Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2021

By Tom Jacobs and Husain Rupawala

The Progressive Corp. had another strong year of growth in the U.S. private auto space in 2020, increasing its market share and written premiums.

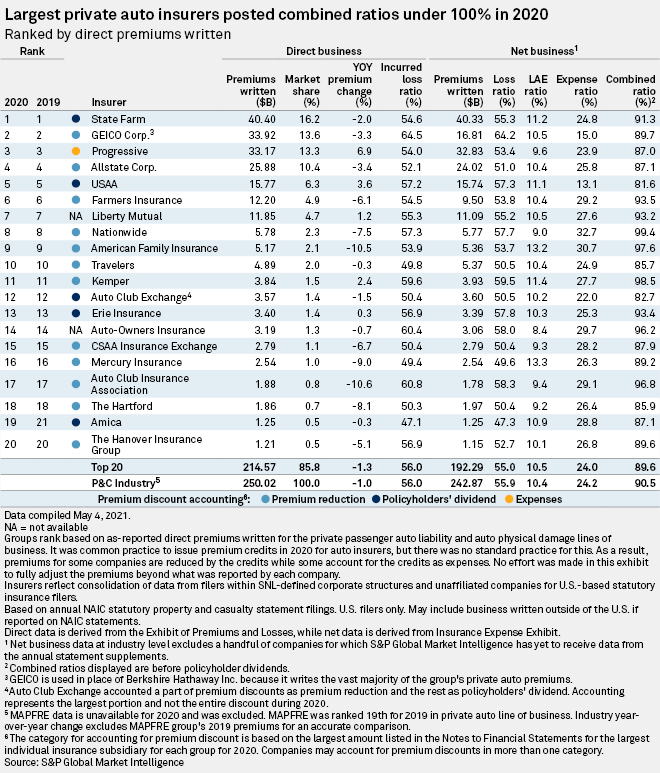

Progressive posted a 6.9% year-over-year increase in direct premiums written, the highest among the top 20 private auto insurers and the only one in the top three to book an increase, according to an S&P Global Market Intelligence analysis based directly on premiums reported by each company.

State Farm Mutual Automobile Insurance Co. retained the top spot in the ranking despite a 2.0% year-over-year decrease in direct premiums written. Berkshire Hathaway Inc.'s GEICO Corp., which saw a 3.3% decline in direct premiums written, held on to second place.

Progressive closed much of the gap with GEICO, as it controlled 13.3% of the market at year-end 2020, up from 12.2% in 2019. GEICO's year-end market share stood at 13.6%, while State Farm finished 2020 with 16.2%, up from 16.1% in the prior year. Due to accounting differences for premium rebates at the start of the COVID-19 pandemic, GEICO's market share is net of reductions for premium rebates while State Farm's and Progressive's reported premiums are not reduced by the amount of rebates issued.

The top three private auto insurers remained unchanged for the fourth consecutive year. Progressive moved up from fourth to third in 2017, surpassing The Allstate Corp.

Piper Sandler analyst Paul Newsome said Progressive pivoted quickly to react to lower claims frequencies during the COVID-19 pandemic and was one of the first companies to lower prices to account for that. He also said the company's "relatively low expense ratio" helps it compete.

"From a pricing perspective, they've done a very good job in just maintaining the direct business, branding and all the other things that matter to make that business run smoothly," Newsome said in an interview.

Both GEICO and Progressive have more than doubled their direct premiums written since 2010. Progressive has gone to $33.2 billion from $12.85 billion in that period, while GEICO has risen to $33.92 billion from $14.17 billion. State Farm's growth has been modest in comparison, rising from $31.13 billion in 2010 to the 2020 total of $40.40 billion.

Berkshire Hathaway Chairman Warren Buffett recently weighed in on the competition between the top three, saying it is "very likely that the top two will be GEICO and Progressive." Newsome said it is quite possible Buffett may be correct.

"State Farm in the last several years has struggled with growth, as has virtually every carrier agency system, and the direct channel has steadily gained market share," Newsome said. "I think, in a lot of ways, it's just the inevitable outcome of the trends that we've seen over the past couple of decades."

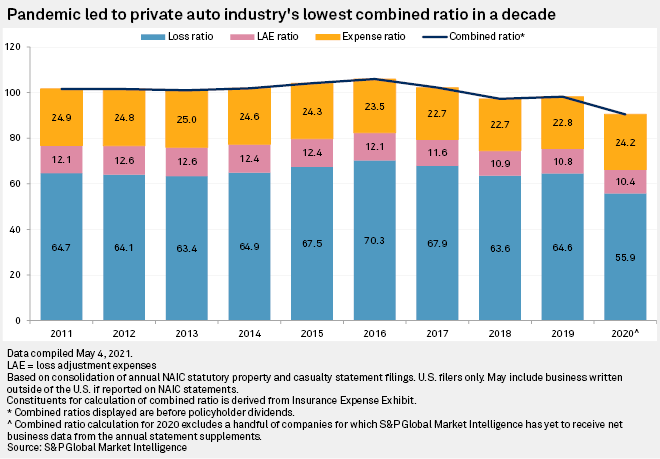

Industrywide, private auto insurers' direct premiums written fell 1.0% year over year to slightly more than $250 billion from $253.5 billion in 2019. The combined ratio, when excluding policyholder dividends, improved to 90.5% in 2020 from 98.2% in 2019.

Premium rebates to policyholders due to the pandemic had an impact on results throughout the industry, which used different methods to account for their givebacks.

Premium discounts were the preferred method for 12 companies. Five companies made their givebacks a policyholders' dividend, while Progressive accounted for its givebacks as an expense. No information was available on the methods used by Liberty Mutual Holding Co. Inc. and Auto-Owners Insurance Group.

Auto Club Insurance Association and American Family Insurance Co. had the steepest declines in direct premiums written among the top 20 private auto insurers at 10.6% and 10.5%, respectively. Direct premiums written fell year over year by 9.0% for Mercury Insurance Co., 8.1% for The Hartford Financial Services Group Inc. and 7.5% for Nationwide Mutual Group.

No insurers in the top 20 had a combined ratio above 100%. Nationwide had the highest combined ratio among the insurers at 99.4%, while United Services Automobile Association had the lowest at 81.6%.