S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Dec, 2022

By Dylan Thomas and Annie Sabater

Private equity and venture capital investments in food and beverage businesses have settled in 2022 after soaring in 2021.

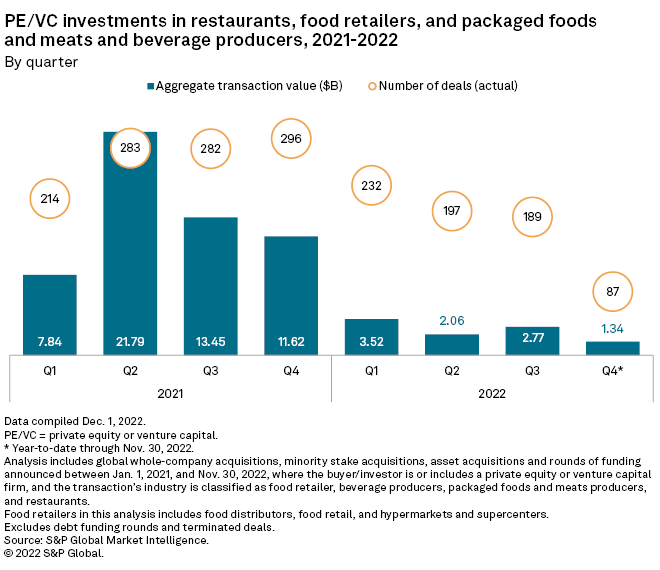

Global private equity-backed deals for a wide variety of food and beverage businesses — restaurants, food retailers, packaged foods and meat businesses, and meat producers — totaled $9.69 billion through the first 11 months of 2022. That is equivalent to less than 18% of the 2021 full-year total, which spiked to $54.7 billion.

Slowing pace

The aggregate value of global private equity-backed investment in food and beverage businesses in 2021 stands out for being at least three times as large as the annual totals recorded in 2018, 2019 and 2020.

The 2021 surge lines up with a broader trend in private equity M&A, which reached record levels last year but sank quickly just a few months into 2022 as inflation, rising interest rates and a shakier geopolitical situation took their toll on deal activity.

|

* * Click here for more private equity coverage. |

The pace of private equity-backed dealmaking in the food and beverage sector hit a recent peak in the fourth quarter of 2021 with 296 transactions but has slowed since. Each quarter that followed recorded fewer deals.

Largest deals

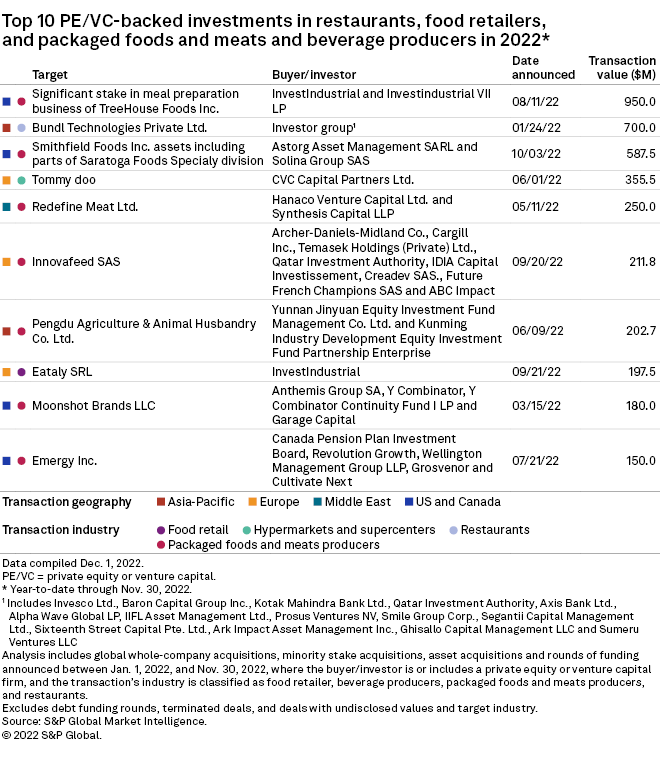

The $950 deal million deal for a stake in the meal preparation business of TreeHouse Foods Inc., a private label food and beverage manufacturer based in Illinois, was the year's largest private equity-backed deal in the sector as of Nov. 30. The buyer was U.K.-based private equity firm Investindustrial.

The second-largest deal announced in the year through Nov. 30 was a $700 million series K funding round for Bundl Technologies Pvt. Ltd., operator of a food ordering and delivery platform in India. Private equity investors in the round included Sumeru Ventures LLC and Prosus Ventures NV.

Third-largest was the $587.5 million acquisition of Smithfield Foods Inc.'s dry seasoning business by strategic buyer Solina Group SAS, a French food producer, and Luxembourg-based private equity firm Astorg Asset Management SARL.

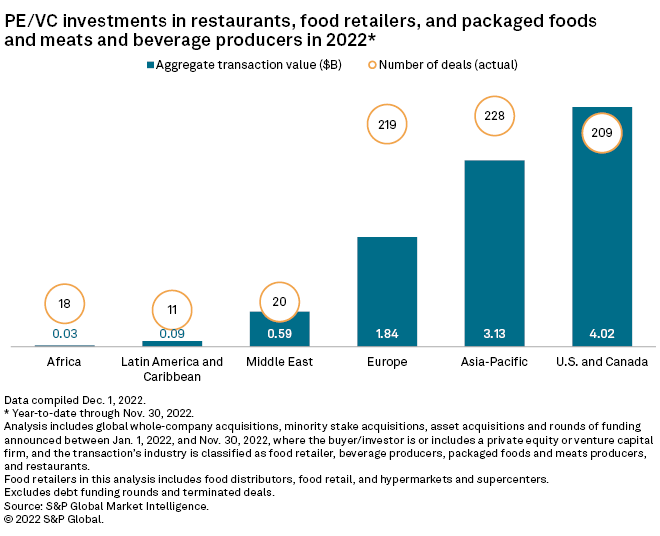

North America leads

The U.S. and Canada absorbed the largest share of private equity deal activity in the food and beverage sector through the first 11 months of 2022. The combined deals of the two countries totaled $4.02 billion and represented about 41% of the global sum.

The next-most active region was Asia-Pacific, with $3.13 billion worth of deals. Third was Europe, with $1.84 billion in announced deal value.