S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Jul, 2022

By Karin Rives

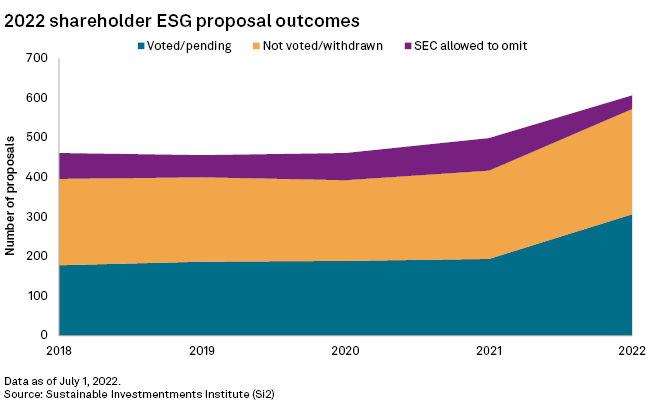

The 2022 U.S. proxy season has yielded a record 607 shareholder resolutions on environmental, social and governance issues, a 22% increase from 2021, according to a midyear update from the Proxy Preview Project, a collaboration of several shareholder advocacy groups.

As of July 1, 266 resolutions had been withdrawn following negotiations between shareholders and management, up from 223 in 2021. A higher number of withdrawals suggests that shareholders are getting more successful at pressuring companies to act, advocates said.

"With the political dysfunction making it hard to get anything done, those who want things to happen go to actors who can, which is often large companies," said Heidi Welsh, executive director of the Sustainable Investments Institute (Si2), part of the Proxy Preview Project. "Collectively, there's still a lot of support for disclosure."

The growing activism by shareholders stands in contrast to the movement afoot in red states to push corporations away from ESG policies, which some attorneys general have dismissed as "woke." Those states have also threatened to sue the U.S. Securities and Exchange Commission over its proposal to require many companies to publicly disclose climate risks, which critics have said goes beyond a company's core business.

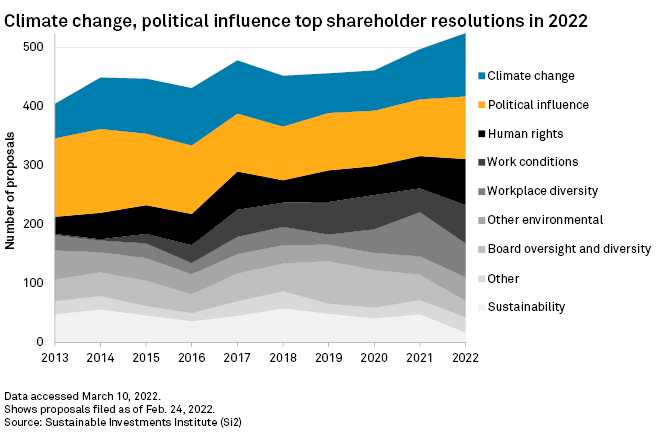

Resolutions seeking to push corporations to set more ambitious emissions reduction goals and achieve other climate-related goals were a high priority for investors this year. Corporate lobbying disclosures and racial justice were also key investor priorities, the groups said.

The U.S. shareholder season starts in the spring and continues into summer, with companies holding annual meetings and investors reviewing their financial performance and voting on directors and other corporate matters. In all, 108 more shareholder resolutions have been filed this year than in 2021 as of July 1, an increase that came despite a Trump-era rule the SEC finalized in 2020 making filing and refiling resolutions more difficult.

"The attempt to silence shareholder voices has, instead, prompted them to get louder," Andrew Behar, CEO of As You Sow, wrote this spring as the season was about to kick off. "This uprising is occurring while investors and fiduciaries increasingly understand that systemic risk affects all players in the capital markets, inspiring leading companies onto the path of serving all stakeholders."

Climate change-related proposals stood out this year because the topic was also at the core of resolutions on corporate lobbying, environmental justice, board oversight and other shareholder priorities, the Proxy Preview Project has reported.

In all, 113 proposals focused on climate change have been filed this season, up from 79 in 2021. Nearly all of those proposals focused on corporate greenhouse gas reduction targets and 2050 net-zero goals, which shareholders can now inquire about after the SEC in November 2021 rescinded other Trump-era rules that said setting timelines constituted "micromanagement."

The big question this year was whether shareholders would ask companies to do more to tackle climate risks or ask for new corporate policies, Welsh said in an interview.

"They pushed the envelope a little bit and asked for more action, and it didn't always get as much support as previous, perhaps less specific, requests," Welsh said. "That doesn't mean that investors in general and companies aren't paying attention to climate change."

Out of a record 282 ESG-focused proposals voted on thus far, 34 won a majority of support, about the same as in 2021, Welsh said.

For the first time, a smaller share of investors in leading oil companies such as Shell PLC BP PLC and Chevron Corp. voted in favor of resolutions calling for more ambitious climate targets, possibly due to energy security and geopolitical concerns. Still, resolutions won strong shareholder support for improved methane management at Chevron and an analysis of the financial impact of a net-zero carbon program at Exxon Mobil Corp.

Vote outcomes do not give a complete picture of shareholder engagement since many resolutions are withdrawn after a company and investors reach an agreement before the annual meeting.

Proposals for three of the largest U.S. electric utilities were withdrawn after As You Sow reached an agreement with Dominion Energy Inc., Duke Energy Corp. and Southern Co. over several climate-related matters. Dominion and Duke expanded their climate targets to include all emissions connected with natural gas, including hard-to-measure Scope 3 emissions. Southern also agreed to include Scope 3 natural gas emissions in its disclosures.

Greenwashing is a growing concern

In a separate report issued July 14, ESG data and risk assessment company RepRisk AG warned that greenwashing risks are "escalating" for American and European companies. Over the past two years, 20% of all climate-related incidents the company tracked were linked to misleading climate communication, RepRisk said.

With the boom in corporate ESG promises, the SEC is seeking to strengthen ESG accountability at publicly traded companies. The agency recently proposed a rule that would require investment firms and advisers to be more transparent about such claims.

"ESG investing is booming because it promises less risk but also brings with it the perils of greenwashing," As You Sow's Behar wrote in his letter. "We clearly need assurance systems for all disclosed material information that provide all market players with truly comparable data."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.