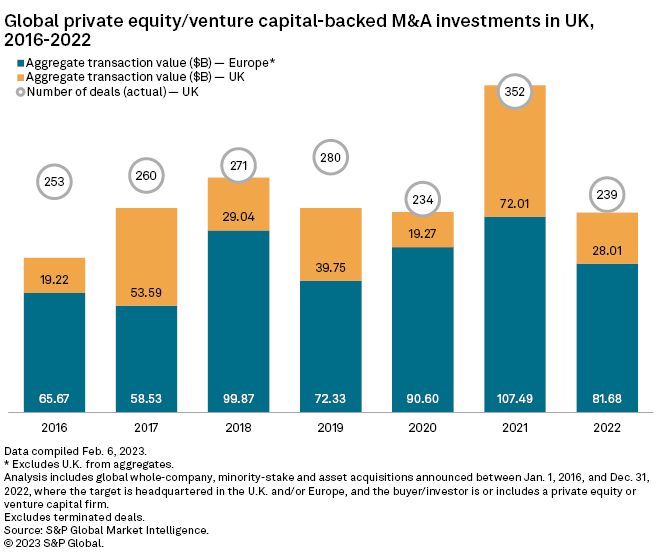

The aggregate transaction value for private equity and venture capital investments in the U.K. plunged 61% year over year in 2022, driven by a decline in large deals.

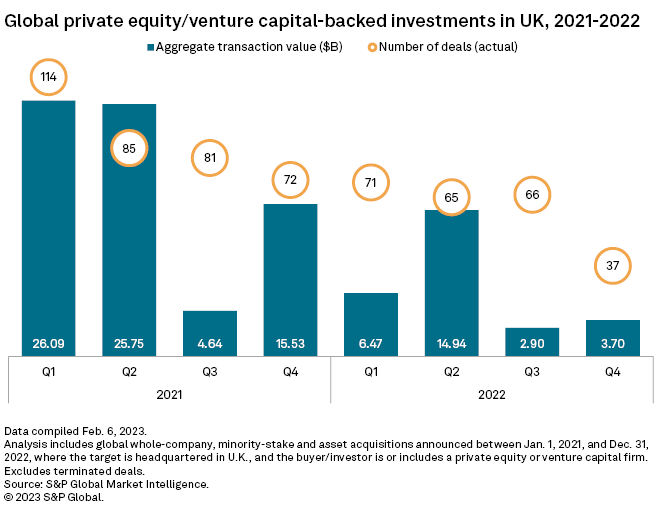

There were 239 private equity and venture capital-backed M&A deals in the U.K. in 2022, with a total value of $28.01 billion compared to 352 transactions aggregating $72.01 billion in 2021, according to S&P Global Market Intelligence data.

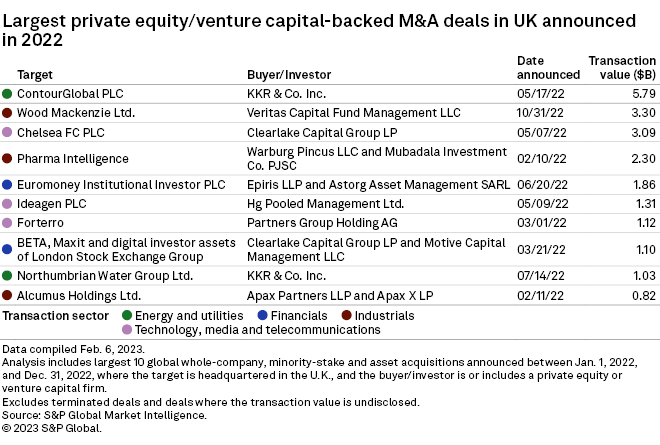

Only nine deals in 2022 were valued at more than $1 billion — the lowest level in five years — and they amounted to nearly three-fourths of the aggregate transaction value.

By comparison, private equity investments in Europe last year were down 24% annually to $81.68 billion, according to the data. In terms of deals worth $1 billion or more, Europe had 23, down from 28 in the previous year.

Pricing dislocation

Private equity transactions in the U.K. are expected to remain slow during the first quarter due in large part to a gap in pricing.

The pricing dislocation between sellers and buyers will impact the number of deals until that gap is bridged, according to Tom Whelan, partner and head of private equity in London at McDermott Will & Emery. "Private equity sponsors will be looking at other ways to bridge the funding gap through higher vendor rollovers, earn-outs and/or more equity funding."

The second quarter is predicted to show an improvement in private equity-backed deals, with the trend pacing up in the last six months of 2023. Deal numbers in the U.K. will be similar to 2022, but transaction values are likely to trend downward as sellers adjust their price expectations.

"There is still a lot of private equity dry powder looking for a home and there will be pressure on sponsors to deploy that cash soon once the seller/buyer pricing gap is bridged," Whelan wrote in emailed comments.

A recent survey by Market Intelligence showed a rosier outlook for overall deal activity across the globe in 2023.

* Download a spreadsheet with data featured in this story.

* Read about global private equity investments in Japan.

* Explore more private equity coverage.

Largest deals

KKR & Co. Inc.'s pending buyout of power generation company ContourGlobal PLC from Reservoir Capital Group LLC for $5.79 billion was the U.K.'s largest private equity or venture capital-backed deal in 2022.

The second-largest was Veritas Capital Fund Management LLC's acquisition of research and consultancy firm Wood Mackenzie Ltd. from Verisk Analytics Inc. for $3.30 billion, followed by Clearlake Capital Group LP's takeover of Chelsea FC Holdings Ltd. for $3.09 billion.