Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2023

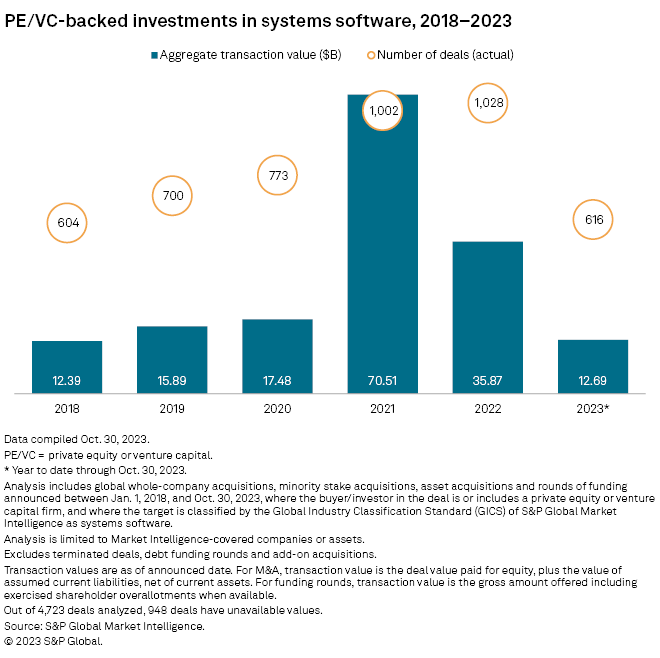

Global private equity investments in systems software companies are on course for a second consecutive year of decline and touching their lowest annual levels since 2018.

Private equity and venture capital investment in the sector totaled $12.69 billion for the year through Oct. 30, far less than the $35.87 billion total for full year 2022, according to S&P Global Market Intelligence data.

The number of deals has also plunged. Data shows 616 transactions in the sector worldwide so far in 2023, compared to the full-year 2022 total of 1,028 deals.

– Download a spreadsheet with data featured in the story.

– Read about US regulations on private equity add-on deals.

– Explore more private equity coverage.

Private equity invested $70.51 billion in system software companies in 2021 as valuations were rising, which led to industry talk about overpaying for the assets. The investment environment then sharply changed.

"It is not surprising to see private equity and venture capital activity decline as macro headwinds like higher debt costs have slowed the overall deal activity," 451 Research analyst Iuri Struta said on a call.

Things could be much worse, according to Struta, were it not for artificial intelligence and higher demand for data management software and automotive technology piquing the interest of investors.

"Without these secular tailwinds, I believe deal activity would be much lower," Struta said.

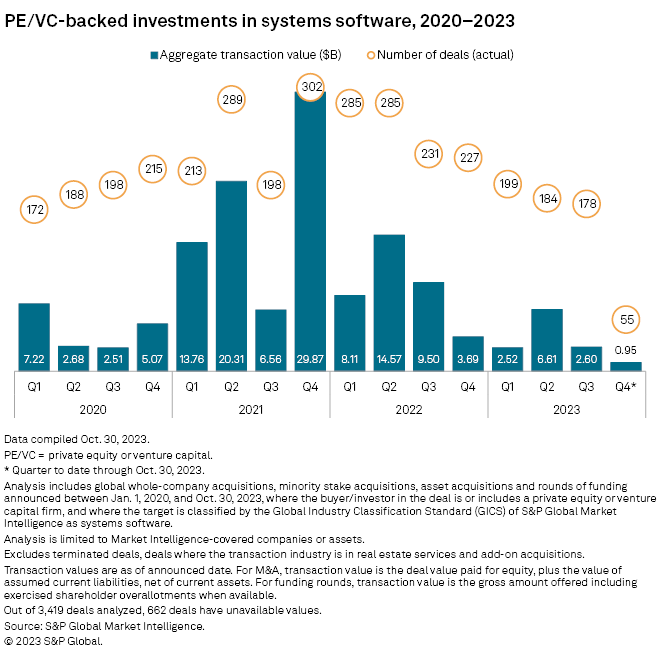

In the third quarter, investment in the sector dropped to $2.60 billion from 178 transactions compared to $9.50 billion across 231 deals in the year-ago period. Investments were down 60.1% sequentially from $6.61 billion in the second quarter.

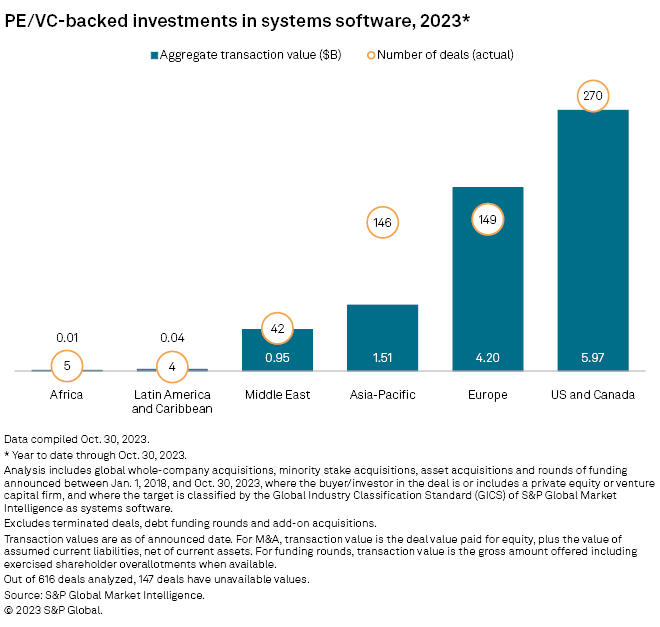

North America-based companies attracted the most capital, accounting for nearly 47% of global private equity deal value in the sector. The region raised $5.97 billion across 270 deals, followed by Europe with $4.20 billion across 149 deals.

Top transactions

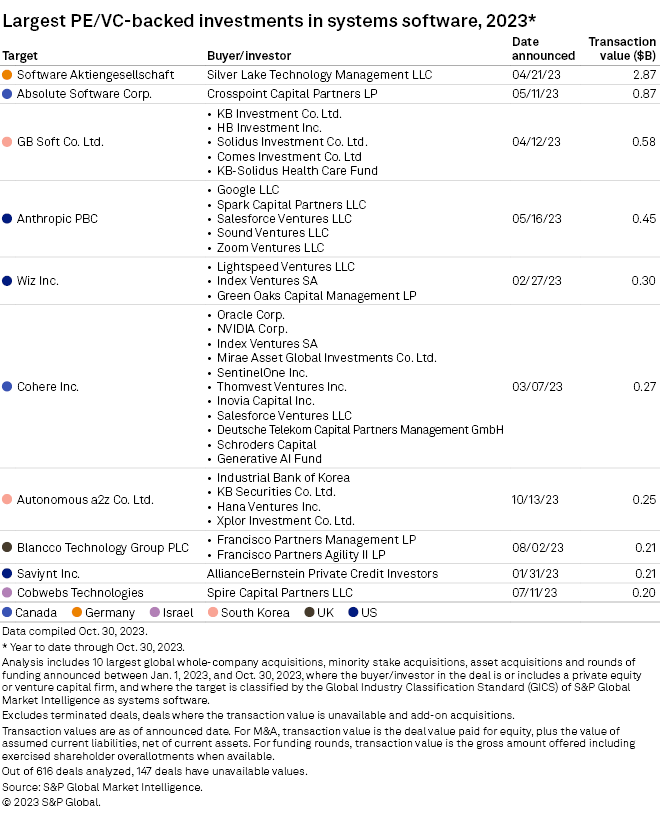

The $2.87 billion acquisition of Software AG, which provides software development, licensing, maintenance and IT services, by Silver Lake Technology Management LLC marks the biggest transaction of the year so far.

For the second-largest deal, Crosspoint Capital Partners LP acquired Canadian company Absolute Software Corp. for $870 million. Absolute Software provides services for management and security of computing devices, applications, data and networks.

451 Research is part of S&P Global Market Intelligence.