S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Nov, 2021

By Eric Oak

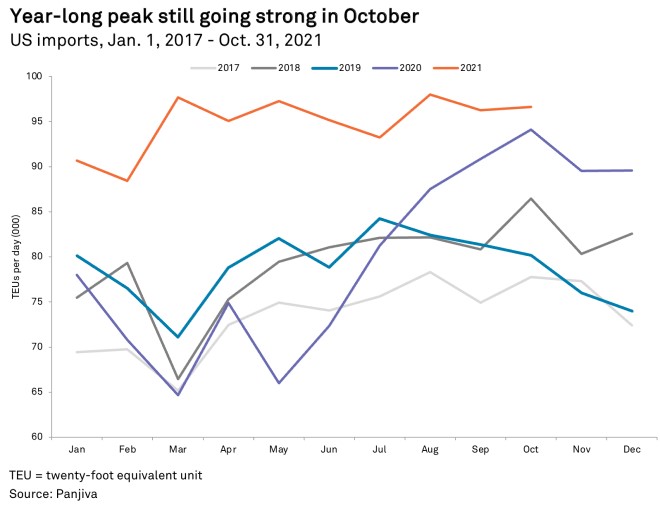

U.S. imports by volume increased 2.7% year over year in October based on preliminary data collected by Panjiva, continuing to indicate that logistics networks are running flat out. U.S. import networks are at capacity, as noted in Panjiva's Q4'21 Outlook, bringing with it much of the congestion and supply chain issues faced by companies this year. The challenge with congestion is that while imports are at record highs — up 20.5% compared with 2019 — individual companies are seeing longer lead times for goods, which then incites increased and early purchases. This can turn into a cycle where congestion in logistics drives further traffic from companies trying to hedge risk by ordering additional supplies.

October is a pivotal month for holiday-focused supply chains. Companies that want to stock shelves by Thanksgiving often need to import by October to allow goods to pass through inland networks. If any additional capacity was to be found, this was the most likely period to appear, but companies have had all year to prepare for this period, and sustained imports in previous months could mean that many businesses shipped earlier than usual. That may be a problem for consumers shopping for a specific present, or manufacturers that have run out of a specific item, as replacements may not make it in time.

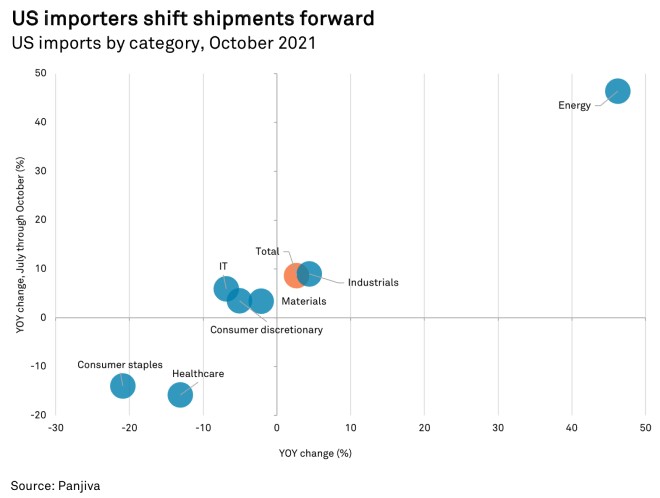

Panjiva data shows that sectors with increased imports compared with both 2020 and 2019 indicate relative success in handling increasingly complex supply chain challenges. These include energy, which saw imports increase 46.3% year over year and by 42.4% from 2019. Surging energy prices and demand across much of the world likely contributed to the growth, with natural gas prices up 89.7% year over year, according to S&P Capital IQ data. Industrials also saw imports improve 4.4% from 2020 and by 22.6% against 2019.

In the chart below, the upper left quadrant shows sectors whose import performance increased versus 2019, benefiting from post-lockdown surges in demand, but declined compared with 2020 due to supply chain issues. Companies in these sectors may have used strategies to mitigate the crisis, such as shipping earlier than usual, as associated imports rose year over year in the July-to-October period. The materials, consumer discretionary and IT industries are part of this category, increasing 3.4%, 3.5% and 5.9% year over year, respectively, in those four months. Overall, this means the sectors may have enough goods but may have to bear an increase in inventories if stocks do not sell until the holiday season.

Imports in healthcare and consumer staples fell 13.1% and 20.9% year over year, respectively, in October. Both segments also saw July-to-October imports drop 15.8% and 14.0% year over year, respectively. These sectors saw exceptional activity during and after coronavirus-related restrictions in 2020 as businesses and consumers stocked up on personal protective equipment and other personal care products. The surge was driven by uncertainty over COVID-19, which has largely faded as the country grapples with new conditions.

Leisure goods, especially toys, are of particular interest in the lead-up to the holiday season. Many toy retailers depend on this time frame for a large percentage of their sales.

Imports of toys fell 1.3% year over year in October, but that figure hides what is likely an effort to ship goods early, with imports up 14.1% year over year from July to October and by 7.2% versus October 2019. Imports of leisure goods other than toys — such as exercise equipment and video games — performed better, increasing 9.0% year over year in October and by 32.1% year over year in the four-month period. Imports versus October 2019 also grew 62.3%, which could mean companies in this category shifted imports earlier and are gearing up for a strong holiday season.

Eric Oak is a researcher at Panjiva, a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.