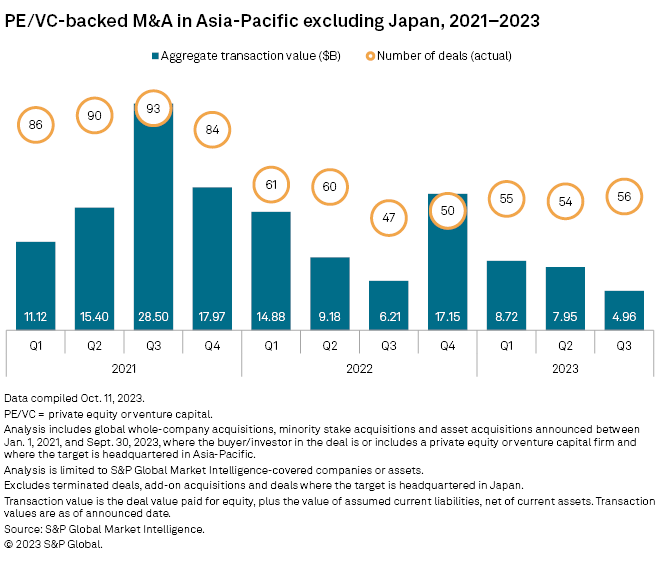

Private equity and venture capital investments in the Asia-Pacific region, excluding Japan, declined 20% year on year in the third quarter, according to S&P Global Market Intelligence data.

Investments stood at $4.96 billion in the third quarter against $6.21 billion recorded a year ago. The number of deals grew 19% year over year to 56 transactions from 47, the data shows.

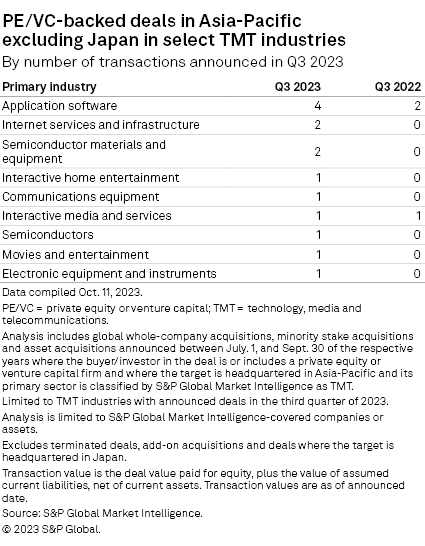

The technology, media and telecom sector saw the largest number of private equity-backed deals, with 14 recorded in the third quarter. Within the sector, the application software subsector recorded four deals, while internet services and infrastructure, as well as semiconductor materials and equipment subsectors, saw two deals each.

– Download a spreadsheet with data featured in this story.

– Read about second-quarter private equity investments in Asia-Pacific, excluding Japan.

– Explore more private equity coverage.

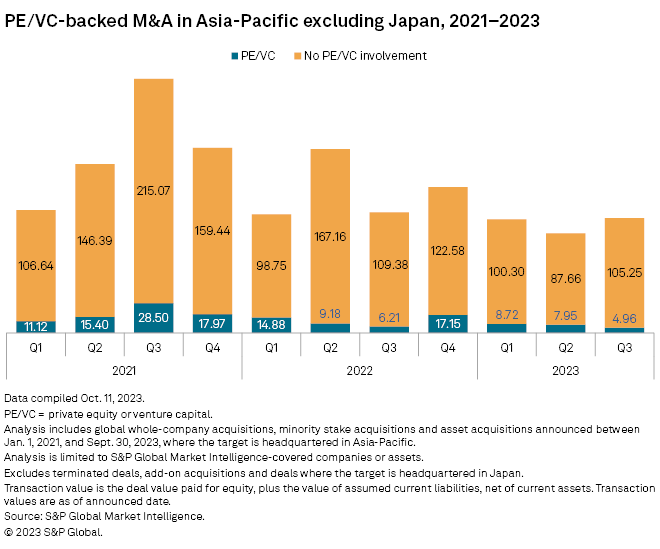

Private equity transactions accounted for 4% of all third-quarter M&A deals in the region, which had an aggregate value of $110.21 billion. In contrast, 5% of the total M&A deal value in the third quarter of 2022 were backed by private equity.

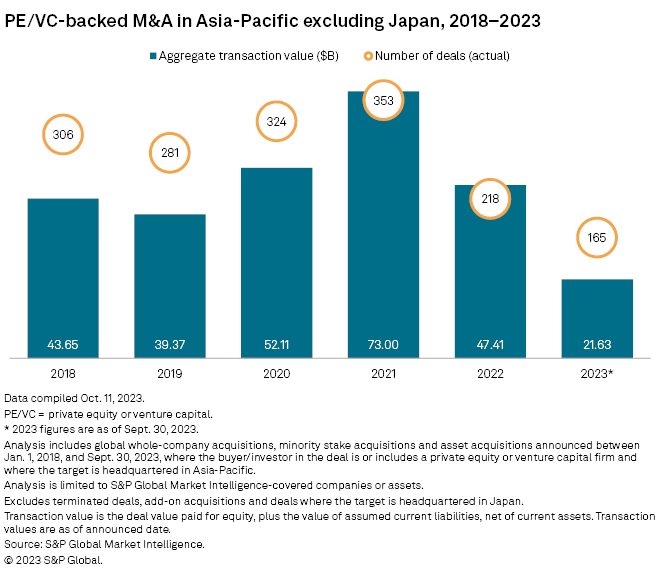

In the first nine months of 2023, private equity-backed investments in the region slid 28.5% year over year to $21.63 billion from $30.27 billion. Deal count slipped to 165 from 168 transactions.

Biggest deal

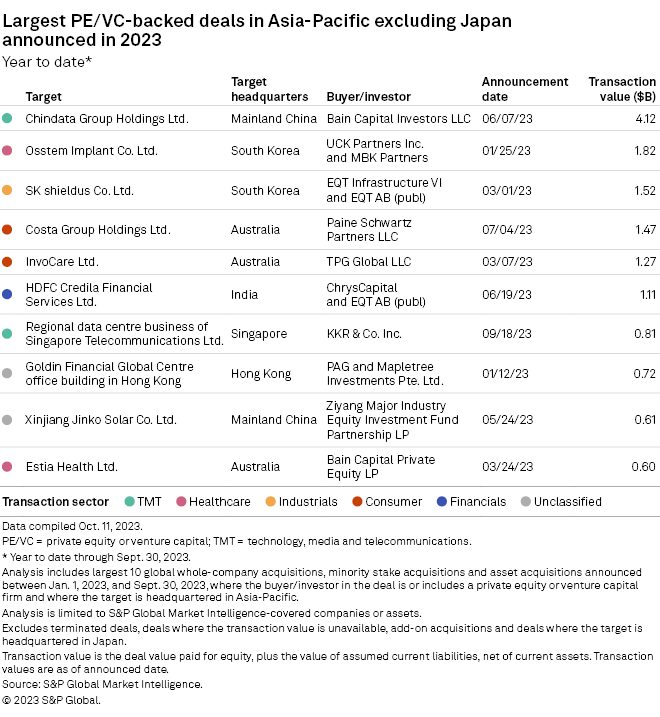

In the largest private equity-backed deal in the region so far in 2023, Bain Capital LP's Bain Capital Investors LLC agreed in August to take data center solution provider Chindata Group Holdings Ltd. private for $4.30 per ordinary share, or $8.60 per American depositary shares. Transaction value stood at $4.12 billion, according to Market Intelligence data.

Bain initially expressed its interest to buy Chindata in June.

Morgan Stanley Asia Ltd., Goldman Sachs & Co. LLC, Kirkland & Ellis LLP, Conyers Dill & Pearman (Cayman) Ltd. and King & Wood Mallesons China advise Bain on the deal. Citigroup Global Markets Asia Ltd., Gibson Dunn & Crutcher LLP, Maples and Calder (Hong Kong) LLP, Haiwen & Partners LLP and Weil Gotshal & Manges LLP Hong Kong were the sell-side advisers on the deal.