Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Sep, 2022

By Zoe Sagalow and Xylex Mangulabnan

An unusual stipulation in the Federal Deposit Insurance Corp.'s approval of Beaumont, Texas-based CBTX Inc. and Houston-based Allegiance Bancshares Inc.'s merger of equals may become more common.

The FDIC's sign-off, granted in June, requires the combined company to submit an action plan "for improving the extent of home mortgage applications from, and originations to, African American applicants in the combined institution's assessment areas," according to the Federal Reserve's order of approval dated Sept. 14.

The stipulation, which might have been prompted by a public comment letter, is a sign of the current environment in which regulators are looking at bank deals with increased scrutiny and will likely become more common in regulatory approvals, experts said.

"We view the condition as continuing our expectation that we serve the communities throughout our markets," Allegiance Bank CEO Ray Vitulli wrote in an email to S&P Global Market Intelligence, speaking on behalf of both banks, which will be named Stellar Bancorp once combined. "Allegiance Bank and CommunityBank of Texas have exceptional track-records of meeting the credit needs of the communities they serve. Our combination reinforces and advances our commitment to all of our communities."

Could one letter prompt a probe?

In a Feb. 17 letter to regulators, Matthew Lee, executive director of Inner City Press and Fair Finance Watch, voiced concerns about each respective company's volume of mortgage loans to African American borrowers, and he believes his letter may have prompted the FDIC to probe the companies' mortgage lending practices, he told S&P Global Market Intelligence in an interview.

Lee said he received a June 17 letter from the FDIC that noted the agency "took into consideration the issues" he raised, investigated them and "the banks' overall [Community Reinvestment Act] performances" and approved the application subject to conditions, according to a copy of the letter he provided to S&P Global Market Intelligence. Lee has lodged numerous objections to bank deals, but he has rarely received such feedback from the FDIC.

CommunityBank of Texas' last Community Reinvestment Act rating, which was in 2019, was "outstanding," and Allegiance Bank's, which was in 2021, was "satisfactory."

According to the Fed's order of approval, it received 18 public comment letters on the MOE. The "vast majority" of those letters expressed support of the deal, and just one letter expressed "adverse" comments on the deal by alleging that both banks made fewer mortgage loans to African American borrowers in Texas.

Still, it is unclear whether one letter alone prompted the agencies to look into the banks' mortgage lending practices.

"There is a chance that the regulators would've caught this on their own and put in the condition either way," Kevin Hill, Community Reinvestment Act manager at the National Community Reinvestment Coalition, said in an interview.

Despite the stipulation, Lee still has concerns about the combined company's mortgage lending practices going forward.

"I think if you're advocating here, you can't declare victory on so little," Lee said in an interview. "How is this improvement going to be enforced? How is it going to be measured? What kind of standing does the community have to say they did it or they didn't do it?"

CBTX, Allegiance Bancshares' mortgage lending to African Americans in Texas

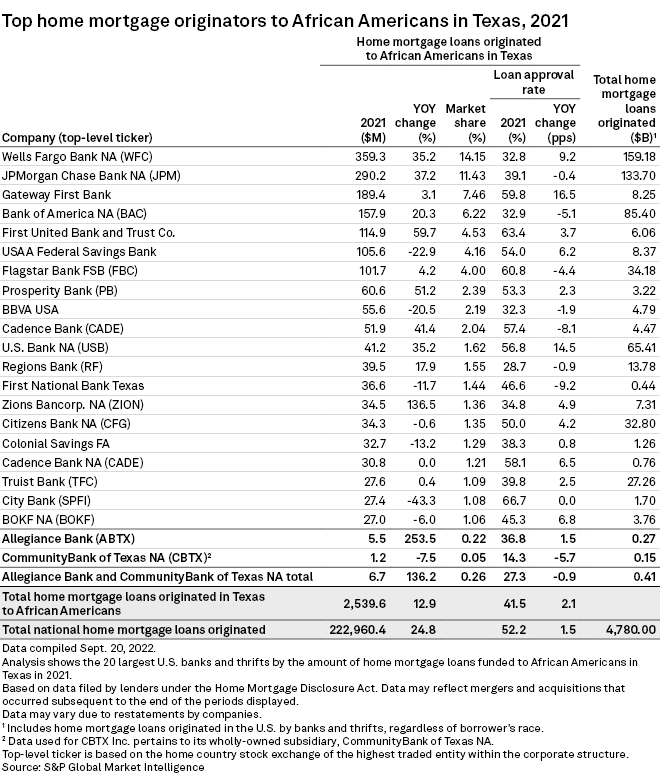

In 2021, Allegiance Bank originated $267.2 million in mortgage loans, and $5.5 million, or 2%, of those were made to African Americans in Texas, according to an S&P Global Market Intelligence analysis. The company's $5.5 million in home mortgage loans to African Americans in Texas was a 253.5% jump year over year. It originated 0.22% of all mortgage loans to African Americans in the state in 2021.

CommunityBank of Texas NA, CBTX's banking subsidiary, originated $145.6 million in total home mortgage loans in 2021, and $1.2 million of that went to African American homebuyers in Texas, or less than 1% of its total mortgage loans in 2021. The company originated 0.05% of all mortgage loans to African Americans in the state in 2021.

A sign of the times

Lawyers and other observers agreed regulators might impose similar stipulations in the future.

"I think there was less of a focus on these particular banks than there was on the specific comment and the specific data point," Joseph Silvia of Dickinson Wright PLLC, who advises financial institutions on M&A and other matters and is a former counsel to the Federal Reserve Bank of Chicago, said in an interview.

While such stipulations in merger approvals are rare, "they're probably going to become more and more common, but they're still probably not going to be on every single merger," NCRC's Hill said.

Chip MacDonald, managing director of MacDonald & Partners LLC, said the condition is new but unsurprising in the current environment.

"Not surprising in light of the public positions that the administration has taken ... about inclusion and fairness," and as expressed by the Federal Reserve's vice chair for supervision, Michael Barr, and FDIC Acting Chair Martin Gruenberg, MacDonald said.

CBTX and Allegiance's deal pended for about 310 days before receiving all required regulatory approvals. The companies now expect the transaction to close on or around Oct. 1.

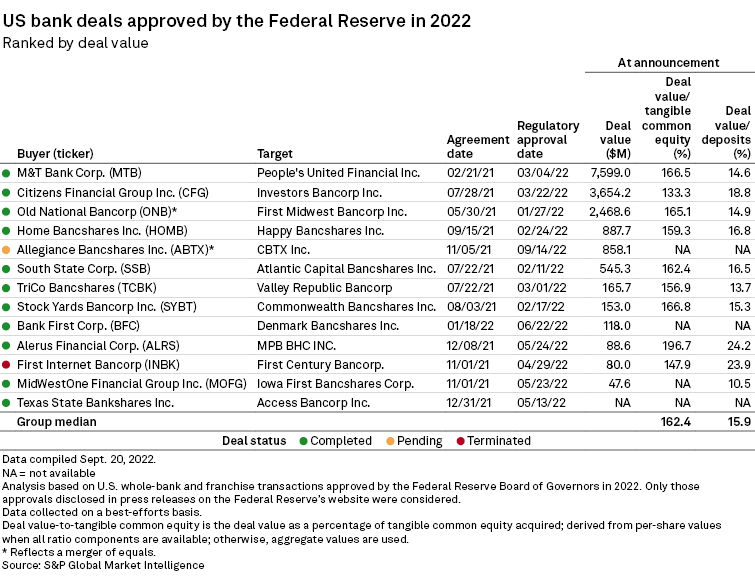

The Fed's sign-off of the transaction was the 13th approval from the Fed's Board of Governors this year, but the only such approval so far in the third quarter. Prior to the CBTX and Allegiance approval, the Fed Board had not approved a deal since June 22.