S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Aug, 2022

By Zeeshan Murtaza and Annie Sabater

Rapidly falling cryptocurrency prices, impending industry-specific regulation and macroeconomic headwinds are taking a toll on global private equity and venture capital investments in blockchain and cryptocurrency.

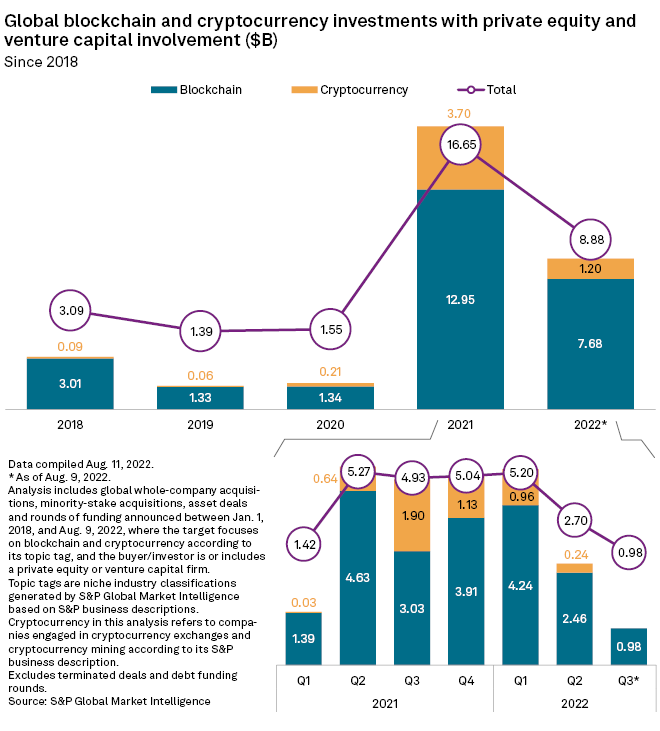

Aggregate global deal value across the two assets tumbled 48.1% quarter on quarter in the three months to June 30, to a combined $2.7 billion, according to S&P Global Market Intelligence data.

A strong $16.65 billion was invested in these assets in 2021, of which $960 million was committed to cryptocurrency.

The ambiguity of digital-currency regulations by central banks, the cost of electricity used to run cryptocurrency mining farms and the ever-growing carbon footprint are among the factors hampering investment in cryptocurrency.

The enterprise interest in [blockchain-powered applications], however, remains strong, said Alex Johnston, research analyst at 451 Research.

"Companies are looking at applying [blockchain] technology to areas such as supply chain tracking, digital identity and B2B payments. As this market gains traction, it may take the edge off the challenges of reduced confidence in the consumer space," Johnston said.

Wider adoption will depend largely on regulators, he said.

"Blockchain vendors and prospective investors are looking for transparency, but where we are seeing legislation, such as the EU's European Securities and Markets Authority law, the focus is on blockchain as an enabler of speculative assets, rather than regulation concerning broader applicability."

* Download a spreadsheet with data featured in this story.

* Explore more private equity coverage.

Largest 2022 PE/VC investments in blockchain, cryptocurrency

New York-based blockchain technology company ConsenSys Software Inc. completed the largest funding round in 2022 to-date, raising $450 million. Returning investor ParaFi Capital LLC lead the round, while Temasek Holdings, True Capital Management LLC and Anthos Capital LP were among the other participants.

Australian company Animoca Brands Corp. Ltd., which provides gamification, blockchain and artificial intelligence technologies for mobile products, raised $409.9 million. Investors included 10T Holdings LLC, Alpha Wave Global LP and Sequoia China Investment Management LLP.

Cryptocurrency exchanges FTX Trading Ltd. and West Realm Shires Services Inc. raised $400 million each in separate funding rounds supported by private equity firms.