S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Jan, 2021

By Tom Jacobs and Husain Rupawala

Receivership activity in the U.S. insurance industry decreased sharply year over year in 2020, but insurers were still adversely affected by a struggling economy brought on by the COVID-19 pandemic.

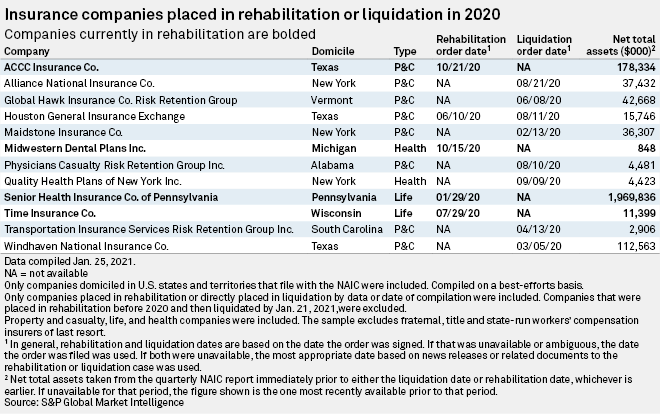

Regulators placed eight underwriters into liquidation and four into rehabilitation last year, according to an S&P Global Market Intelligence analysis. That compared with 22 companies put into liquidation or rehabilitation in 2019.

Net total assets of companies under receivership in 2020 totaled $2.42 billion, a dramatic decrease from $7.85 billion in 2019.

Midwestern Dental Plans Inc. of Dearborn, Mich., was one company on the list directly affected by the pandemic. The company was a network of dental providers comprised of seven offices between Detroit and Lansing and was ordered into rehabilitation on Oct. 15, 2020.

The company had to shutter six of its locations after Gov. Gretchen Whitmer issued an executive order limiting nonessential medical and dental procedures because of the pandemic. The Dearborn office remained open for emergency procedures.

Midwestern informed the state Department of Insurance and Financial Services, or DIFS, in a May 21, 2020, letter that it was permanently closing all seven offices eight days later due to "the economic challenges and uncertainties" related to the pandemic.

Midwestern surrendered its certificate of authority to DIFS and asked that it be dissolved and was placed in rehabilitation. However, on Jan. 26, the state petitioned Ingham County Circuit Court to issue an order converting rehabilitation to liquidation, as well as a judicial declaration of insolvency. A hearing on the petition is scheduled for Feb. 3 in Ingham County Circuit Court.

Global Hawk Insurance Co. Risk Retention Group was ordered into liquidation on June 8, 2020, three days after a Vermont Superior Court judge placed the company under the receivership of the state's financial regulator.

The judge's order cited the insurer's financial condition, particularly the "significant and material" net losses and underwriting losses reported in December 2019. The order further stated that Global Hawk's insolvent status precluded any further business as it would be financially hazardous to its policyholders, creditors or the public.

The liquidation of Windhaven National Insurance Co. was ordered by the district court of Travis County, Texas, after finding the company's lack of admitted assets were at least equal to all its liabilities, on top of the required minimum surplus of $5 million. It also lacked the liquid assets necessary for it to meet its obligations.

Transportation Insurance Services Risk Retention Group Inc. was ordered into liquidation on April 13, 2020, one month after its petition for Chapter 11 bankruptcy was dismissed. Judge Alison Lee of the Richland County, S.C., Court of Common Pleas appointed South Carolina Insurance Director Raymond Farmer as liquidator.

Farmer said in his petition that the company "violated the insurance laws of this state" and was insolvent.

Transportation Insurance Services, which insured a portion of commercial auto liability risks for its parent, trucking company Celadon Group Inc., filed for Chapter 11 protection in December 2019. Farmer in January 2020 asked that the petition be dismissed. He said the insurer did not meet the criteria of a debtor under the federal bankruptcy code.