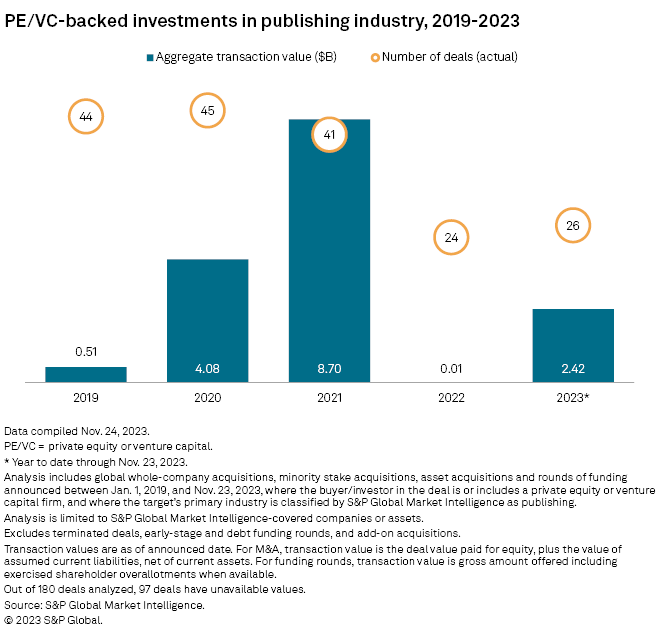

The value of private equity-backed investments in the publishing industry soared in 2023 on the back of a billion-dollar deal by private equity giant KKR & Co. LP, S&P Global Market Intelligence data shows.

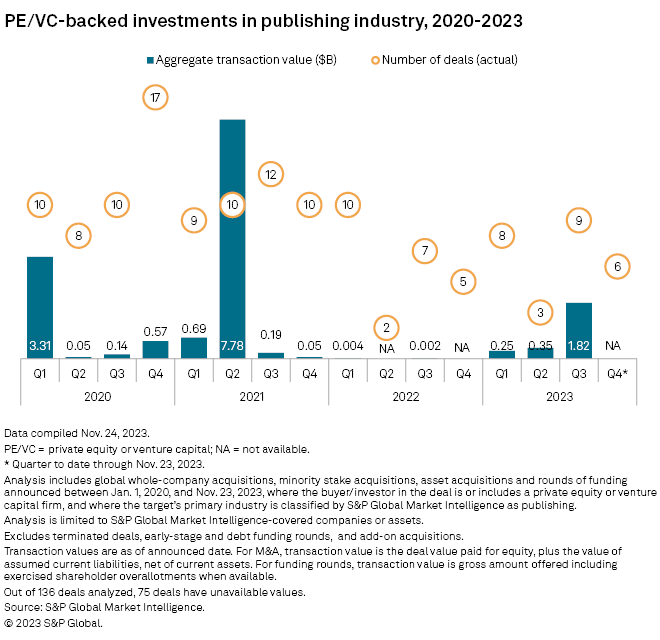

Aggregate transaction value between Jan. 1 and Nov. 23 stood at $2.42 billion, compared with just $5.4 million recorded for all of 2022.

The number of deals, meanwhile, grew to 26 from 24 transactions a year ago.

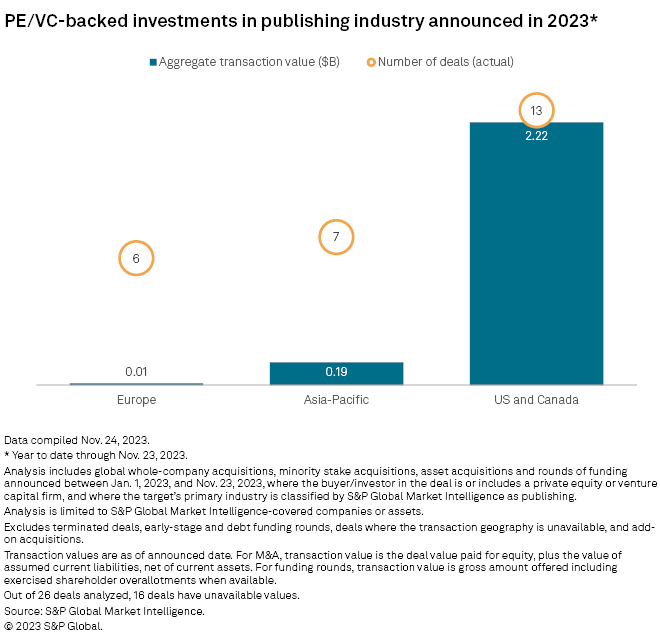

Thirteen of the deals were in the US and Canada. Asia-Pacific and Europe recorded seven and six deals, respectively.

In the fourth quarter to Nov. 23, the publishing industry recorded six private equity-backed transactions, slightly up from five in the full fourth quarter of 2022.

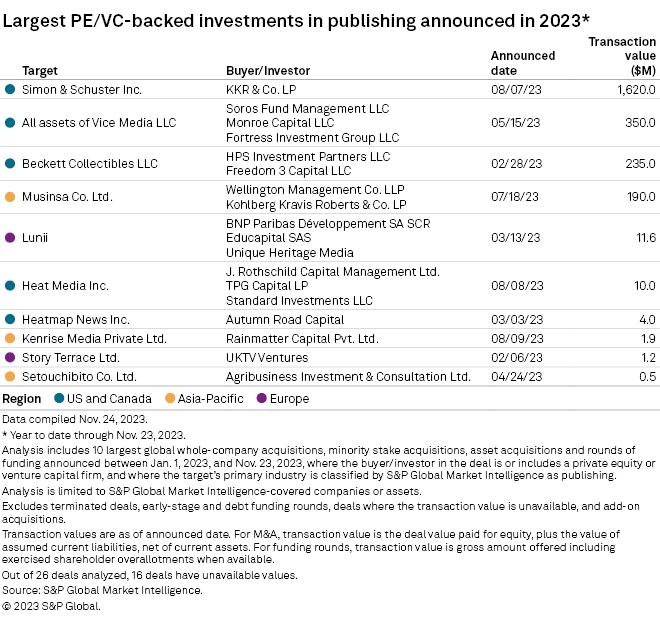

Biggest deals

The publishing industry saw a couple of big transactions in 2023. In the biggest deal, KKR, through its KKR North America Fund XIII SCSp, acquired book publisher Simon & Schuster Inc. from Paramount Global for $1.62 billion in an all-cash transaction.

Paramount first agreed to sell Simon and Schuster to rival book publisher Penguin Random House LLC, but the deal was blocked by a federal judge.

– Download a spreadsheet with data featured in the story.

– Click here to read about venture capital funding in October.

– Explore more private equity coverage.

KKR also led the $190 million series C funding round of Musinsa Co. Ltd., a Korean online platform that offers original content.

In the second-biggest transaction in 2023, Vice Media LLC was acquired for $350 million by a group of its lenders that included Fortress Investment Group LLC, according to Market Intelligence data.

Vice Media, which filed for bankruptcy in May, has been struggling to compete with social media companies for ad revenues, The Wall Street Journal reported.