S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Jun, 2022

By Kris Elaine Figuracion

• This analysis by S&P Global Market Intelligence is limited to publicly available rate filings submitted to state insurance regulators.

• Rate filing information is sourced from the System for Electronic Rate and Form Filing documents.

• States employ a variety of rate regulation mechanisms such as prior approval, modified prior approval, file and use, and use and file. Form filing laws govern the type of policy form regulation used by the state and may not require explicit approval by the regulator prior to using new rates.

• The analysis is based on when a rate filing is "disposed" by the state regulator and does not take into account when the new rate became effective for new and renewal business. In some instances, the new rate has been in effect prior to the particular month the filing was "disposed" by the regulator.

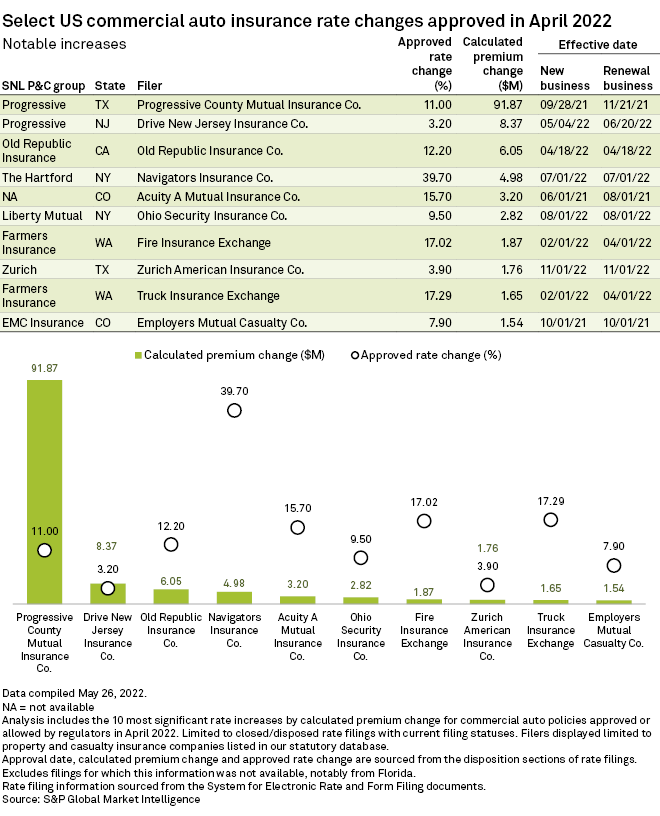

The Progressive Corp. could see the largest cumulative commercial auto premium increase from rate hikes approved in April, according to an S&P Global Market Intelligence analysis.

The group is expected to log $101.2 million of premiums increase from seven rate-hike requests approved by regulators in five states.

Two Progressive rate filings entered the top 10 most significant increases for April. Of the two filings, the most significant in terms of impact to premiums is the 11% rate hike approved in Texas, which will impact nearly 105,000 policyholders. That rate increase alone could add $91.9 million to the group's cumulative premiums.

The Hartford Financial Services Group Inc. is expected to see the second-largest cumulative increase in commercial auto premiums after securing approvals for 28 rate hikes that could increase the company's total premiums by about $7.5 million.

Rates rise in Lone Star State

A total of 15 rate hikes approved in Texas could lead to the biggest change in total premiums statewide at $96.8 million. That figure accounts for 55.3% of the total calculated premium increase from rate hikes approved across the entire U.S. in April.

In the mid-Atlantic, rate increases approved by New York's state regulator could boost commercial auto premiums by $13.7 million statewide.

Penn National Insurance

At the other end of the spectrum, rate reduction requests approved for Pennsylvania National Mutual Casualty Insurance Co. and its subsidiary could lead to the largest cumulative premium decrease for the month of April. Penn National Insurance units were approved for three rate reductions in Pennsylvania and Maryland that, when combined, stand to reduce the group's calculated premiums by about $941,000 and $189,000 in those respective states.