S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Mar, 2023

By Jason Woleben and Tim Zawacki

The Progressive Corp. has overtaken Berkshire Hathaway Inc.'s GEICO Corp. to become the second-largest personal auto insurance underwriter in the U.S.

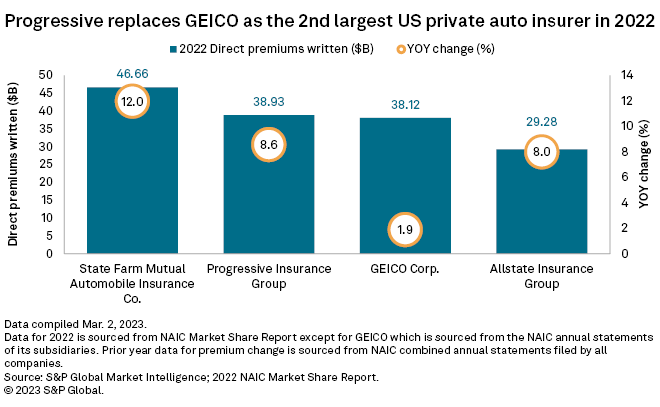

The Ohio-based insurer has been closing the personal auto gap over the past several years and finally surpassed GEICO by recording almost $800 million more in annual direct premiums written in 2022. Progressive's direct premiums written grew 8.6% in 2022 to $38.93 billion. GEICO recorded direct premiums of $38.12 billion within its personal auto business, an increase of roughly 1.9% over the prior year, according to an S&P Global Market Intelligence analysis of preliminary market share data released by the National Association of Insurance Commissioners.

State Farm Mutual Automobile Insurance Co. remains far and away the largest writer of personal auto insurance, logging direct premiums of $46.66 billion in 2022, up from $41.67 billion in 2021. The Allstate Corp. is in fourth place with $29.28 billion in direct premiums in 2022, up 8.0% year over year.

Tough year for underwriting

Personal auto insurers have been contending with soaring claims costs due to the impact of inflation and the changing driving habits of their policyholders since the peak of the COVID-19 pandemic. Losses from Hurricane Ian also contributed to insurers' woes in 2022. Both factors have pushed the Big Four personal auto insurers to experience substantial year-over-year increases in claims severity, or average cost per claim.

|

* Read about the big four personal auto writers rate changes |

State Farm's direct incurred loss and cost containment expense ratio deteriorated by 22.7 percentage points in 2022 from the prior year to 98.2%. Allstate's direct incurred loss and cost containment ratio jumped 13.4 percentage points to 81.6%, while Progressive's ratio was 70.8% in 2022, the lowest among the group.

Based on Berkshire Hathaway's annual GAAP statement, GEICO's net loss and loss adjustment expense was 93.1% during the year. The insurer's regulatory data reflects a direct incurred loss and cost containment expense ratio of roughly 88.0% for all of Berkshire Hathaway's personal auto business.