S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Mar, 2024

By Maira Imtiaz and Annie Sabater

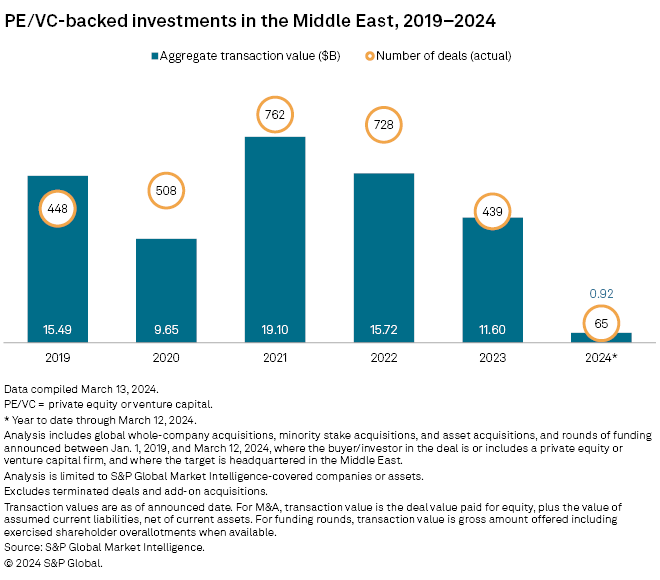

Private equity and venture capital activity in the Middle East continued its downward trajectory in 2023, marking the third consecutive year of decline.

Private equity deals in the Middle East reached a value of $11.60 billion in 2023, down 26% from the $15.72 billion prior-year total, according to S&P Global Market Intelligence data. Deal volume stood at 439, down roughly 40% from 728 in 2022.

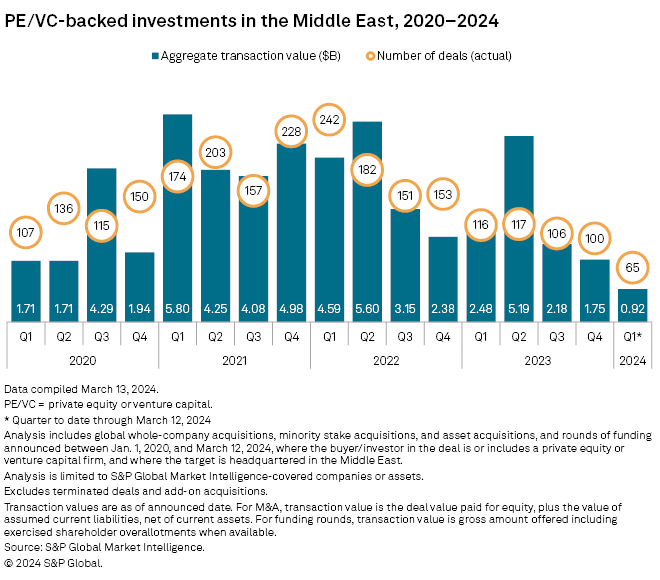

Quarter to date through March 12, 2024, private equity-backed investments — including whole company and minority stake acquisitions, asset deals, and funding rounds — totaled $920 million, compared to $2.48 billion in the full first quarter of 2023.

The number of announced deals so far in the first quarter was 65, or only around 56% of the deal count in the first three months of 2023.

Quarterly private equity transaction value and volume in the Middle East have been on the decline since the third quarter of 2023, according to Market Intelligence data.

– Download a spreadsheet with data featured in this story.

– Explore more private equity coverage.

Decline in major deals

The slower pace of dealmaking in the Middle East in 2023 is largely a result of fewer big-ticket infrastructure and [private equity] deals completed, Jeff Schlapinski, managing director of research at Global Private Capital Association, said in emailed comments to Market Intelligence.

The period from 2020-2022 saw several multibillion-dollar infrastructure deals that drove regional totals significantly higher, Schlapinski said, adding that [venture capital] activity in 2023 has held up well considering the slowdown recorded in the US, Europe, LatAm and Asia.

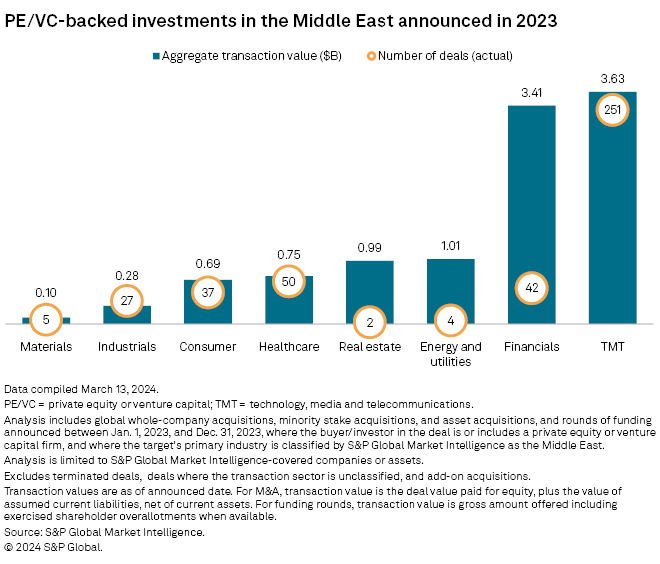

Top sector

In 2023, the technology, media and telecommunications sector led in securing the highest private equity capital in the region, totaling $3.63 billion across 251 deals, followed closely by the financials sector at $3.41 billion across 42 deals.

Largest transactions

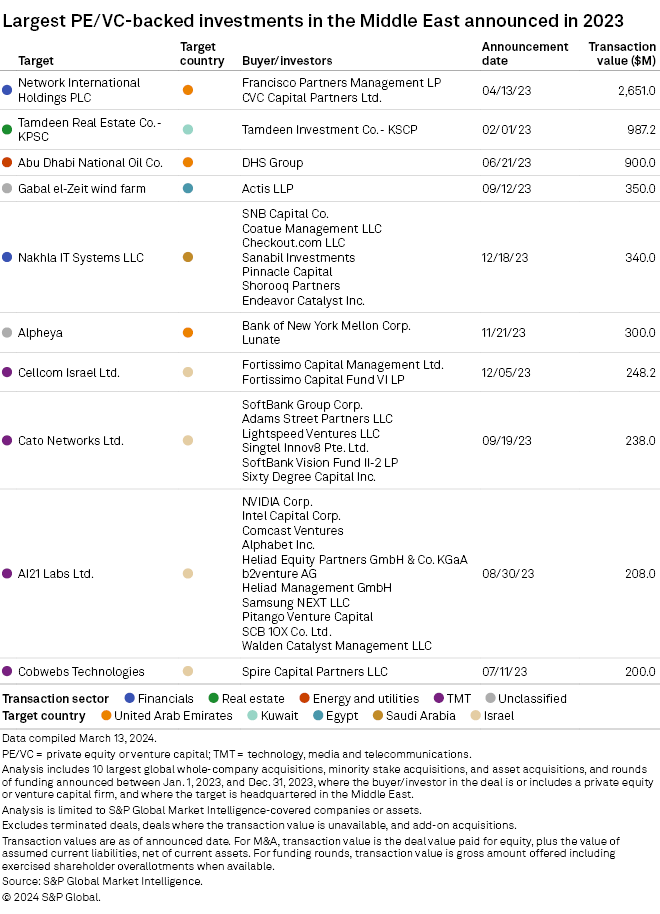

Francisco Partners Management LP and CVC Capital Partners Ltd.'s bid to acquire payment services company Network International Holdings PLC was the top private equity deal in 2023.

Tamdeen Investment Co. - KSCP's acquisition of a 52% stake in Tamdeen Real Estate Co. - KPSC ranked second, with a transaction value of $987.2 million