offer, a spread called price improvement. Schwab recently disclosed that its clients received $598 million in price improvement on their equity and option orders in the fourth quarter of 2020. Citadel Securities has said it provided $1.5 billion in price improvement on equity orders in 2020. And Virtu disclosed Feb. 11 that it provided about $1.3 billion of price improvement.

Cracking down on payment for order flow would not prompt any changes for Virtu, Cifu said Feb. 11 on a quarterly earnings call.

"Payment for order flow, or the rebate if you will, is important for innovation," he said. "When people look at what the marketplace has done and what has been created for retail investors in this country, where they can literally on a smartphone or a laptop or an iPad push a button and buy 1,000 shares of Tesla at or better than the national best bid [and] offer for zero, why would you change that? No reason."

Still, the uproar over retail brokerages off-loading the execution of their clients' orders to large Wall Street trading firms is not likely to die down.

Two congressional hearings are already being planned, with one scheduled Feb. 18, to debrief the GameStop episode with payment for order flow likely to figure as a key point of discussion. But large-scale changes to the payment for order flow model being handed down in light of so-called meme stock volatility remains unlikely, according to Compass Point Research & Trading LLC's Isaac Boltansky.

"PFOF is ripe for attack given the potential for misaligned interests and its admittedly nefarious name, but PFOF proponents argue that the practice has increased market liquidity and lowered consumer costs," the analyst wrote in a Jan. 31 research report. "We have spent a decade in this seat watching PFOF regulatory headlines cross the tape only to eventually die when PFOF proponents reframe the debate within the context of consumer costs."

Location

Segment