Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Dec, 2024

By Tim Siccion and Shambhavi Gupta

Participate in the 2025 Private Equity and Venture Capital Outlook Survey to gain insights into private market sentiment for the upcoming year from global private equity, venture capital and limited partner professionals.

_____________________________________________________

Private equity and venture capital activity in the US solar industry is poised to hit a four-year low in 2024, while private inflows into the sector globally have rebounded.

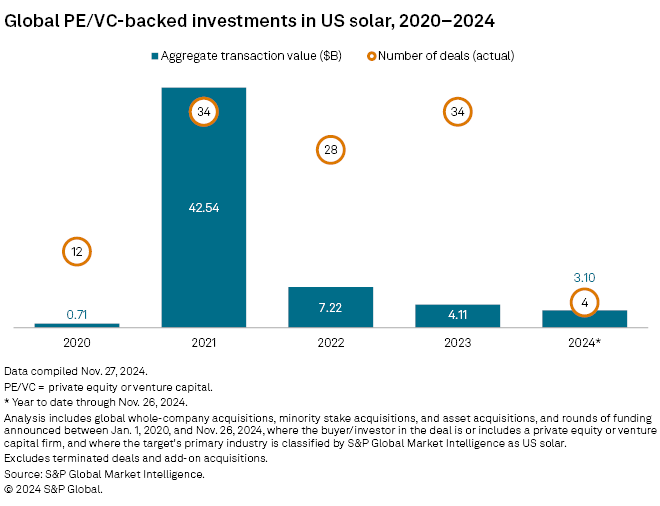

Private equity inflows into US residential and utility-scale solar from Jan. 1 to Nov. 26 amounted to $3.1 billion, about 24.6% lower than the total reached in 2023 and making up just 7.3% of the $42.54 billion amassed in 2021. Only four private equity deals in US solar have been announced thus far in 2024.

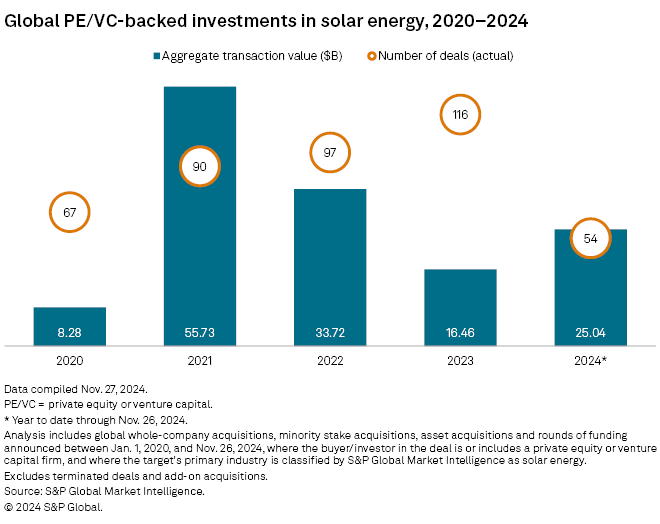

Worldwide, deal value in residential solar and utility-scale solar amounted to $25.04 billion, an approximately 52% increase from the $16.46 billion in full year 2023, according to S&P Global Market Intelligence data.

The rising global levels come amid China's solar panel dominance, which has reached oversupply levels. According to a Wood Mackenzie report, the Asian country will continue to hold more than 80% of global solar manufacturing capacity through 2026.

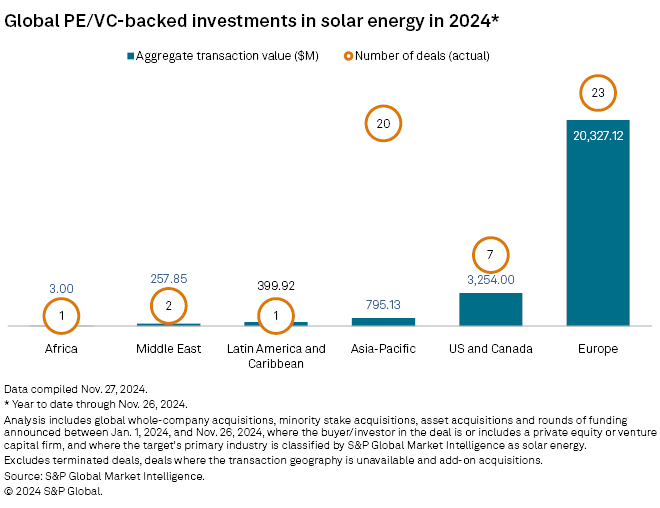

Europe, including the UK, attracted most of the private equity investments in residential and utility-scale solar, with 23 deals exceeding $20 billion. The value of private equity deals involving UK-based renewable energy companies has already surpassed private investments in the US renewable energy sector this year.

The US and Canada had the second-highest deal value at $3.25 billion across seven solar deals. Asia-Pacific, including China, followed next with 20 deals worth more than $795 million.

– Download a spreadsheet with data featured in this article.

– Catch up on private equity dealmaking in November.

– Learn about private equity trends in the Southeast Asian software market.

European megadeals drive surge in private equity funding

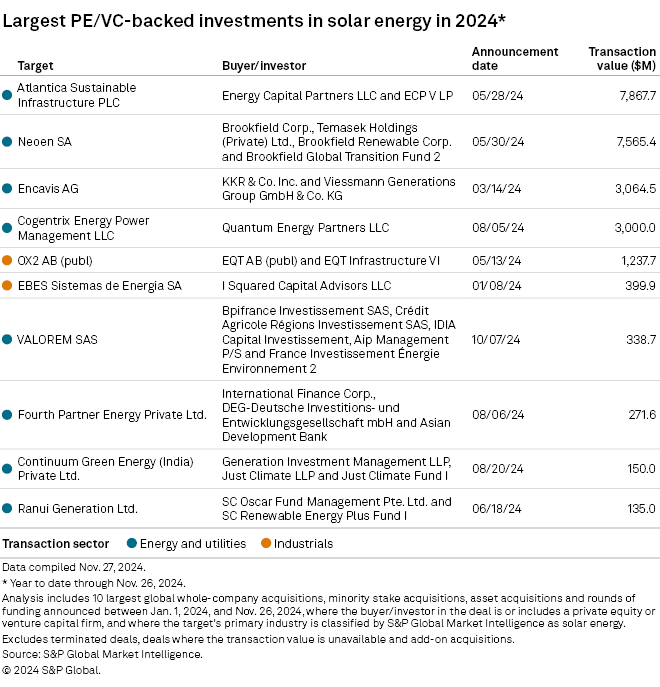

Several multibillion-dollar deals contributed to the solar energy sector's total deal value year to date.

The largest private equity-backed solar energy deal announced so far in 2024 is Energy Capital Partners LLC's planned $7.87 billion acquisition of UK-based Atlantica Sustainable Infrastructure PLC. Its ECP V LP fund is set to purchase Atlantica from Algonquin Power & Utilities Corp., which decided to sell following a strategic review of its renewable energy business.

The second-largest deal is Brookfield Asset Management Ltd. and Temasek Holdings (Pvt.) Ltd.'s proposed $7.57 billion acquisition of 53.32% of Paris-headquartered Neoen SA. The buyers are expected to eventually fully acquire the company and take it private.

Private equity opportunities in new solar tech

Private investments in the industry can help pave the way for the development of new solar technologies.

Solar's shorter development timeline, lower capital cost and compatibility with battery energy storage systems have kept it more attractive than other alternative energy sources, such as wind or nuclear, according to Benedikt Unger, a principal at consulting firm Arthur D. Little.

"By funding next-generation solar technologies like bifacial modules and perovskite cells, private equity investments can accelerate innovation," Unger wrote in an email to Market Intelligence.

Bifacial modules capture light on both sides of the solar panel. Perovskite cells are high-performance, lower-cost materials than those currently used in solar technology.

Unger also sees opportunities for private equity in emerging local solar technology chains and the growing solar panel recycling industry.

"Photovoltaic recycling has been a nascent industry but is critical to be developed, especially in regions with a more mature industry such as Europe or US," Unger said. "Localized supply chains will be needed in many regions, including Africa and Southeast Asia."