Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Nov, 2021

Renewable energy developers are cheering the U.S. House of Representatives' proposal to expand and extend tax credits for clean power projects as part of a new budget reconciliation package.

But to receive the full benefits of the credits, utilities and other project owners would need to meet domestic content and labor requirements that industry members say could be tough to satisfy. And large generators face potential headwinds from a proposed corporate alternative minimum tax that could eliminate the use of certain deductions beneficial to renewable energy development.

House Democrats released the nearly 1,700-page Build Back Better Act on Oct. 28. The $1.75 trillion budget reconciliation package pared back total spending from an earlier version of the legislation, a response to moderate Democrats' concerns about the initial bill's $3.5 trillion price tag.

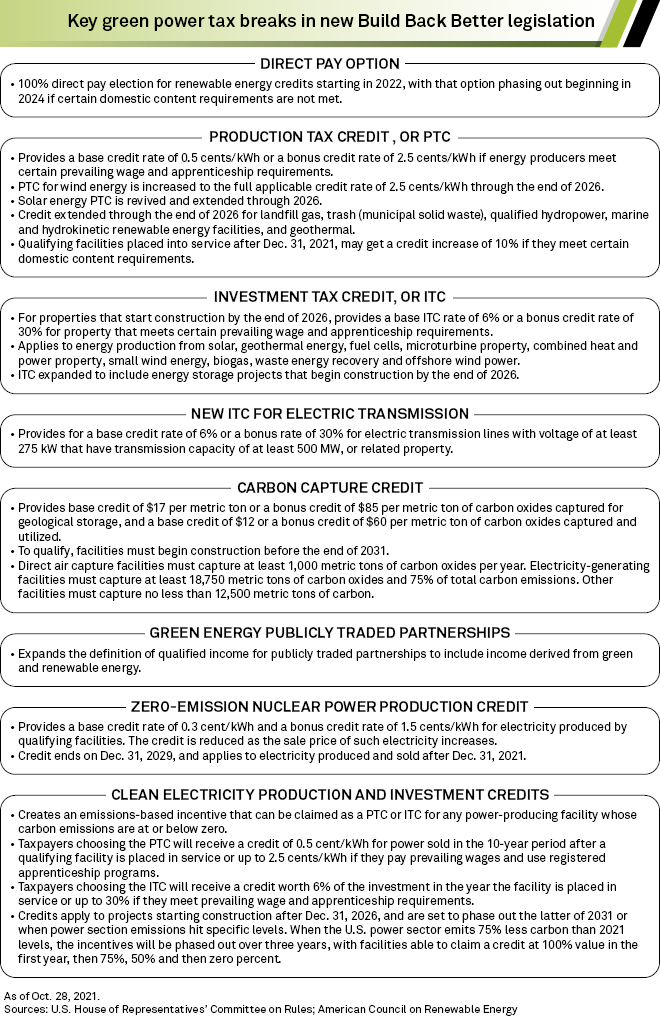

The proposal released Oct. 28 still contains extensive clean energy tax provisions. The legislation would bolster and extend existing tax credits for wind and solar power by five years, reflecting earlier legislation from the House Committee on Ways and Means. In addition, standalone energy storage projects and large new transmission lines would be able to qualify for federal investment tax credits, while nuclear plants could receive a new zero-emission production tax credit.

In a nod to the U.S. Senate's tax-writing committee, the new bill would transition to providing technology-neutral tax credits for zero-emission electric facilities for a five-year period running through 2031, or until power sector emissions fall to a certain amount.

The bill would also allow clean energy developers to claim the value of the credits through direct payments, opening up those incentives to a wider range of entities, including those that are tax-exempt.

House Democrats will present an amended version of the new Build Back Better Act to the House Committee on Rules on Nov. 3, with a hearing on the legislation to occur the same day, House Speaker Nancy Pelosi, D-Calif., said in a dear colleague letter. If the House passes the bill, it will head to the Senate, where the legislation could undergo further changes.

The legislation "is the largest federal investment in clean energy in American history," American Clean Power Association CEO Heather Zichal said.

The Oct. 28 proposal "makes clear that Congress is rising to meet this critical moment," said Gregory Wetstone, president and CEO of the American Council on Renewable Energy. "The provisions in the framework represent an unprecedented national commitment to accelerating the clean energy transition and credibly addressing the climate challenge."

'Two-tiered incentives'

In an update to the existing tax code, the Build Back Better Act would create "two-tiered incentives" for clean energy projects, according to a summary of the legislation. The bill would provide either a base rate for the credits or a "bonus" rate equal to five times the base rate if projects meet certain prevailing wage and apprenticeship requirements.

To qualify for the bonus credit, companies must ensure that any laborers and mechanics receive prevailing wages during project construction and that qualified apprentices perform a certain percentage of labor hours. Those percentages were set at 10% for projects that start construction in 2022, rising to 12.5% in 2023 and 15% thereafter.

Taxpayers will have the option to "cure" potential wage shortfalls, including by compensating workers for the difference between their pay and prevailing wages and paying penalties to the U.S. Treasury Department. A good-faith exemption was also included in the bill for developers who make an effort to find qualified apprentices, with one industry source saying not nearly enough apprenticeship programs exist to meet the legislation's targets.

But other requirements could be harder to satisfy.

Under the bill, projects that choose to receive direct payments in lieu of tax credits must fulfill domestic content requirements for steel, iron and manufactured products in order to receive full payments.

Steel and iron ore that are not part of manufactured products must be 100% produced in the U.S. starting in 2024. For manufactured products, at least 40% of the total cost of project components must be for U.S.-made goods for projects that start construction before 2025, rising to 50% for 2026 and 55% for projects thereafter.

For offshore wind facilities, the domestically produced share would be 20% for projects that start construction before 2025, then gradually rising to 45% for projects that begin construction after 2026.

Those targets could be difficult for many projects to meet, potentially limiting the value of the direct pay option for small developers and tax-exempt entities who are already shut out from accessing tax equity because they have little to no tax liability.

"It remains hard for anyone other than the larger developers to raise tax equity," said Keith Martin, a tax and project finance lawyer for Norton Rose Fulbright. "This problem will become more pronounced as these huge offshore wind projects come into the tax equity market and as more carbon capture projects start to lay claim to tax equity."

But renewable industry groups remain upbeat.

"The bill provides so much opportunity for every American community to adopt solar and invest in and benefit from the growth of the industry," said Erin Duncan, vice president of congressional affairs for the Solar Energy Industries Association. "So, yes, while the details may yet be tweaked between now and final passage, we believe the requirements will be feasible."

Worries over corporate minimum tax

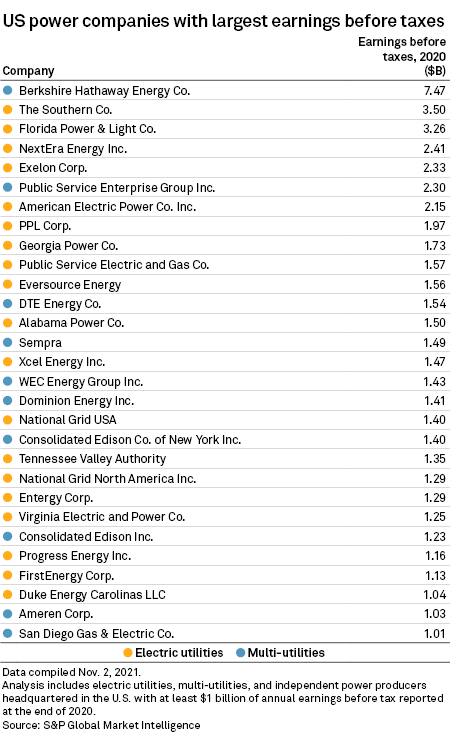

Another potential risk for renewable energy developers is a proposed 15% corporate alternative minimum tax on adjusted financial statement income for companies that make over $1 billion in annual profits.

|

The proposed tax would preserve the value of clean energy credits when determining a company's tax obligations. But it would disallow the use of accelerated depreciation, which lets companies claim higher deductions in the earlier years of an asset's life.

"As we look to deploy new clean energy resources and transmission, the accelerated depreciation incentive is really important to lower costs for customers and improve the business case," said Patrick Reiten, senior vice president of public policy for Berkshire Hathaway Energy. "If you don't allow that to be used, we've calculated a significant loss of value over the next 10 years within our current plans."

Reiten said customers of the company's regulated utilities — PacifiCorp, MidAmerican Energy Co. and NV Energy Inc. — would lose $1.5 billion in value over the next 10 years on carbon-free energy and transmission growth if the proposed tax were enacted.

Although new and expanded tax credits for clean energy are a plus, the loss of depreciation "works counter to that," Reiten concluded.

Despite those concerns, Martin said the legislation was supportive of expanded renewable deployment overall.

"Restoring the tax credits to their full level and allowing a direct pay alternative is a positive," Martin said. "The fine print is a challenge to deal with, but I think the industry will find a way to do that."