Private equity and venture capital-backed investment in Taiwan plunged in 2023, its third consecutive year of decline, on the back of tensions with mainland China and the global rise in interest rates.

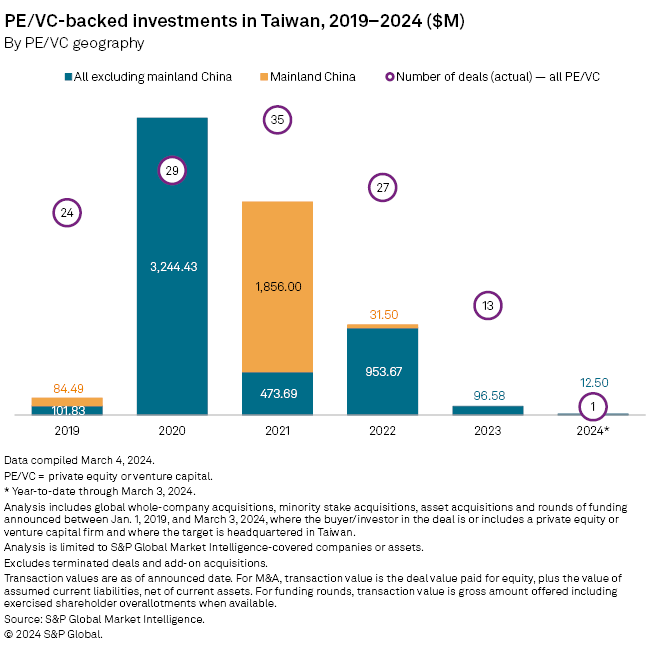

Aggregate deal value stood at $96.6 million in 2023, compared with $985.2 million in 2022 and $2.33 billion in 2021, according to S&P Global Market Intelligence data.

The number of deals slipped to 13 from 27 in 2022.

One factor in declining deal activity is the "rising awareness of the geopolitical risks in the Taiwan Strait" and emerging trade tensions, said Lotta Danielsson, vice president at the US-Taiwan Business Council, a group developing trade and business relationships between companies in the US and Taiwan.

Mainland Chinese private equity firms had previously been active in Taiwan. In 2021, mainland private equity investment in Taiwan surged to $1.86 billion, driven by Beijing Wise Road Asset Management Co. Ltd.'s announced acquisition of GAPT Holding Ltd. and ASE (Kunshan) Inc. for $1.46 billion, according to Market Intelligence data.

In 2022, mainland firms invested $31.5 million and in 2023 made no investments.

– Download a spreadsheet with data in this story.

– Read about private equity investments in India and China in 2023.

– Explore more private equity coverage.

Headwinds for deals also include the rise in inflation and interest rates, which brought down private equity investments globally in 2023, as well as the Taiwanese government's legacy regulations that don't reflect current realities.

"Companies consistently talk about complicated investment review and exit processes, and say that the review processes can be unpredictable, opaque and lengthy," Danielsson said.

Sector focus

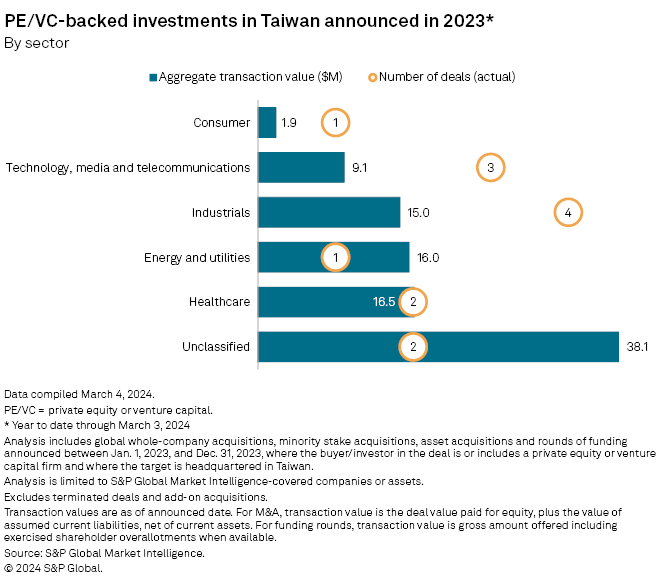

The industrial sector recorded the highest number of private equity-backed deals in Taiwan in 2023, with four. The technology, media and telecommunications sector recorded three deals.

Largest deals

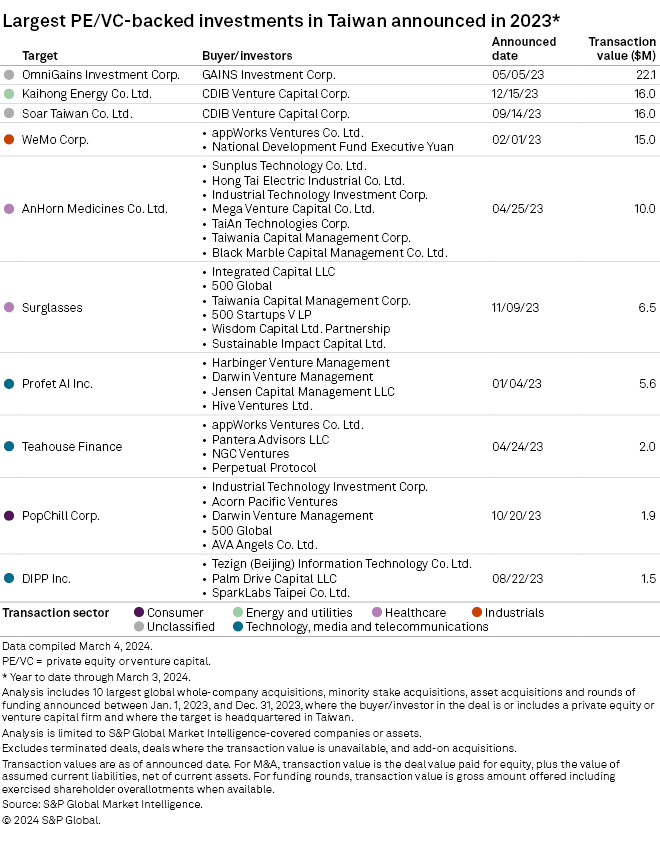

Taiwan-based Gains Investment Corp.'s $22.1 million investment in OmniGains Investment Corp. was the biggest private equity-backed deal in 2023.

Kaihong Energy Co. Ltd. and Soar Taiwan Co. Ltd. came second, securing $16 million each from Taiwan-based CDIB Venture Capital Corp.

Per-quarter figures

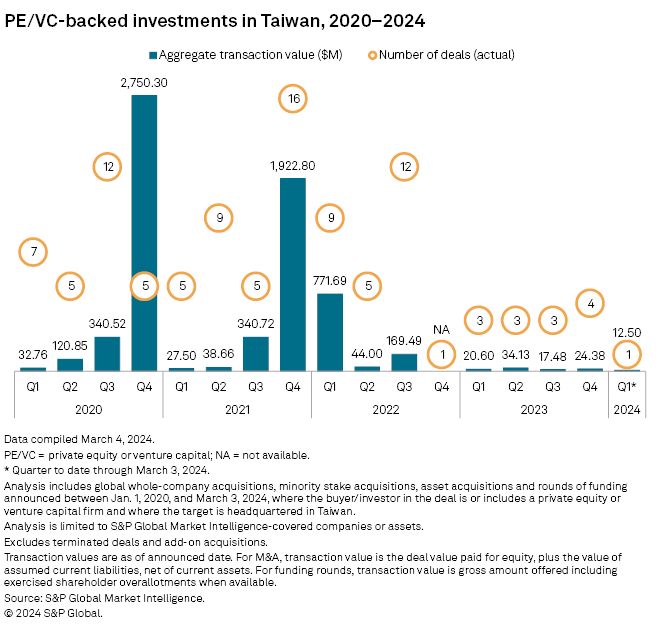

Four deals were recorded in the fourth quarter of 2023, higher than three transactions in the last three quarters and one in the fourth quarter of 2022.

In 2024 to March 3, one deal valued at $12.5 million was announced.

Outlook

The US-Taiwan Business Council expects the president-elect of Taiwan, Lai Ching-te, to continue the policies of President Tsai Ing-wen, and be open to creating conditions to encourage more private equity investment. Lai Ching-te is currently serving as vice-president and will assume the presidency May 20.

The appetite for investments in Taiwan remains, particularly in the semiconductor sector, but inflation and interest rates need to recede more before activity revives, Danielsson said.