S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jun, 2022

By Karl Angelo Vidal and Annie Sabater

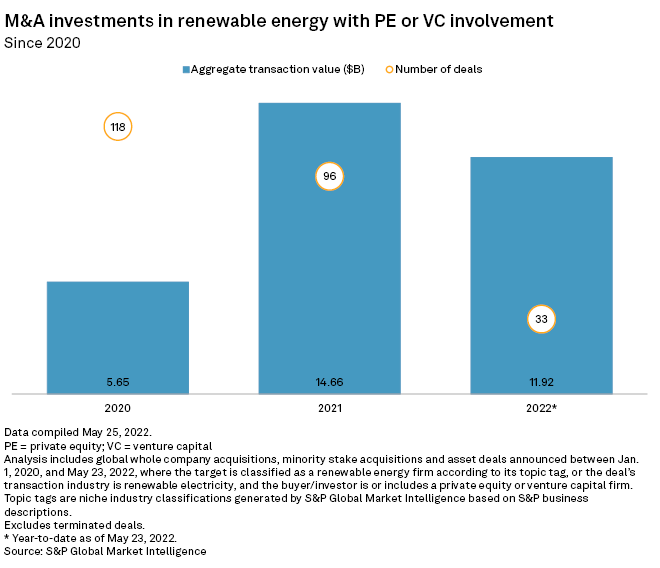

Private equity and venture capital investment in renewable energy increased about 144% to $11.92 billion across 33 deals in the year to May 23 from $4.89 billion across 33 transactions recorded in the same period in 2021, S&P Global Market Intelligence data shows.

The figure in 2022 is fast approaching the full year 2021 private equity investment in the sector of $14.66 billion.

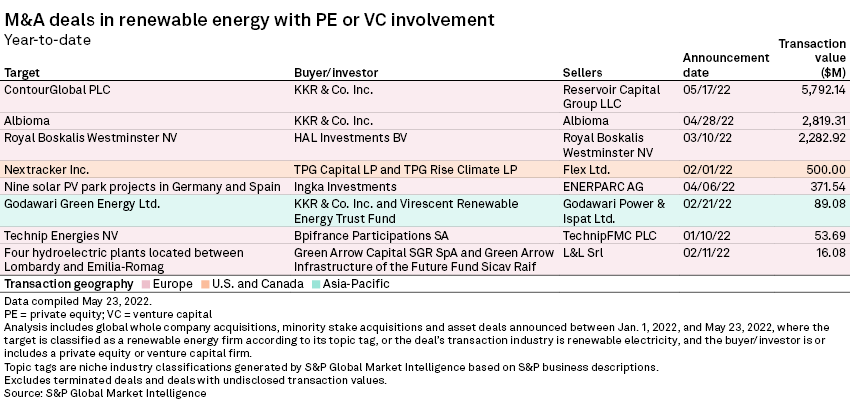

KKR & Co. Inc.'s planned $5.79 billion acquisition of ContourGlobal PLC and approximately $2.82 billion proposed purchase of Albioma were the two biggest renewable energy-focused private equity transactions announced so far in 2022. HAL Investments BV's pending $2.28 billion acquisition of the remaining 53.8% stake in Royal Boskalis Westminster NV came in third.

Private equity firms have been focusing on energy transition companies, as traditional energy investments over the last 10 years yielded low returns and investors seek alternatives to fossil fuel investments in order to offset carbon emissions, law firm Reed Smith said in its Energy and Commodities Outlook 2022 report.

* Explore KKR's recent private equity investments in renewable electricity.

* Explore more private equity stories.

* Read some of the day's top news and analysis from S&P Global Market Intelligence.

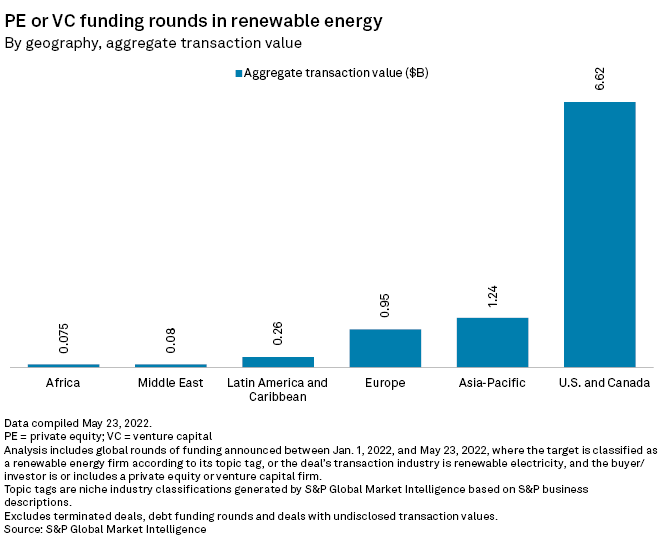

From Jan. 1 to May 23, renewable energy companies based in the U.S. and Canada received $6.62 billion in funding rounds where private equity and venture capital firms were involved. Companies in Asia-Pacific and Europe pulled in $1.24 billion and $950 million, respectively.

Fifty-five funding rounds in renewable energy were announced in the U.S. and Canada. Europe saw 45, while Asia-Pacific recorded 28 funding rounds. There were two each in Africa, as well as Latin America and the Caribbean, and one in the Middle East.