S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 May, 2023

By Muhammad Hammad Asif and Annie Sabater

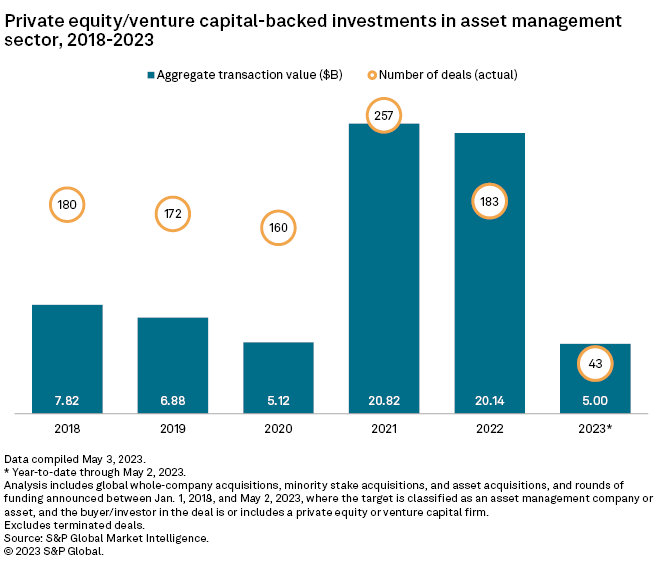

Private equity and venture capital firms announced $5.00 billion of investments across 43 transactions in the asset management sector worldwide this year through May 2, according to S&P Global Market Intelligence data.

With a strong private equity interest in the sector, it is likely the 2023 full-year aggregates will match private equity investments in asset management in 2021 and 2022.

– Download a spreadsheet with data featured in the story.

– Click here to read about global venture capital investment activity.

– Explore more private equity coverage.

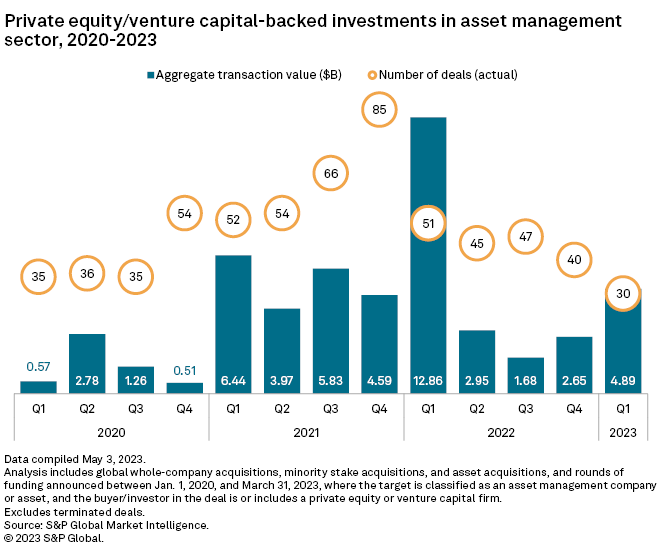

During the first quarter, the asset management companies pulled in $4.89 billion across 30 deals. Clayton Dubilier & Rice LLC and Stone Point Capital LLC's $4.23 billion acquisition of an unknown majority stake in Focus Financial Partners Inc. was mainly responsible for the 84.5% quarter-over-quarter growth.

The aggregate transaction value was down 62% from $12.86 billion in the first quarter of 2022, which remains the biggest quarter since the start of 2020.

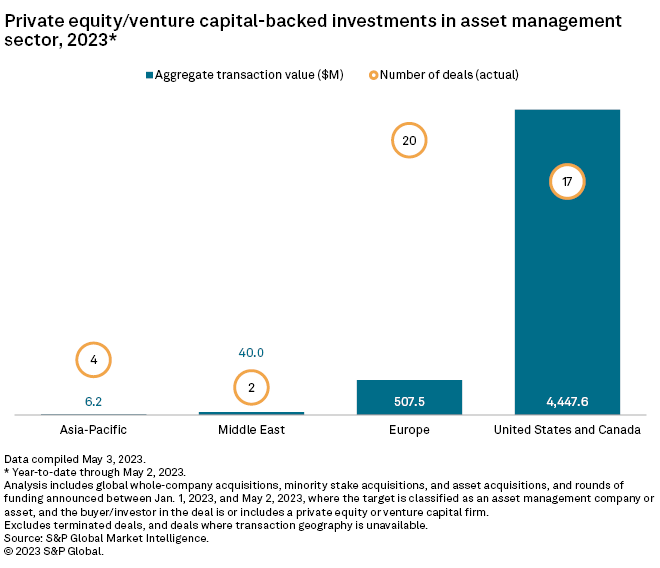

Europe had the most number of transactions with 20 deals worth $507.5 million, while the US and Canada had the biggest total investment of $4.45 billion across 17 deals so far in 2023.

Largest transactions

Among the largest private equity investments in the asset management sector year to date through May 2 was Tikehau Capital and Arjun Infrastructure Partners Ltd.'s acquisition of an unknown stake in Amarenco Solar Ltd. for $316.1 million. Tikehau will take a controlling stake in the company, while Arjun will own a minority position.

Another notable deal was KfW Capital GmbH & Co. KG's investment in Planet A GmbH's $171.7 million round of funding in February.