Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Feb, 2021

By Chris Rogers

Canadian aluminum producers breached their quota for exports to the U.S. in December 2020, S&P Global Platts reports, raising questions as to whether U.S. President Joe Biden will stick to the trade rules put in place by the Trump administration. There are signs that President Biden is happy to reverse earlier rulings, shown by the reversal of a tariff exemption from section 232 duties tied to a quota for imports from the United Arab Emirates.

With low capacity utilization still prevailing in the non-ferrous metals industry, as outlined in Panjiva's Jan. 19 research, it would be a surprise to see President Biden remove tariffs in the short-term. Indeed, they may prove a useful bargaining chip as the U.S. seeks to rebuild its relations with allies. Yet, relaxing the restriction on imports from Canada could be an easy win, reverting relations regarding the section 232 restrictions back to those applying when the United States-Mexico-Canada Agreement trade deal was signed.

Panjiva's data shows that the imposition of the quotas had a devastating effect on imports from Canada, with the mass of shipments in December down 72.2% year over year while imports in the fourth quarter of 2020 overall dropped 76.4%. Shipments from the UAE, meanwhile, fell by 20.8% in the fourth quarter of 2020 and those from the EU — another potential beneficiary from a tariff-driven settlement with U.S. allies — declined 26.4%.

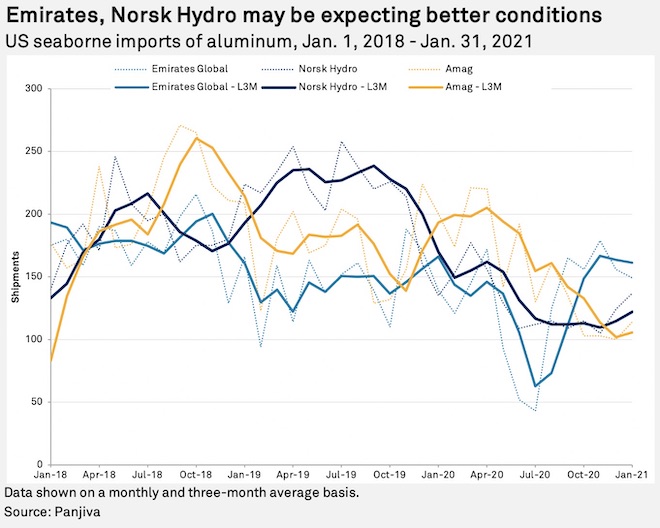

There are signs that the rate of decline has slowed, with U.S. seaborne imports of aluminum products in January having declined by just 4.6% year over year. That has included a 7.2% increase in imports linked to Emirates Global Aluminium PJSC, which may indicate an anticipation of the leniency granted by former President Trump given that the shipments would have left the UAE several weeks before the decision was made.

Imports from leading European supplier Norsk Hydro ASA improved by 1.5% year over year after falling 42.7% in the fourth quarter of 2020, though not all European exporters are proving as optimistic, with AMAG rolling GmbH's shipments having dropped 43.0%.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.