S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Mar, 2023

By Dylan Thomas and Annie Sabater

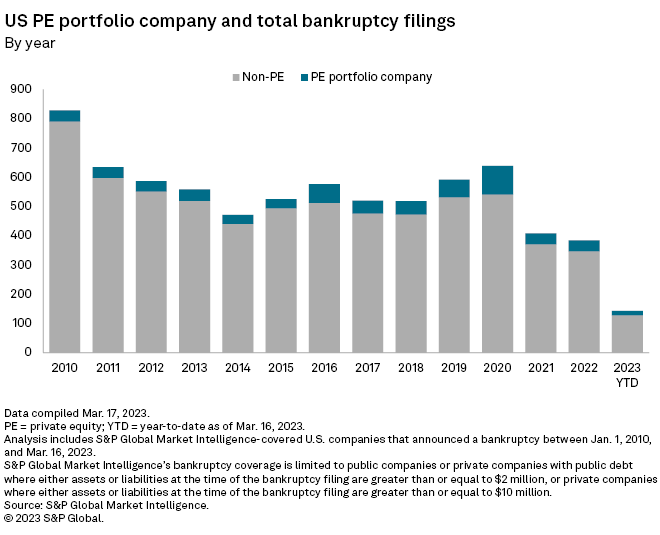

Private equity portfolio companies in the US are on track in 2023 to see the highest annual number of bankruptcies since 2020, as rising interest rates and an uncertain economic outlook force tough decisions.

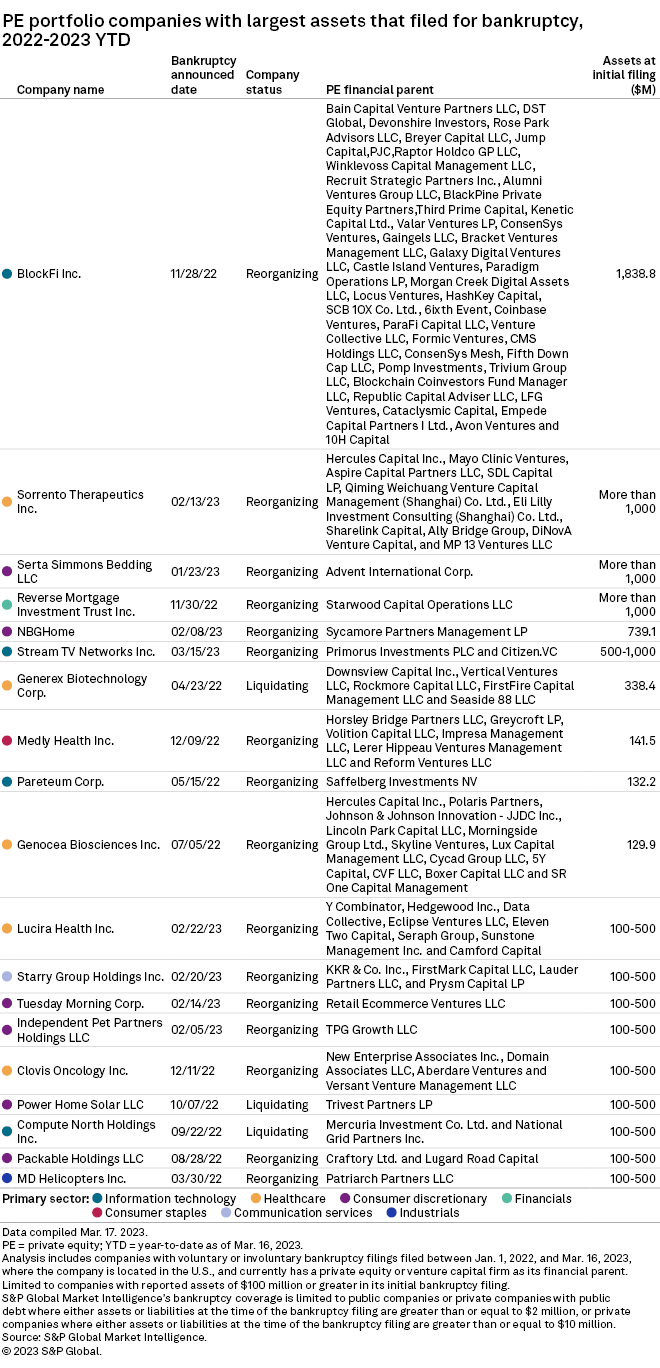

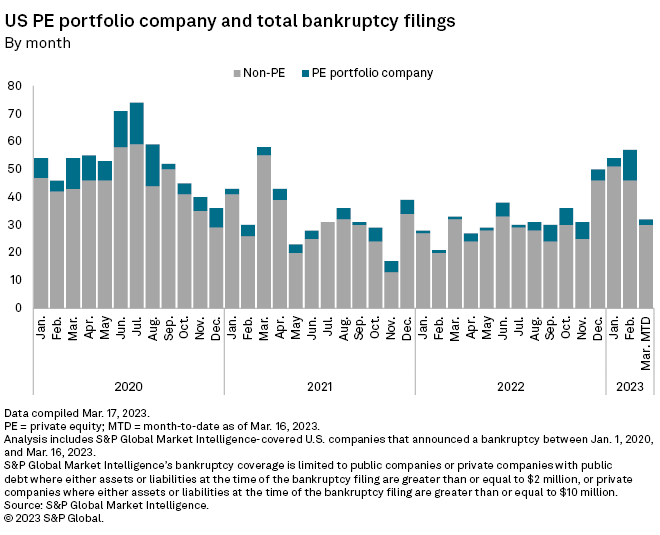

There were 143 US companies that filed for bankruptcy protection in the first 75 days of the year, including 16 companies with private equity or venture capital backing, according to an S&P Global Market Intelligence analysis.

If the current pace continues, bankruptcies by private equity portfolio companies will be on track to total nearly 78 by the end of 2023, more than double the totals in 2021 and 2022 and the second-highest number of portfolio company bankruptcies in more than a dozen years.

The rise in troubled private equity-owned companies comes amid a spike in US company bankruptcy filings overall. The data is an indicator that business restructurings, including out-of-court arrangements, are rising in general to lighten the debt loads of companies struggling through macroeconomic headwinds, said Michael Handler, a partner in the financial restructuring practice of law firm King & Spalding.

"Not only do you have higher cost of capital, but you have more uncertainty in the forecast — the ability of the [portfolio] company to meet its targets. It's a one-two punch," Handler said.

In a lower interest rate environment, private equity sponsors were more willing to "kick the can," Handler said, pouring more capital into faltering businesses that looked like they could turn the corner. Now, as macroeconomic turbulence erodes corporate valuations and creates bargain entry points, fund managers may see more compelling opportunities in new investments.

"Why am I investing $100 million in my existing portfolio company when I can put that capital into another business which I think is going to provide a much better [return on investment] down the line?" Handler said.

* Read about risk indicators in the consumer discretionary sector.

* Catch up on the rise in private equity-backed take-private deals.

* Download a spreadsheet of data from this story.

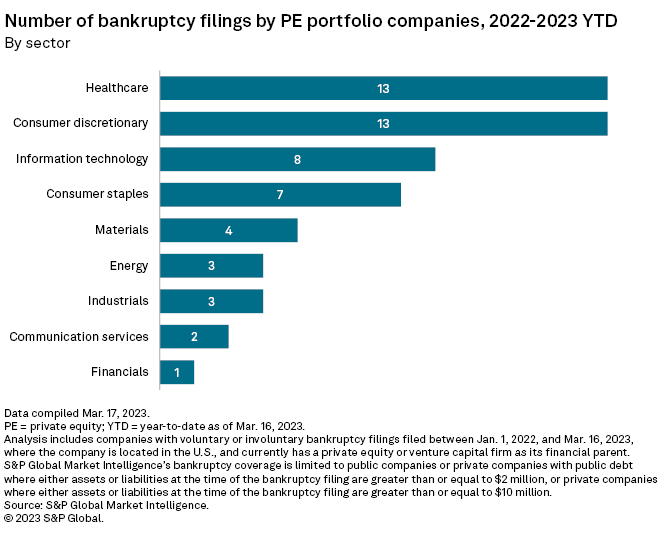

Private equity portfolio company bankruptcies since Jan. 1, 2022, are largely concentrated in the consumer discretionary and healthcare sectors, which Market Intelligence identified as the highest risk sectors at the end of 2022.

Home decor business NBGHome, owned since 2017 by private equity buyout specialist Sycamore Partners Management LP, filed for voluntary Chapter 11 bankruptcy protection in February. NBGHome President and CEO Hope Margala said the company was forced to restructure its debt after the COVID-19 pandemic led to supply chain disruptions and a mismatch between inventory and demand. Margala also cited freight cost hikes.

The pandemic also figured prominently in the January bankruptcy declaration by Serta Simmons Bedding LLC, part of the Advent International Corp. portfolio. The company took on new debt in 2020 to weather the impact of the pandemic, including a runup in raw material costs. The company is "facing significant debt maturities in 2023" just as consumer demand is slackening under the pressure of higher interest rates, according to a disclosure statement filed in bankruptcy court.