S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Dec, 2022

By Hassan Javed and Tyler Hammel

Progressive's direct loss ratio rose significantly during the third quarter as the impact of Hurricane Ian was felt throughout the U.S. homeowners insurance space.

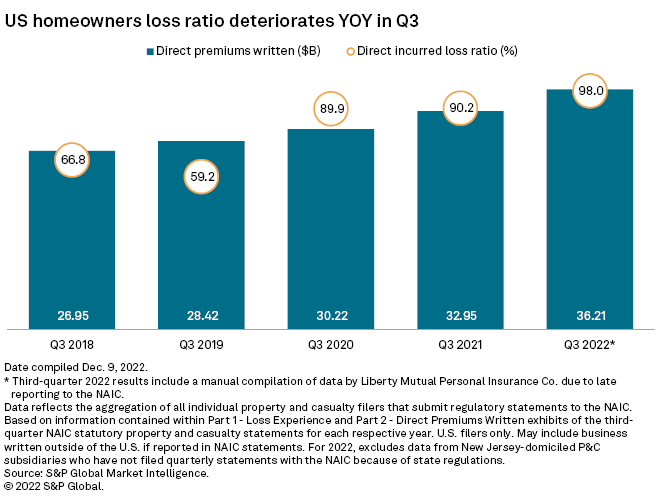

Premiums, loss ratio rise

The direct incurred loss ratio for U.S. homeowners lines rose to 98.0% in 2022, from 90.2% in the prior year, as widespread inflationary pressures and the impact of Hurricane Ian contributed to the financial woes felt by the property and casualty insurance market.

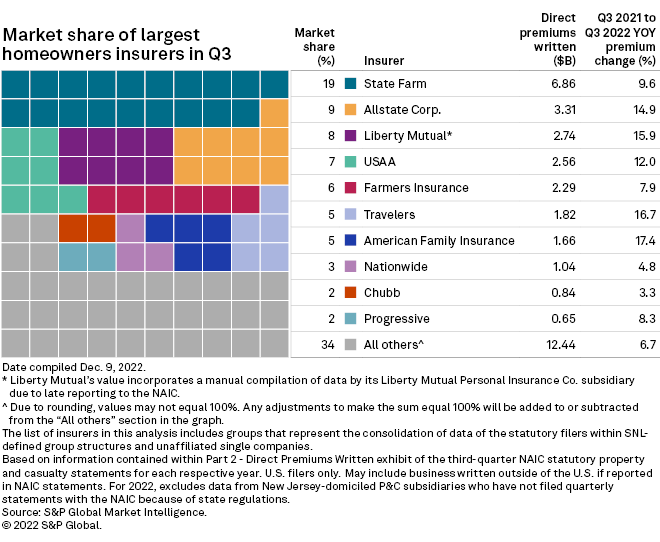

Direct premiums written for the 10 largest U.S. homeowners insurers came in at $23.77 billion in the third quarter, rising 11.65% in the period from $21.29 billion a year earlier.

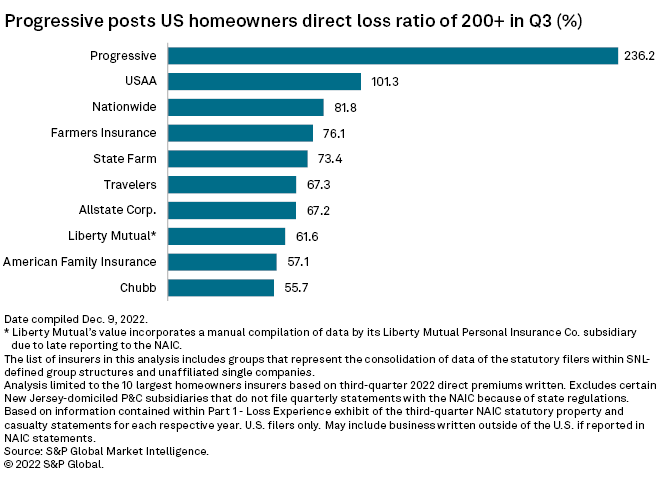

Progressive posts largest loss ratio

Despite having the smallest market share among the 10 largest U.S. homeowners insurers, The Progressive Corp. recorded the largest direct loss ratio, by far, totaling 236.2% for the third quarter. Progressive, unlike most other large U.S. homeowners insurers, underwrites in Florida where damage from Hurricane Ian was the most severe.

In its third-quarter earnings release, Progressive cited $175 million of net property losses after reflecting the catastrophe reinsurance coverage on its property business, which writes residential property insurance for homeowners, other property owners and renters.

According to the company's Nov. 1 Form 10-Q filing, Progressive retained $25 million of allocated loss adjustment expenses, net of reinsurance. On a gross basis, prior to reinsurance, Progressive estimated property catastrophe losses and allocated loss adjustment expenses from Hurricane Ian were $1.4 billion.

LEARN MORE BOX

|

* Read more about the significant catastrophe losses incurred by property insurers. |

Because Progressive "heavily" reinsures its catastrophe exposure in its property business, the insurer retained "only $200 million of loss and allocated loss adjustment expenses from Hurricane Ian," according to the report.

Progressive reported $760 million in losses for the quarter related to the hurricane, with its property business incurring 23% of the losses, net of reinsurance, and vehicle losses accounting for $585 million, including boats and recreational vehicles.

Among the 10 largest U.S. homeowners insurers, only Progressive and USAA Casualty Insurance Co. logged loss ratios above 100%. Chubb Ltd. logged the lowest loss ratio among the largest U.S. homeowners writers at 55.7%.

Double-digit premium change

More than half of the 10 largest homeowners insurers in the U.S. — The Allstate Corp., Liberty Mutual Group Inc., USAA Casualty Insurance Co., The Travelers Cos. Inc. and American Family Insurance Group — posted double-digit premium increases year over year.

During a November earnings call, Mario Rizzo, Allstate's president of property-liability, said the insurer is increasing homeowners prices through both rates and the inflationary adjustment factor embedded in Allstate's homeowners product to improve underlying margins going forward.

American Family rose by the largest percentage, growing by 17.4% to $1.66 billion in direct premiums written.

Despite logging a lower premium change year over year than some of the other insurers, industry leader State Farm logged the largest sum of premiums, totaling $6.86 billion.