S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Oct, 2021

The price of tin skyrocketed to nearly $40,000 per tonne this month, and it is primed to test new records with little metal in the wings to replenish stocks, a power crunch in China curbing output and the prospect of further supply disruption in the coming months, according to tin-market expert Tom Mulqueen.

"The price is going to be really volatile and tin is going to be highly vulnerable to more supply shocks," said Mulqueen, head of research at Amalgamated Metal Trading Limited and the former manager of market intelligence at the International Tin Association.

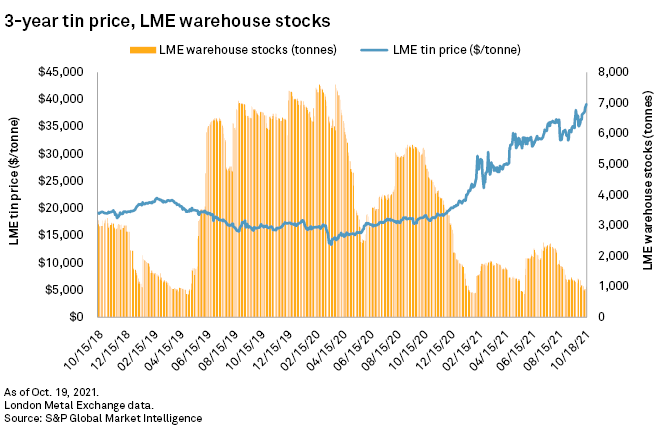

In recent years the price of tin largely traded between $15,000 and $20,000 per tonne, but it has roughly doubled in 2021, while London Metal Exchange stockpiles have plummeted.

The rise of tin comes as prices in other base metals like copper and aluminum also spike on the back of strong demand and tight markets that have been hit by supply chain issues, including a power crunch in China forcing smelters to curb production.

Demand for tin in the first half of 2021 surged as consumers snapped up electronics, appliances and other products amid the COVID-19 pandemic. The International Tin Association said Oct. 11 that refined tin demand is set to jump 7.2% this year in part due to the sudden increase in people working from home, which has driven new purchases for electronics and other items.

Among major uses, tin is applied as a nontoxic solder instead of lead.

While tin demand appears to have moderated in the second half, issues related to COVID-19, power and weather have disrupted supply and cut into warehouse stocks, Mulqueen said.

Since August, London Metal Exchange stocks halved to under just 1,000 tonnes. Tin stocks in London hit similar levels in 2019 without a corresponding price spike, but this time around, there appears to be less metal outside official stocks to fill warehouses back up, Mulqueen said.

Among the tin market's supply woes, Malaysia Smelting Corp. Bhd. cut back output this year in the wake of COVID-19 restrictions and furnace related issues that emerged in April. It is operating with about 80% of normal staffing levels, according to media reports.

"They're still struggling to recover from both of those things," Mulqueen said.

Likewise, Indonesia's tin output fell earlier this year under the strain of restrictions related to COVID-19, according to media reports.

A power crunch in China has also had an impact on manufacturers of tin solder in particular, Mulqueen said. China is a major tin producer, with four of the top 10 tin producing companies of 2020 based in the country, according to the International Tin Association.

With the lingering impact of COVID-19, the ongoing supply issues in Malaysia and the potential for fresh disruptions, the price of tin could continue to rise over the next three to six months. Further, tin is a relatively small and illiquid market, making it less resilient to disruption than larger base metal industries, Mulqueen said.

"People are concerned. It's going to be the wet season in Indonesia soon, and supply may tail off again"," Mulqueen said, while also pointing to unresolved power issues in China and beyond.

Supply-chain issues may dissipate in late 2022, leading to some pull back in tin prices, though longer term demand will continue to grow amid the ongoing push to electrify and decarbonize economies, Mulqueen said.