Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2021

By Chris Rogers

This report is one of three looking at the prospects for supply chains in the third quarter of 2021 and beyond. In this note, we consider the outlook for retail and manufacturing supply chains resulting from a short-term approach to corporate planning. Others analyze the impact of underinvestment in logistics, the prospects for medical supply chains and the results of geopolitical rivalry in trade policy in the U.S., Europe and globally, and can be found here.

There have been two major signs of disruptions to supply chains in North America in the first half of 2021 and they will likely unwind during the second half of the year. One is the surge in consumer demand seen in elevated retail sales and fall in inventories despite rising imports of goods to the U.S. The second is a shortage of components for the industrial manufacturing sector, though macroeconomic data suggests the challenges are focused on specific products.

The boom in U.S. retail sales, discussed in Panjiva's research of June 16, reached a 15.7% increase in May 2021 compared with the same period of 2019. The sustainability of that boom will depend on the delivery of COVID-19 vaccinations and the reopening of the services economy.

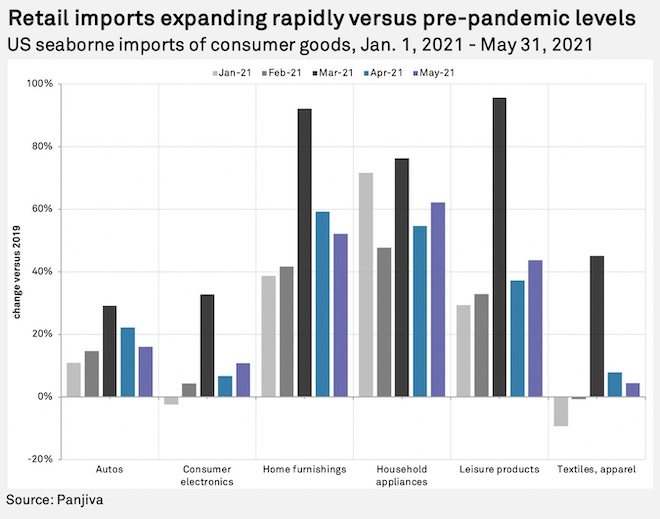

Retailers have certainly attempted to keep up with demand growth. U.S. seaborne imports of consumer discretionary goods in May increased 88.2% year over year and by 32.9% compared with 2019, led by shipments of home furnishings and household appliances.

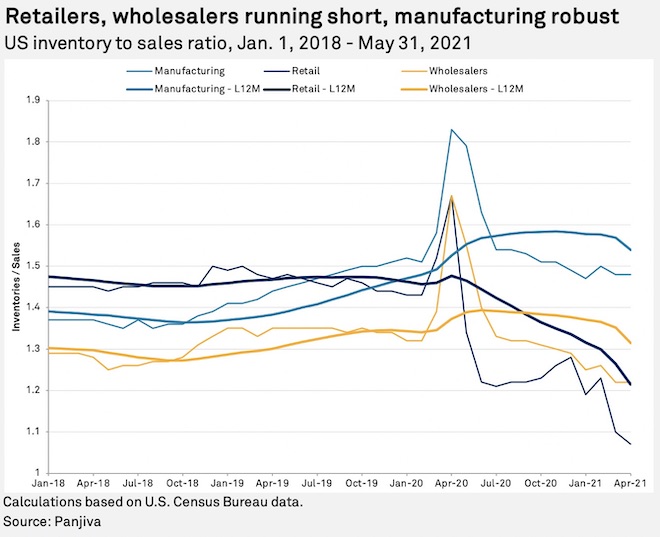

Yet, the increased level of imports has not been enough to support sales on the basis of falling inventory-to-sales ratios. Panjiva's analysis of official data shows that the inventory-to-sales ratio in the U.S. retail sector fell to 1.07 in April compared with a level of 1.47 averaged in 2019 as a pre-pandemic benchmark. Rebuilding inventories may mean seaborne shipping activity remains elevated even if demand reverts to normal or below in the second half of the year.

The fallout from short-termism in manufacturing

As the chart above shows, the situation in manufacturing is somewhat different with an inventory-to-sales ratio of 1.48 in April compared with 1.46 on average in 2019. That may indicate that predictions of the death of just-in-time manufacturing, which allows balance sheet optimization at the cost of increased operational continuity risk, are overstated.

That has not presented challenges in specific sectors, though, from a shortage of specific components resulting from earlier manufacturing strategy decisions. The automotive industry has been the main example here, with the ongoing shortage of supply versus demand in semiconductors being a proximate cause of reduced manufacturing.

The most recent example is Ford Motor Co.'s reported shutdown at eight North American plants because of a shortage of electronic components, which it said was due to the "global semiconductor shortage [that] continues to affect global automakers and other industries in all parts of the world," according to CBS News. On the basis of past experience, other automakers may soon follow suit. Suzuki Motor Corp. in Japan has already done so.

The impact of the volatility of supplies of specific parts can be seen in Mexican imports of automotive components linked to Ford, which slumped 39.3% in May 2021 versus May 2019 after jumping 33.8% in April. Shipments linked to Volkswagen AG also declined 39.3% while General Motors Co. and Stellantis NV improved by 3.2% and 2.5%, respectively.

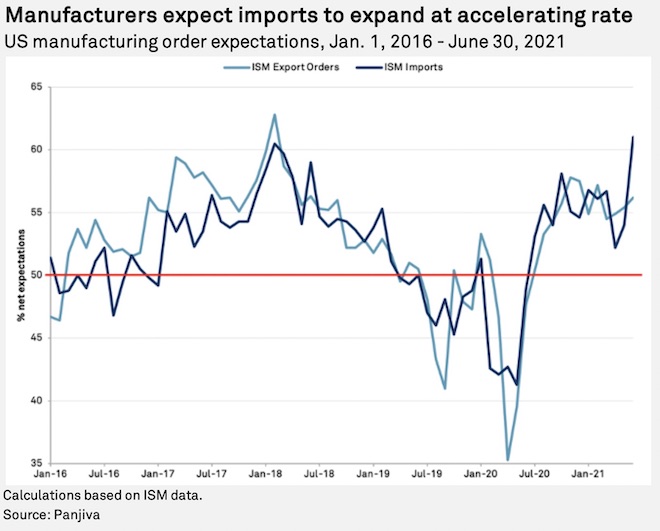

There are few signs, however, of manufacturing activity slowing down. The U.S. Institute for Supply Management survey of manufacturing firms indicates import order expectations are becoming more bullish, reaching 61.0 in June from 54.0 a month earlier (a figure over 50 indicates expansion). That represents the highest level since at least 2010. There are clear signs of challenges, though, with a computer and electronics firm noting that "[s]upply chain constraints, from mechanical to electronics (products) continue to be challenging, from both availability and logistics perspectives," leading to "inflationary pressure." Meanwhile, an electrical equipment firm noted, "[H]igher prices, inflation and lack of available labor are impacting all organizations in our supply chain."

There are, however, conflicting messages from exporters in Asia. Export expectations in China, measured by the China Federation of Logistics and Purchasing survey, dipped to 48.1 in June, the lowest since June 2020 (a figure below 50 indicates contraction). That may indicate a desire for imports in manufacturing in the U.S. may not be matched by supplies from China.

There has nonetheless been a rapid expansion in imports of industrial goods to the U.S. during the second quarter of 2021. Across all industrial sectors, imports climbed 17.6% in May 2021 versus May 2019 after increasing 23.3% in April. Importantly, that included a 33.5% rise in industrial components imports, suggesting manufacturing within the U.S. is still doing well.

One distraction from long-term supply chain planning is short-term parts challenges. Another is cost inflation, which is leading firms to focus on their pricing strategies for the coming months rather than long-term positioning.

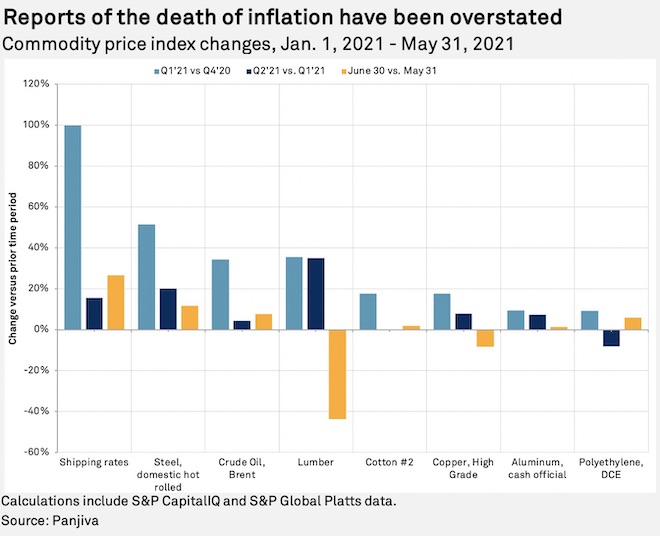

As a proxy for costs set to be reported for corporations in their second-quarter 2021 earnings reports, a basket of seven industrial raw materials plus shipping costs tracked by Panjiva increased 14.3% on average in the second quarter of 2021 versus the first quarter. That follows a 42.0% sequential rise in the first quarter of 2021 versus the fourth quarter of 2020. While some items are falling more recently, including a 43.7% slide in lumber prices and an 8.3% decline in copper in June, it is too early to write off inflationary pressures given steel, oil, polyethylene and shipping (see below) all increased during the month.

Companies as diverse as Herman Miller Inc. (furniture), Donaldson Co. Inc. (filtration systems) and FedEx Corp. (logistics) have all said they plan to pass on higher costs to their customers. S&P Global Ratings noted that most U.S. inflation measures in the U.S. "have surged well past the 2% threshold and look likely to stay well above target for several quarters."

The forthcoming corporate earnings reporting season, running from mid-July to mid-August, will reveal the extent to which firms are focusing on short-term planning issues such as component sourcing and pricing strategies. It will also reveal the extent to which they are implementing longer-term plans to build resilience.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.

S&P Global Ratings and S&P Global Market Intelligence are owned by S&P Global Inc.