Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2022

The California Public Utilities Commission scrapped a Jan. 12 hearing on its controversial proposed decision to slash payments for rooftop solar generation in the nation's leading market for harnessing sunlight at homes and businesses.

The cancellation came amid mounting criticism of the PUC's net energy metering reform package, proposed in December 2021, and in the wake of wide-ranging views expressed in recent days by investor-owned utilities, solar companies, environmental groups, ratepayer advocates, economists and Gov. Gavin Newsom.

The proposal — largely applauded by utilities as well as some environmentalists and ratepayer advocates — would cut net-metering credits for solar exports to the grid by roughly 80%, impose hundreds of dollars in new fixed charges annually on individual system owners and backtrack on a previously agreed grandfathering policy.

"Nobody, as far as I know, has ever proposed anything quite that extreme," Ahmad Faruqui, a veteran energy economist, said in an interview. "These are extremely radical. I did not expect California would be the state where these proposals would even see the light of day."

Such criticism is significant coming from Faruqui. The independent economist recently retired from The Brattle Group, where he represented utilities in net-metering battles across the United States, including in Arizona, Kansas, Idaho, Montana, Nevada and South Carolina.

Faruqui's recent calls in written comments and interviews for regulators to reject the proposal, scheduled for a Jan. 27 vote, come as Gov. Gavin Newsom acknowledges that changes are needed.

"We still have some work to do," Newsom said when asked about his view of the draft solar decision during a Jan. 10 media briefing on his latest budget proposals.

The California Solar & Storage Association, which represents large companies like Sunrun Inc. and SunPower Corp. and hundreds of smaller solar installers, asked Newsom to defend rooftop solar against what the industry and its backers characterize as a utility profit grab.

In a Jan. 7 filing with the PUC, the trade group reiterated its position that the proposal's grid participation charge on solar-powered customers violates both state and federal law. If adopted, the proposed reforms "will be a potent weapon in the hands of utilities across the country seeking to snuff out customer-sited solar," attorneys for the group said.

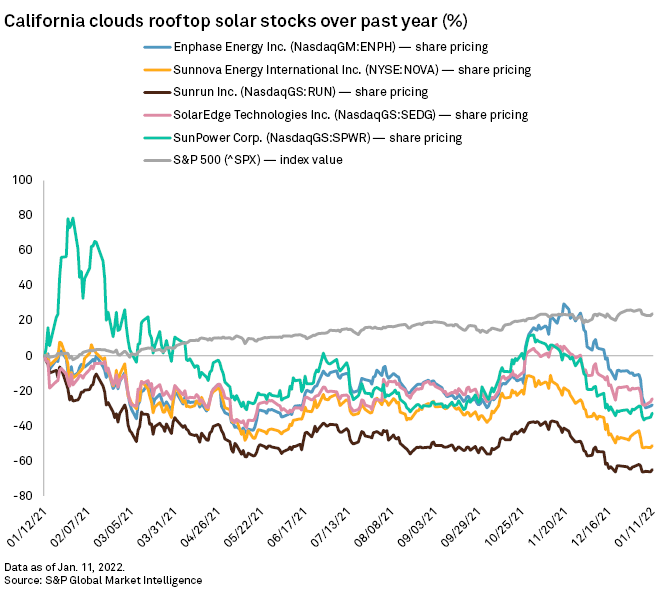

Investor concerns are high, measured by the downtrodden stock prices of publicly traded rooftop solar companies that are highly active in California. But analysts at Roth Capital Partners believe Newsom's comments indicate that political pressures are mounting for the governor to intervene, whereas the overall reaction to the proposal could be positive for California-exposed solar companies.

In a Jan. 13 note to clients, the analysts said they expect the final decision to be delayed beyond Jan. 27 and see the possibility that an alternate proposal might emerge. The five-member commission has two new Newsom-appointed members in 2022, including President Alice Reynolds, the governor's former senior energy adviser.

'Strategically myopic'

Some stakeholders, however, agreed with the hard departure from the state's existing net-metering policy, which compensates excess solar generation at the full retail rate.

The commission's Public Advocates Office, in its Jan. 7 comments, called the "structural elements" of the proposed decision "reasonable and appropriate" while arguing that the tariff reform proposals "do not go far enough."

The ratepayer advocacy group has criticized a net metering "cost shift" that penalizes nonsolar-powered utility customers, especially low-income households that cannot afford to go solar, to the tune of billions of dollars per year.

In their joint comments, also filed Jan. 7, Pacific Gas and Electric Co., Southern California Edison Co. and San Diego Gas & Electric Co. called for the final decision to adopt a tariff "that first eliminates the cost shift entirely."

While the policy does represent a shift in costs to utility customers without solar, California's electric rates are "riven with cost shifts," Faruqui told regulators in Jan. 7 comments. Large cost shifts occur between rural and urban customers, large and small energy users, and those with more and less energy-efficient properties.

The proposal singles out "just the cost shift that's created when solar customers import less power from the grid, ignoring all other cost shifts," Faruqui wrote. Regulators should "put cost shifts in perspective."

Without doing so, the proposed decision "is treating solar customers as if they have some kind of social stigma," Faruqui told S&P Global Market Intelligence.

Regulators also grossly miscalculated the cost of solar and the time it would take customers to achieve financial payback, Faruqui said in a criticism also voiced by the solar industry. The proposed decision would extend payback periods from seven to nine years currently to more than 20 years, making solar unaffordable for most customers and also undermining the commission's effort to encourage more battery storage installations to meet peak energy demands after sunset, according to the economist.

"If customers will not install rooftop solar panels because they have a very long payback period, they will not install a battery either," Faruqui wrote.

An implosion of the distributed solar and battery market could pull down California's buoyant electric vehicle market, Faruqui said, because of their increasingly intertwined customer base. "Making it wildly more expensive to go solar could also cannibalize EV sales and make vehicle-to-grid integration impossible."

That, in turn, contrasts with California's efforts to decarbonize its economy, the economist added.

"The state will pay the price for adopting a strategically myopic policy that is orthogonal to its stated intent of decarbonizing the energy sector by electrifying the consumption of energy," Faruqui said.

The economist recommended that regulators review a proposal from the Sierra Club that includes peak time-of-use periods to encourage electrification and solar "but not absurdly high discriminatory fees on future solar-plus-battery customers."

Faruqui also advised California regulators to look at elements of a solution that emerged in a net-metering case in South Carolina, where he testified on behalf of Duke Energy Corp. affiliates. That included rebates if solar-powered customers allow the utility to control smart thermostats during critical times of peak demand "since the customer will create long-term benefits for the electric grid by reducing supply-side costs," Faruqui said.