S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Feb, 2022

|

Private-market investors said their funding for green-energy projects, like this rooftop solar array in China, is not subject to |

A stock rout that slashed the value of renewable energy companies by 41% in the past year has yet to discourage private market investors backing climate technology startups and green infrastructure projects.

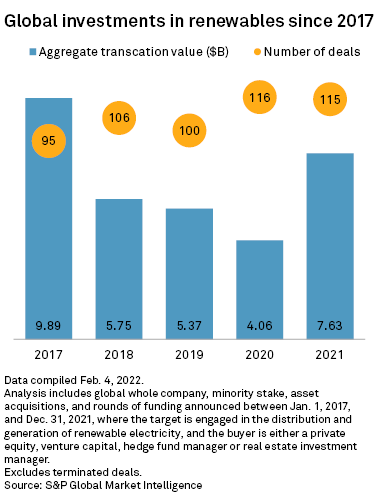

While listed green energy companies spent 2021 trying to hang onto shareholders amid supply chain disruptions and soaring raw material costs, investors rushed into private markets for green energy. Private equity and venture capital firms poured $53.7 billion into climate technology in 2021, according to research firm BloombergNEF, and Brookfield Asset Management Inc. launched what it claims is the largest-ever fund dedicated to the transition to a net-zero world.

The momentum looks set to continue, with climate-focused investors saying their funding decisions in the private markets are insulated from near-term headwinds and market cycles by a wager that, over the coming decades, the global economy will inevitably decarbonize.

"I look at what's happening in the public markets kind of like how I look at policy variability or commodity swings: They're speed bumps along the way," said Steve McBee, founder and CEO of Huck Capital Management LLC. "They may put pressure on certain parts of the market for small periods of time. But if you're really thinking about the long game and you're playing a long game, I think it's largely noise, with the positive benefit being to put some rationalization back in acquisition prices."

For climate- and carbon-focused startups, private investors are a vital source of funding, accounting for 94% of the money those companies raised in 2021, according to BloombergNEF.

Drastically cutting emissions while strengthening electric grids against extreme weather requires changing long-standing business models in the power industry, McBee said, and financing that sort of innovation is difficult in public markets where investors fixated on quarterly earnings have "a hard time properly pricing and being patient with service models and transition strategies that run out over a period of time."

That disconnect is becoming less of a problem for climate startups. With more investment firms prioritizing environmental sustainability, there is a growing pool of money for green energy companies that want to remain private for longer, said Kevin Stevens, a partner at venture capital firm Energize Ventures LLC

"Institutions, endowments, big companies ... have committed to this publicly," saying they will eliminate greenhouse gas emissions, Stevens said. "That's great for us. We want people to say, 'We have this 40-year horizon, we're going to make this happen, there's going to be capital here.'"

Markets tighten

An expected rise in interest rates in 2022 has added to headwinds that the renewable energy industry is facing from persistent bottlenecks in global supply chains. Since early January, when the Federal Reserve signaled it could raise rates faster than expected, the iShares Global Clean Energy ETF fell 5.49% as of Feb. 9, mirroring declines in the broader technology sector.

In addition to raising borrowing costs, tighter monetary policy would likely pressure the valuations of privately held companies and assets, which have boomed in recent years as money flooded into the green energy sector.

Among startups, the impact is likely to be felt most by companies looking for late-stage funding, market participants said.

"I think we're going to see companies that are able to be cash-efficient really weather this storm, if there is a storm impending," Stevens said. "But I do think we'll see companies have to hit certain milestones to grow into the valuations that maybe were a little exuberant in the last 24 months. For companies who don't do that or take a little bit longer doing that, the capital markets will be quite tight."

|

The landscape could also shift for owners of green-energy infrastructure who have reaped outsized returns as bidding wars drove up prices for low-risk assets.

"I don't think we can continue having 15%, 20% overpayments for [infrastructure] assets that, in some cases, operate very much like fixed income," said Eamon Nolan, a partner at Vinson & Elkins LLP who specializes in financing infrastructure and energy projects. "You can't overachieve on these assets. And when you can't overachieve, you also can't overpay."

ESG is out of the bottle

Those risks do not appear to have dampened the interest of private-market investors.

Copenhagen Infrastructure Partners K/S said Feb. 3 that it is launching a debt fund with a target size of €1 billion to help finance renewable energy projects in North America, Europe and parts of the Asia-Pacific region. Days earlier, on Jan. 31, NextEnergy Capital Ltd. said it raised $896 million for an investment fund that will target solar infrastructure in Organization for Economic Cooperation and Development countries. And Blackstone Inc. said Jan. 21 it is creating a new business line within its credit division to fund renewable energy companies and others tied to the energy transition.

"Private buyers of infrastructure assets, especially those for high-quality, de-risked, essential infrastructure, take a longer-term view and are less influenced by short-term economic conditions or sentiment," Sam Pollock, CEO of Brookfield Infrastructure Partners LP, which is on the lookout for investment opportunities in decarbonization and electrification, said on an earnings call Feb. 2.

Craig Golinowski, president and managing partner at Carbon Infrastructure Partners, a hydrocarbon-focused private equity firm, sees another powerful force at work: the wave of environmental, social and governance mandates sweeping the corporate world.

Regardless of rattled public markets, net-zero pledges and moratoriums on fossil fuel investing will ensure money continues flowing into private markets for renewable energy and clean tech, Golinowski said.